Happy Thanksgiving week ahead market watchers!

There will be plenty to discuss around the dinner table this year, that’s for sure! It’s always a good idea to discuss politics with family, right?

I think it’s fair to say that President Trump’s base in the middle of the country is on shaky ground, especially those of us in agriculture! I, as others, totally subscribed to the need for change and resetting terms, but I’m unsure that the recent politization of agricultural trade, particularly of beans and beef, is achieving anything, but weakening the domestic producer of these products.

Frankly, there is no excuse for the absolute havoc that has been wreaked on the US cattle producer over the past several weeks. In fact, the main beneficiary of the situation are the packers, namely the two, Brazilian-owned packers, JBS and Marfrig, the majority owner of National Beef. I have worked alongside these companies and understand that imports play an important role in balancing and stabilizing the demand and pricing of ground beef prices. I'm not even pointing fingers at packer wrongdoing with this comment, which is another topic, but more saying they have pulled the right strings to achieve an outcome very much in their favor. In fact, there is something for us to learn from this strategy.

Having said that, there is absolutely no reason whatsoever for the bombshell announcements of tariff reductions or eliminations and market access that are being broadcast! If bombing Iran or invading Venezuela, the element of surprise is critical to success. This same approach to the beef market however results in precisely the opposite. Government intervention in markets is never a good idea and if such intervention is warranted, it is best done through steps and forward announcements that the market and its participants can prepare for. There is no reason for announcements intended to “help” the beef industry or even the consumer be immediate and retroactive with the absolute intention to shock the market. We are not the enemy.

I have withheld such comments, but enough is enough and I’m witnessing clients and farm families that are the backbone of our rural communities and the beef industry getting whipsawed around daily and feeling panicked by the careless decisions of leaders that we elected who should know better. There have been millions of dollars lost across rural America in the past three weeks due to this behavior that did not have to be done in this manner and still achieve the same outcome, whatever that is.

In fact, the consolidation that we are told is being investigated is only emboldened financially by these actions while the producer base is being weakened. Risk tolerance of banks and producers and the corresponding interest to retain heifers to rebuild the herd, which I believe is the ultimate objective, has only been damaged in this process as the market is no longer trading fundamentals. Furthermore, information is getting out before it is being officially released. There is little doubt about this as we are seeing major market movement one-to-two sessions before the actual news is released. This is problematic for the trust and functioning of a futures contract as a risk management tool.

If you haven’t been following all of this in the news, which is admittedly a chore amidst all the chaos, President Trump put 40 percent tariffs, in addition to the 10 percent reciprocal tariffs, on Brazil on July 30th for the reason that “the Government of Brazil’s politically motivated persecution, intimidation, harassment, censorship, and prosecution of former Brazilian President Jair Bolsonaro and thousands of his supporters are serious human rights abuses that have undermined the rule of law in Brazil.” As of Thursday, all of these tariffs have been eliminated immediately and retroactively on beef and select items that the US imports. See full announcement here: Fact Sheet: Following Trade Deal Announcements, President Donald J. Trump Modifies the Scope of the Reciprocal Tariffs with Respect to Certain Agricultural Products – The White House

Due to domestic pressures of affordability, President Trump has taken active measures to reduce prices at home. Beef prices are high, but there is no reason for the government to get involved as beef is a non-essential item. That’s where pork and poultry come in as cheaper protein options that are plentiful and delicious. Beef is the best, which is why it is more expensive. I have lived all over the world and that is the case everywhere due to how much time and investment it takes to produce beef.

Another critical difference is that drought doesn’t impact pork and poultry like it does beef as these former proteins are nearly all vertically integrated supply chains birthed, raised and fattened inside, undeterred by the lack of grass pastures or hay or pond water that the beef industry relies on outside. And that folks, is the fundamental reason why beef prices are high and higher than usual along with the US consumer’s insatiable appetite for beef.

Do you know why beef prices remain high? Because consumers keep paying high prices. As soon as consumers stop buying beef and switching to cheaper pork and poultry like we’ve seen in typical cycles, then the retail beef price will come down until it is low enough for consumers to switch back to beef. It is not due to the cattle producer getting paid a high and fair price for their cattle. During COVID, we had surging beef prices, but plummeting cattle prices due to shortages at processing plants and because consumers were willing to pay to secure beef supply. In the 80s, it took 12 minutes of labor to buy a pound of beef. Guess what, it still takes 12 minutes of labor to buy a pound of beef, which is rare when compared to most all other food products, especially packaged products with little nutritional value.

Lowering the retail beef price is unfortunately not as simple as lowering the cattle price and in fact, it ultimately has the opposite effect as producers will stop investing in cattle when the market price is too low that will translate into a shortage of cattle and higher beef prices to come.

If consumers can buy other proteins cheaper to lower their grocery bill, then why is there such a ‘beef’ with beef? Unfortunately, it is about money and the influence that money gets you and has nothing to do with the consumer and especially not the producer, many of which have been wrecked by this recent and unnecessary reflex under the guise of consumer affordability. As undemocratic as it sounds, we may need to divert some checkoff dollars to our nation's Capitol instead of to marketing campaigns to get the voice the US cattlemen deserve. I have said a lot and would be happy to spend time in Washington to share perspectives, which I believe are informed from a career in international meat supply chain and investment, banking, commodity trading, local beef supply chain and distribution investor, cow/calf and stocker operator and restaurant owner. I have skin in the game and want to help America win.

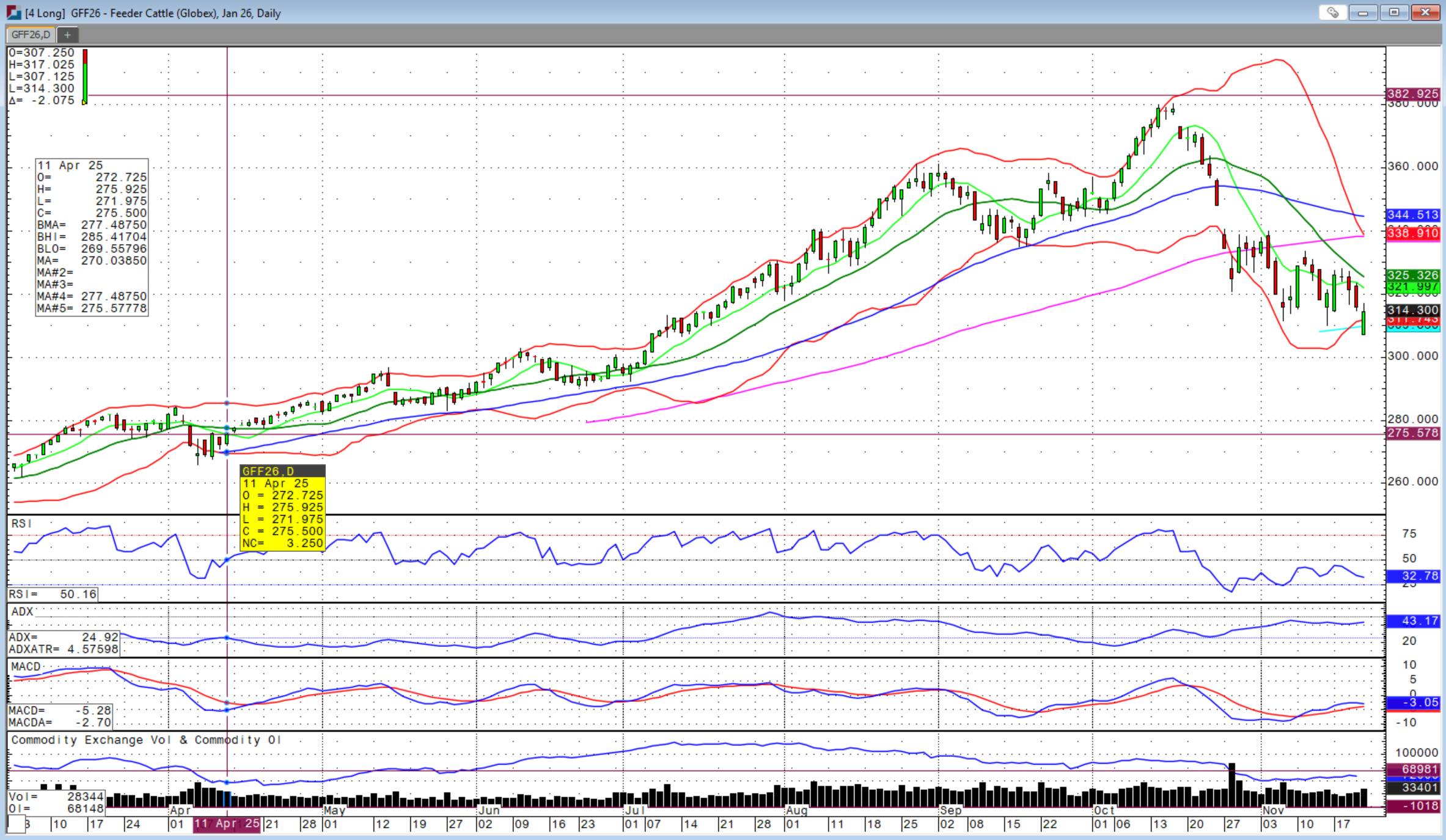

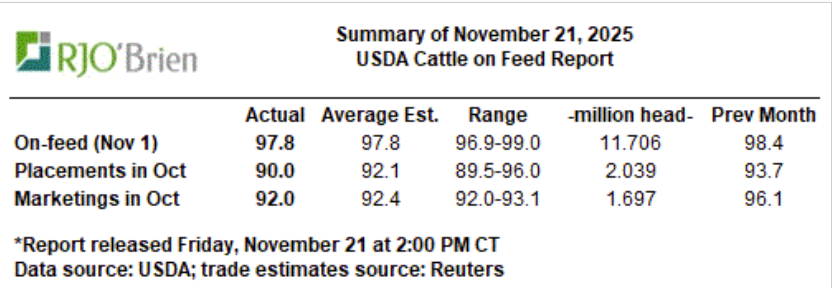

Last Friday’s post-close announcement of reciprocal tariffs being removed resulted in the market surging Monday. Thursday’s announcement of the 40 percent tariffs on Brazil being removed resulted in a limit down open on Friday morning, but recovery and positive close largely due to the expected bullish tilt of the monthly Cattle-on-Feed report released that afternoon at 2 PM, after the cattle market close. While expectations were bullish, it was bullish plus some.

November 1st on-feed came in as expected at 97.8 percent of last year, but the lowest level in 7 years. The October placement figure was quite a bit lower than expected at 90.0 percent versus 92.1 percent expected and the lowest in over 30 years. October marketings were slightly lower than expected at 92.0 percent versus 92.4 percent expected and the lowest in 10 years. Due to the government shutdown, the COF for October report was not released with those figures also released Friday, but all focus will be on the current report.

Also on Friday, Tyson announced closure of its Lexington, Nebraska beef packing plant due to a lack of cattle and reducing its Amarillo, Texas, beef packing plant to one-shift. Expectation of such news has been anticipated for months due to the declining slaughter ready cattle numbers although which packer and timing of such closure was not widely known. Barring other major announcements from Washington, I believe we could see some follow-through rally into next week.

Note, we will eventually hear news of the US-Mexican border reopening. However, after all the damage done from the multitude of surprise announcements, I believe much of this could be priced into the market. Be cautious though as we need to see these lows hold and an immediate rally out of this territory. Be vigilant and give me a call about protecting your downside price risk exposure.

With all of the shock announcements, managed money continues to exit long positions, which only exacerbates the selling pressure in addition to the hedging pressure that builds when funds shift. The government shutdown has severely delayed Commitment of Traders Reports that show fund positioning. We learned this week that COT reports will not be current until January 23rd!

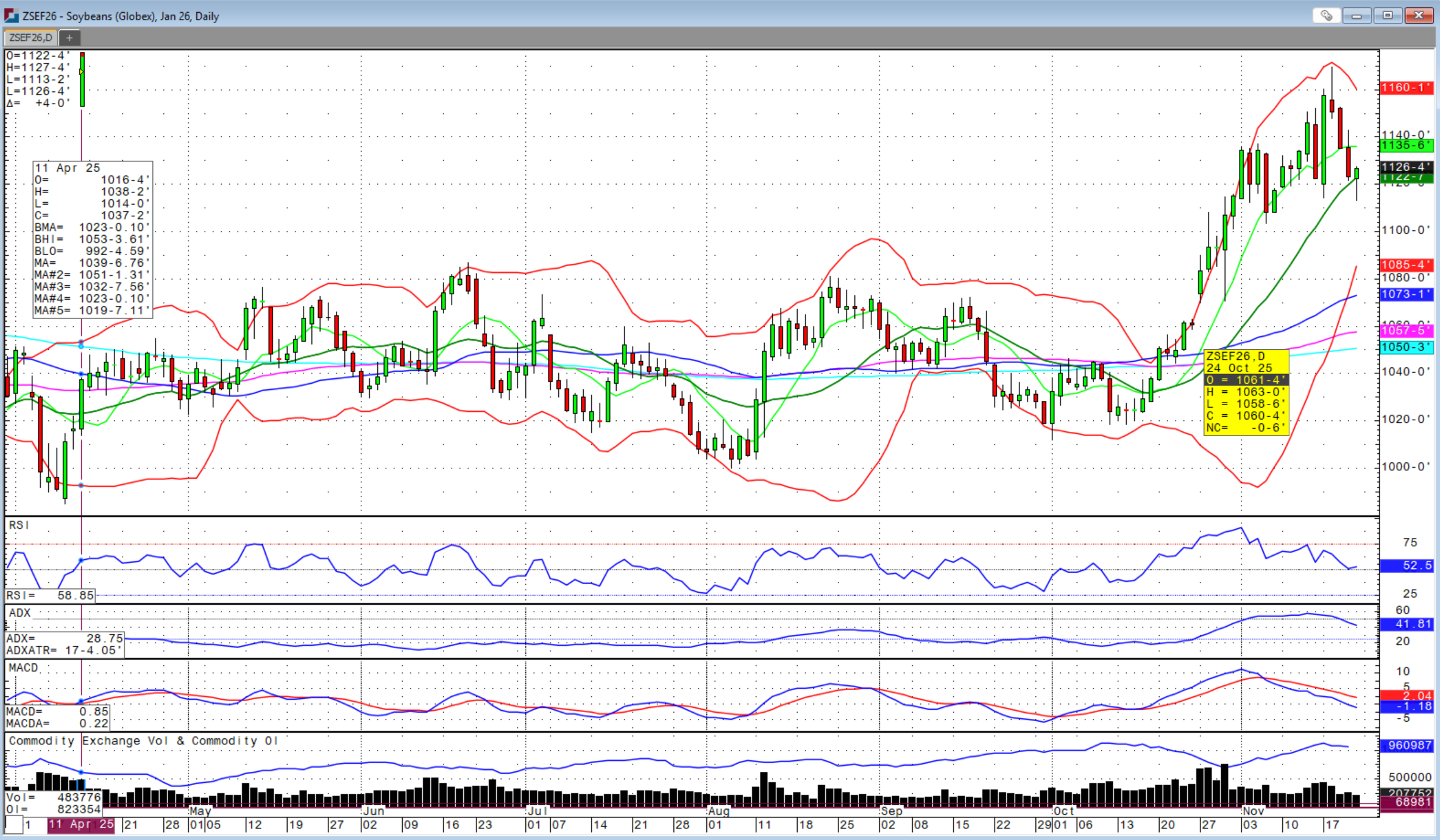

The grain markets had a two-sided week that quickly faded after early strength. Despite additional China soybean purchase announcements from the US and even white wheat, the news was not enough for the bulls. The slow pace of China buying versus commitments has been disappointing with the end of year deadline quickly approaching with many expecting they will fall short.

Brazil is currently cheaper than US origin beans, which gives them an out. Lower soybean futures may be needed to further incentive China buyers to US origin. January soybean futures closed well off overnight lows on Friday and back above the 20-day moving average and I believe we could see another 10-cent rally to the 9-day moving average at $11.45, but then we may see the strength stall. With markets closed on Thanksgiving and lighter volume likely to emerge late Tuesday into Wednesday, this could play out before the holiday.

US NOPA soybean crush released Monday reported sharply higher than expected demand, which lends support.

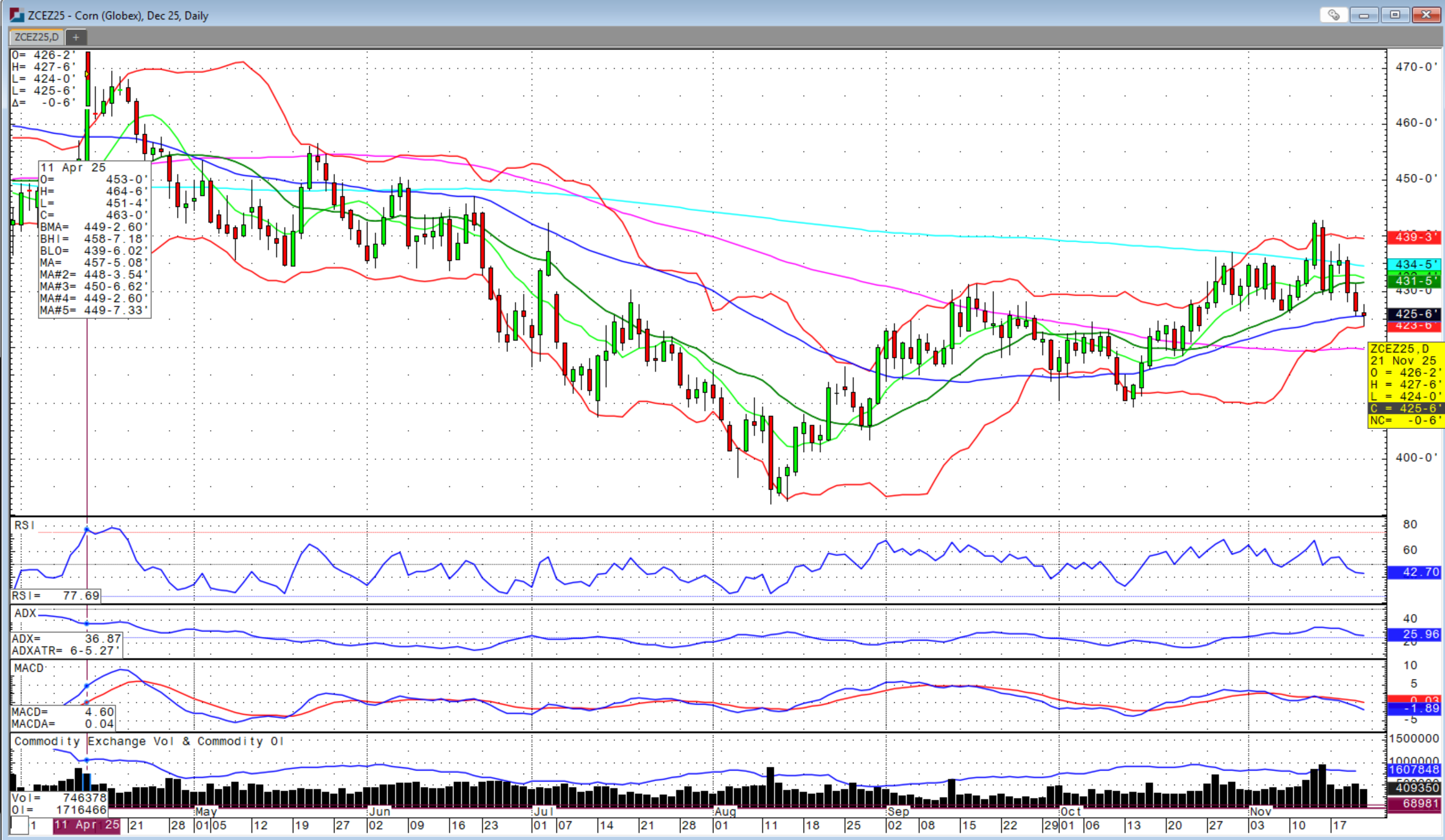

Corn has been the weakest link this week with an unexciting close on Friday, but still above the 50-day moving average. While some weather concerns have been discussed in Argentina, it seems that rain and planting progress in Brazil will limit much support to these contracts from South American risk premium.

In the wheat market, I feel like we could see another 8-to-10 cent rally from Friday’s close well off the lows, but we may fade mid-week with Southern Plains receiving rains to improve the lower crop conditions reported by the USDA this week.

The rally in the US dollar has been a headwind for grains and oilseeds despite some strength in export sales.

The delayed September US payroll data showed more jobs added versus expectations and another data point that may lead the FOMC to leave interest rates unchanged at the upcoming December 10th decision.

Sidwell Strategies is the one-stop shop to protect cattle with futures, puts, LRP or a combination of all, which is probably the best strategy overall. If you’re ready to trade commodity markets, give me a call at (580) 232-2272 or stop by my office to get your account set up and discuss risk management and marketing solutions to pursue your objectives. Self-trading accounts are also available. It is never too late to start and there is no operation too small to get a risk management and marketing plan in place.

Wishing everyone a successful trading week! Let us know if you'd like to join our daily market price and commentary text messages to stay informed!

Brady Sidwell is a Series 3 Licensed Commodity Futures Broker and Principal of Sidwell Strategies. He can be reached at (580) 232-2272 or at brady@sidwellstrategies.com. Futures and Options trading involves the risk of loss and may not be suitable for all investors. Review full disclaimer at https://www.sidwellstrategies.com/fccp-disclaimer-21951.

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)