/Fidelity%20National%20Information%20Services%2C%20Inc_%20logo%20outside%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)

Valued at a market cap of $34.5 billion, Fidelity National Information Services, Inc. (FIS) is a leading global financial technology company headquartered in Jacksonville, Florida. It provides core banking systems, payment processing, digital banking solutions, risk and fraud-management tools, and technology services to banks, capital markets firms, merchants, and insurers worldwide.

Companies worth $10 billion or more are typically classified as “large-cap stocks,” and FIS fits the label perfectly. Founded in 1968, FIS powers critical financial infrastructure and processes billions of transactions globally each year, playing a central role in enabling secure payments and modern digital finance.

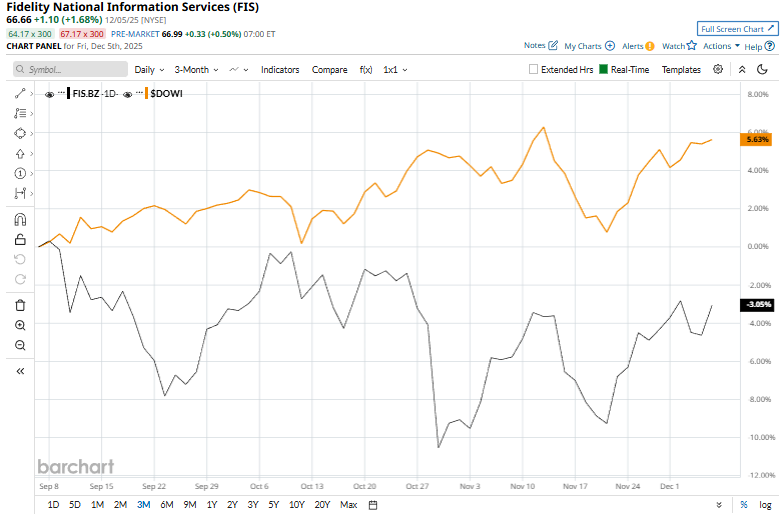

Despite its notable strength, this financial services provider has dipped 22.4% from its 52-week high of $85.86. Moreover, shares of FIS have declined 3% over the past three months, underperforming the Dow Jones Industrial Average’s ($DOWI) 5.6% rise during the same time frame.

In the longer term, FIS stock has declined 22% over the past 52 weeks, significantly lagging behind DOWI's 7.1% uptick over the same time period. Moreover, on a YTD basis, shares of FIS are down 17.5%, compared to DOWI’s 12.7% return.

To confirm its bearish trend, FIS stock has been trading below its 200-day moving average since early August and has recently edged above its 50-day moving average.

On Nov. 8, FIS introduced the FIS Asset Servicing Management Suite, an integrated platform designed to streamline and automate all major asset servicing functions, such as corporate actions processing, proxy voting, class-action and operational claims, and tax reclaim management, replacing fragmented multi-vendor systems. The suite improves efficiency, reduces operational risk, enhances data accuracy, lowers costs, and boosts client experience by providing transparency and control across the full asset-servicing lifecycle. Following the announcement, FIS shares rose 1% in the next trading session.

Although FIS has lagged behind the broader market, it has outpaced its rival, Fiserv, Inc. (FI), which declined 69.7% over the past 52 weeks and 68.9% on a YTD basis.

The stock has a consensus rating of "Moderate Buy” from the 26 analysts covering it, and the mean price target of $82.38 suggests a 23.6% premium to its current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.