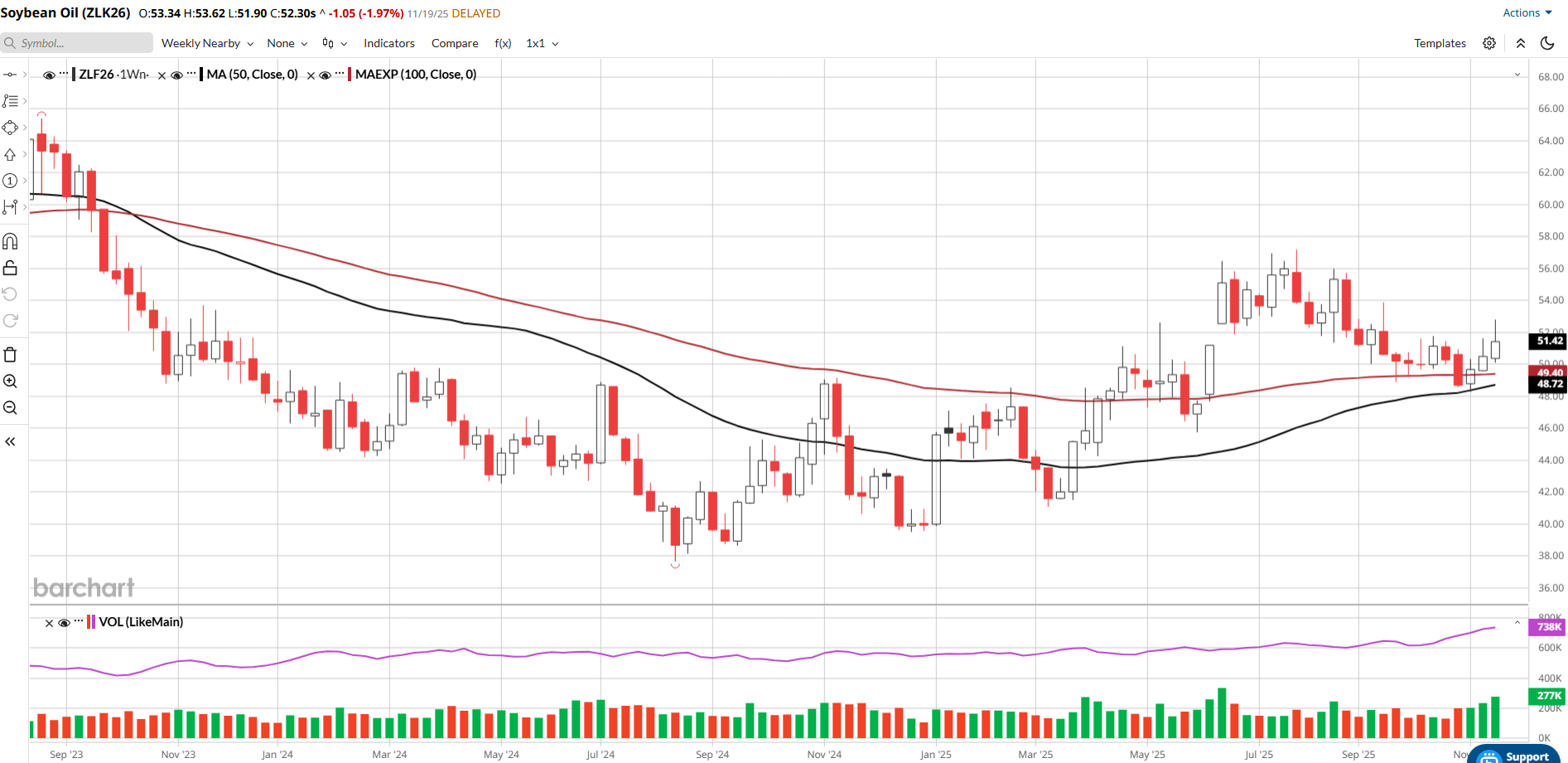

This is a very bullish chart pattern, in my opinion.

If you would like to receive more information and trading strategies in the commodity markets, please use the link below to join our email list

The monthly chart shows Soybean Oil above the 100-period EMA and testing the 50-period MA.

.

.

May ’26 SOYBEAN OIL

BUY 1 May ’26 55 Call 2.53

SELL 1 May ’26 65 Call 0.69

SELL 1 May ’26 56 Put 5.88

BUY 1 May 51 Put 2.85

Price: 1.19 CREDIT Cost: $714 CREDIT/TRADE PACKAGE, PLUS FEES AND COMMISSIONS.

MAY’26 SOYBEAN OIL OPTIONS EXPIRE 4/24/26 (156 DAYS)

MAXIMUM LOSS: LIMITED

This trade is buying a call spread and selling a put spread, which gives you a CREDIT of 1.19 to enter the trade. Yesterday the CREDIT to enter the trade was 0.61 or $366. The oil share is 44.475%. I don’t think the oil share will move much lower than this. You are already seeing Soybean Meal start to break, -9.00 today. If you are interested in being long Soybean Oil NOW is the time. My target for May Soybean Oil is 64.00-66.00 cents.

.

.

If you would like to receive more information and trading strategies in the commodity markets, please use the link below to join our email list

.

.

May ’26 SOYBEAN OIL

BUY 1 MAY’26 56.00 CALL 2.19

SELL 1 MAY’26 61.00 CALL 1.12 ½

SELL 1 MAY’26 51.50 PUT 3.11

BUY 1 MAY’26 46.50 PUT 1.15 ½

PRICE: 0.89 CREDIT

COST: $534.00 CREDIT/TRADE PACKAGE, PLUS FEES AND COMMISSIONS.

MAY’26 SOYBEAN OIL OPTIONS EXPIRE 4/24/26 (156 DAYS)

MAXIMUM LOSS: LIMITED

This trade gives you a 0.89 CREDIT to enter the trade. Again, I’m looking to see 64.00-66.00 cents in May Soybean Oil. Both these trades have a great risk/reward and give you a CREDIT to enter the trade.

.

.

If you would like to receive more information and trading strategies in the commodity markets, please use the link below to join our email list

.

.

FUTURES SPREADS

I also like the following spreads and believe they could move higher (more positive/less negative) so there may be opportunity in getting long them.

- MAR-JULY’26 SOYBEAN-OIL SPREAD (ZLH26-ZLN26): Today’s Settlement is -0.47

- MAY-JULY’26 SOYBEAN-OIL SPREAD (ZLK26-ZLN26): Today’s Settlement is -0.12

- JAN-MAR’26 SOYBEAN-OIL SPREAD (ZLF26-ZLH26): Today’s Settlement is -0.53.

SYNTHETIC LONG SOYBEAN OIL

Buy 1 SEPT ’26 SOYBEAN FUTURE, Sell 2 JULY ’26 SOYBEAN MEAL FUTURES

ZSU26 – (ZMN26x2)

.

.

If you would like to receive more information and trading strategies in the commodity markets, please use the link below to join our email list

Hans Schmit

Broker, Walsh Trading

312-765-7311

hschmit@walshtrading.com

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)