/A%20SoFi%20logo%20on%20an%20office%20building%20by%20Tada%20Images%20via%20Shutterstock.jpg)

Fintech stocks have been among this year's standout performers, with investors rewarding firms that can combine fast growth, profitable unit economics, and expanding product suites. But the same catalysts that send these names higher, rapid member growth, new product rollouts, and opportunistic capital raises, can also trigger sharp volatility when expectations shift.

SoFi Technologies (SOFI) just delivered one of those jolts. The company priced an underwritten public offering of roughly 54.5 million shares at $27.50 each, a raise that should bring in about $1.5 billion and is expected to close today, Dec. 8.

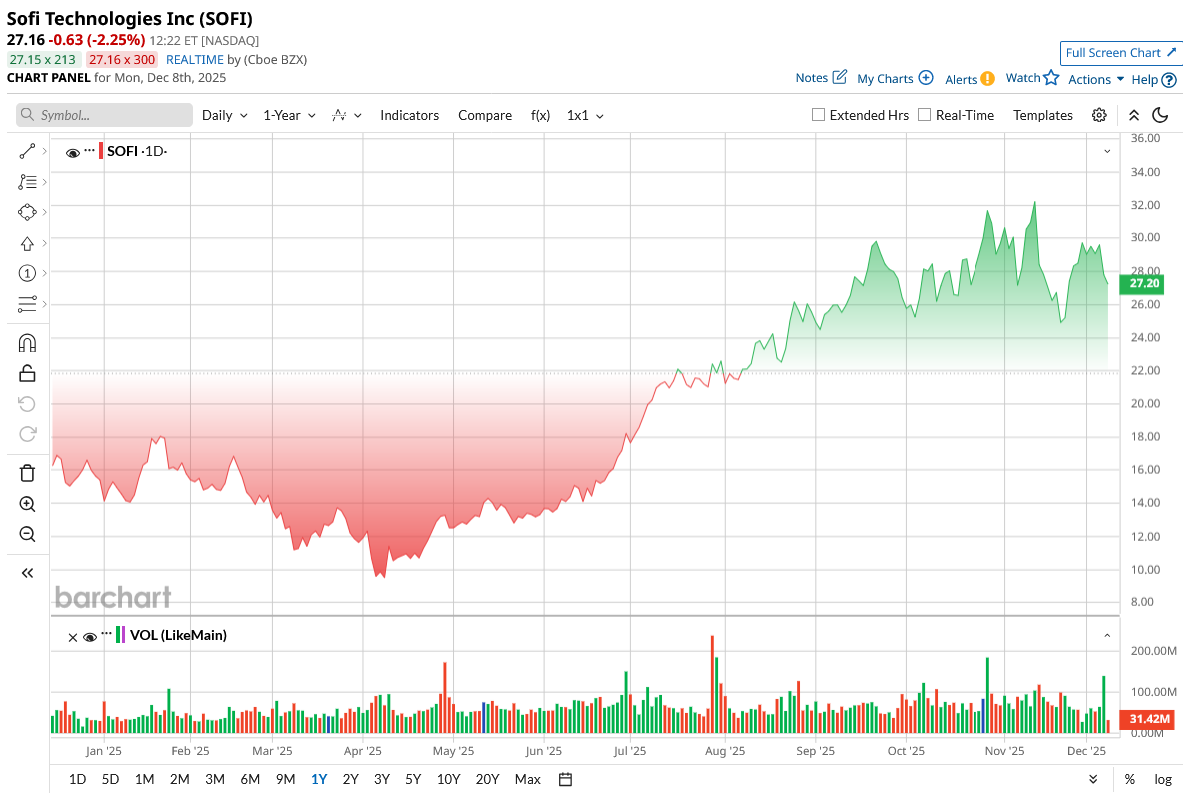

Investors reacted quickly after the news, shares tumbled more than 6% on Friday trading as dilution fears kicked in. SOFI stock is down another 2% today as well. The company says the proceeds will be used for “general corporate purposes,” giving management a bigger war chest but leaving shareholders to decide whether the trade-off is worth it.

About SOFI Stock

Founded in 2011, SoFi is a fintech company built around a one-stop mobile banking app. With about 12.6 million members, it offers checking, savings, loans, credit cards, investing and insurance all in one place. It also owns Galileo, a payment infrastructure platform. The company was founded as a student-loan refinancing startup. SoFi has expanded into full banking services and even integrated crypto trading in its app.

Valued at $33.4 billion by market cap, SOFI stock has had a banner year, roughly doubling in 2025. These gains came as investors piled in on SoFi’s momentum, driven by rapid loan growth, rising deposits, and consistently stronger profits.

After the rebound rally, SOFI stock is trading at elevated levels. The price-to-earnings (P/E) ratio of 98 is much higher than the sector median of 11, indicating the stock is very expensive compared to its peers. Additionally, the price-to-book (P/B) ratio of 4x is more than double the sector median of 1.2x, further highlighting its premium pricing. Simply put, investors have paid up for high growth, leaving little margin for error.

SoFi Beats Q3 Earnings Estimate

SoFi’s latest quarter shows that this isn’t the same company it was a few years ago. In Q3, Revenue jumped to about $962 million, up 38% year-over-year (YoY), and every business line showed momentum: banking and deposits surged roughly 76%, lending revenue climbed 25%, and Galileo’s payments platform posted healthy double-digit growth. Fee-based income stood out at $409 million, a 50% increase, helping the firm deliver net income of $139 million versus $60 million a year earlier and diluted EPS of $0.11, beating expectations by 22%.

Beyond the numbers, SoFi continues to build a broad financial ecosystem, expanding from crypto trading to blockchain-powered international remittances tailored to high-traffic corridors like the U.S.–Mexico market. These additions are fueling member growth and more in-depth engagement across the platform.

The company now holds roughly $3.25 billion in cash, and management raised full-year guidance to about $3.54 billion in revenue and $0.37 in EPS, signaling stronger confidence in its scaling path.

What Do Analysts Say About SOFI Stock

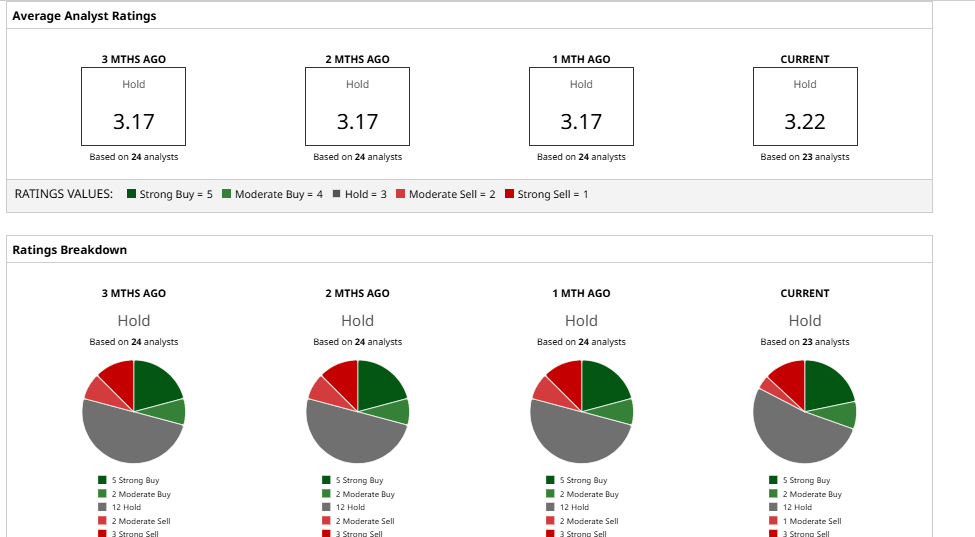

The Wall Street view of SoFi is out across the board, and that is what is making the story interesting. Morgan Stanley is on the pessimistic side, with a price target of $18, arguing that the stock valuation has overtaken itself.

Goldman Sachs recently hiked its target to $27 and retained a “Hold” rating, also impressed by the revenue beat but being concerned about the look of a rich stock post-run.

On the other hand, Mizuho raised its target to $38 on the bullish side, with a “Buy,” citing that SoFi's growth story and underlying fundamentals, along with its long-term revenue profile, are difficult to ignore.

Similarly, Needham is also positive, with a $29 target, as financing conditions are more favorable, the refinancing trend is strong, and SoFi's broader potential in the financial ecosystem is greater.

Moving back, SOFI stock has a consensus “Hold” rating from 23 analysts, followed by Barchart. And since the stock is already trading at its average price target of about $27, some analysts believe that much of the good news may be reflected in the price, and an investor will have to decide whether the following fault will need another round of standout performance.

The Bottom Line

SoFi's Long-term narrative is still good for SoFi, but the company is no longer cheap, and the sale of equity puts a strain on it. The new pullback can be helpful to those who believe in its fintech ecosystem, but valuation-oriented investors can wait. All in all, it would be a position as a travelling hedge, with selective trading on the downside.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Tesla%20Inc%20logo%20by-%20baileystock%20via%20iStock.jpg)

/Salesforce%20Inc%20logo%20on%20building-by%20Sundry%20Photography%20via%20Shutterstock.jpg)