/Green%20hydrogen%20by%20Scharfsinn%20via%20Shutterstock.jpg)

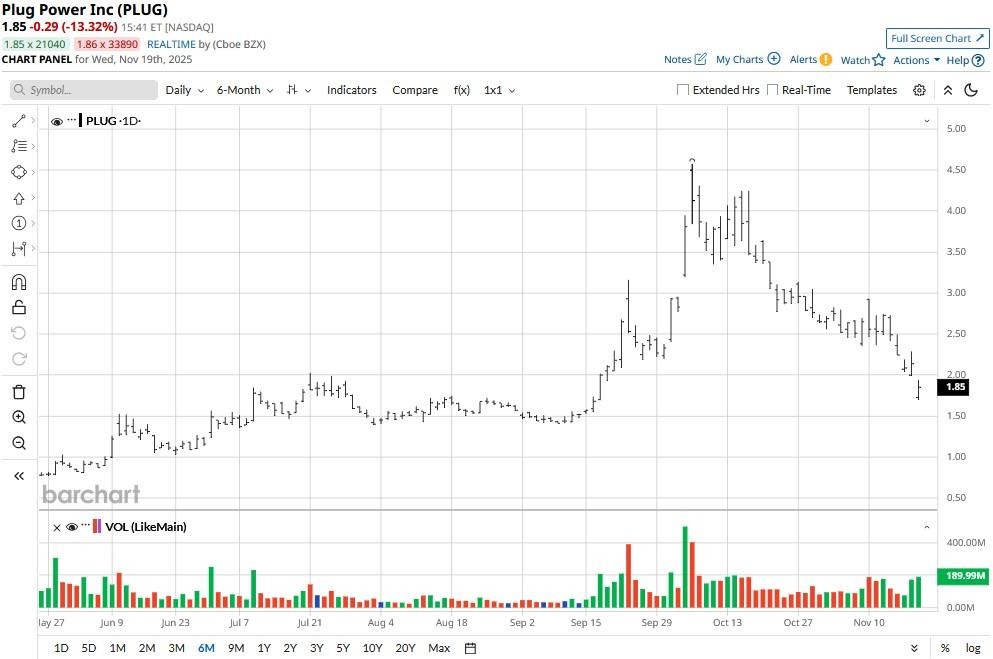

Plug Power (PLUG) stock was down more than 13% on Wednesday after the hydrogen fuel cell and electrolyzer systems company announced a $375 million convertible notes offering.

In its press release, the Latham-headquartered firm said it will use net proceeds from this offering to primarily to refinance as much as 15% of its expensive debt.

Following today’s plunge, Plug Power shares are trading well over 50% below their October high.

Why Is the Offering Negative for Plug Power Stock?

Investors bailed on PLUG shares following the announcement today as the convertible notes carry a 6.75% interest rate with a 2033 maturity and conversion price of $3 per share, representing a 40% premium to its Nov. 18 closing price, indicating substantial dilution risk for current shareholders.

While the debt refinancing strategy improves its balance sheet by cutting interest costs and extending maturities, it also signals ongoing financial distress and liquidity challenges that have persistently plagued the Nasdaq-listed firm.

The timing of this capital raise is particularly troubling, arriving just one week after management assured investors during Q3 earnings that improving cash burn and access to capital would support operations.

This rapid turnaround undermines management credibility and suggests the company’s financial position may be more precarious than previously disclosed.

Fundamentals and Technicals Warrant Selling PLUG Shares

Despite a massive since early October, the clean energy stock remains rather unattractive for 2026 since the company’s operational performance continues to deteriorate.

Plug Power lost $139 million in its third fiscal quarter, ending the three-month period with about $166 million in cash and a concerning debt-to-equity ratio of 66%.

At the time, it had nearly $1 billion in total debt on its balance sheet.

Caution is warranted in playing PLUG stock also because President Donald Trump’s administration has terminated federal funding for clean energy solutions as well.

From a technical perspective, Plug Power has slipped decisively below its 100-day moving average (MA), indicating continued downward pressure in the near to medium term.

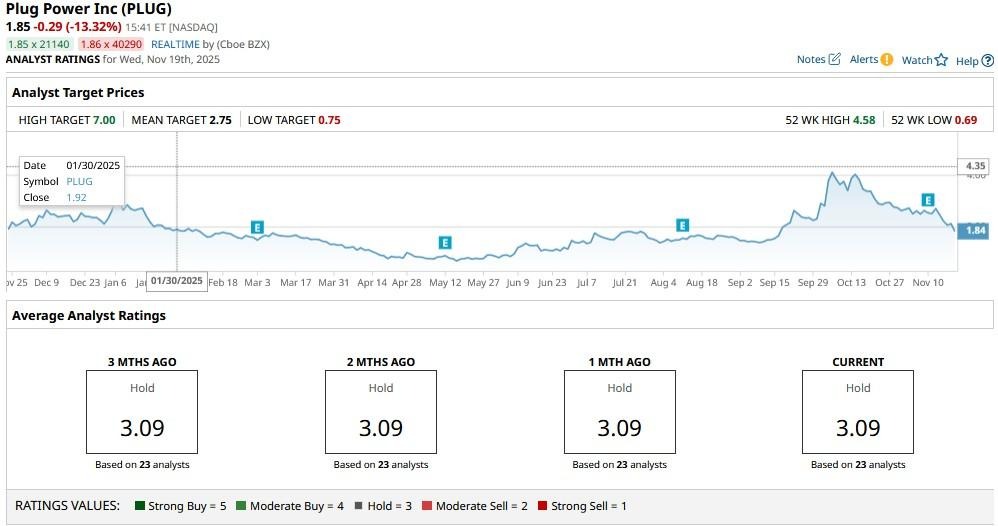

Wall Street Continues to See Massive Upside in Plug Power

Despite the aforementioned risks, Wall Street seems to believe the downside is more than reflected in Plug Power stock already.

While the consensus rating on PLUG shares remains at “Hold” only, the mean target of about $2.75 indicates potential upside of some 50% from here.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)