Purely from a stock returns perspective, 2025 has been subdued for FTAI Aviation (FTAI) with year-to-date (YTD) returns of 8%. However, the business progress has been positive, and the valuations seem compelling.

In a recent development, FTAI announced a multi-year partnership with Palantir (PLTR). Through this, FTAI will be leveraging Palantir’s AI platform across its global maintenance footprint. Besides cost savings, this partnership will allow FTAI to disrupt the MRO model and “ramp-up to meet growing demand.”

Of course, this is just one of the positives in the recent past. There are other catalysts likely to support an uptrend in FTAI stock.

About FTAI Stock

FTAI Aviation is a provider of aftermarket power for the CFM56 and V2500 engines. These engines power the most widely used commercial aircraft globally and have an addressable market of $22 billion.

Additionally, through its Strategic Capital Initiative, FTAI is also a manager and co-investor in on-lease narrow-body aircraft.

With positive business developments coupled with an optimistic growth outlook for FY 2026, FTAI stock has trended higher by 32% in the last six months.

Fundraising for Strategic Capital Vehicle

Last month, FTAI Aviation announced the completion of its inaugural Strategic Capital Vehicle fundraising with $2 billion in equity commitments.

With the completion of this financing, FTAI has $6 billion in financial flexibility (including current and future debt financing).

Currently, FTAI SCI has invested $1.4 billion for the acquisition of 101 aircraft. Further, there are $2.1 billion in aircraft under contract or LOI. The full deployment of 190 aircraft is expected by the first half of 2026 and is likely to be a key growth catalyst.

To put things into perspective, FTAI expects aviation leasing adjusted EBITDA of $525 million in FY 2026. While the company’s leverage will increase, recurring income from leasing of aircraft is likely to ensure that the credit metrics remain healthy.

Healthy Growth in Aerospace Products

The company’s maintenance solutions segment delivered robust growth in Q3 2025. Further, considering the addressable market, healthy growth is likely to be sustained.

For the quarter, adjusted EBITDA swelled by 77% on a year-on-year (YoY) basis to $180 million, with the margin increasing by 100 basis points to 35%.

It’s worth mentioning that the total addressable market for CFM56 & V250 aftermarket is $22 billion. Of this, FTAI currently has an annualized market share of $2 billion (9%). With the market share doubling in the last 12 months, the segment outlook is positive.

Besides organic growth, FTAI also announced an agreement to acquire ATOPS. The acquisition will expand the product capacity from 450 modules to 600 modules.

FTAI has guided for adjusted free cash flow of $750 million for 2025. For the next year, the company has guided for adjusted FCF of $1 billion. This will provide ample flexibility to pursue opportunistic acquisitions for growth acceleration.

What Analysts Say About FTAI Stock

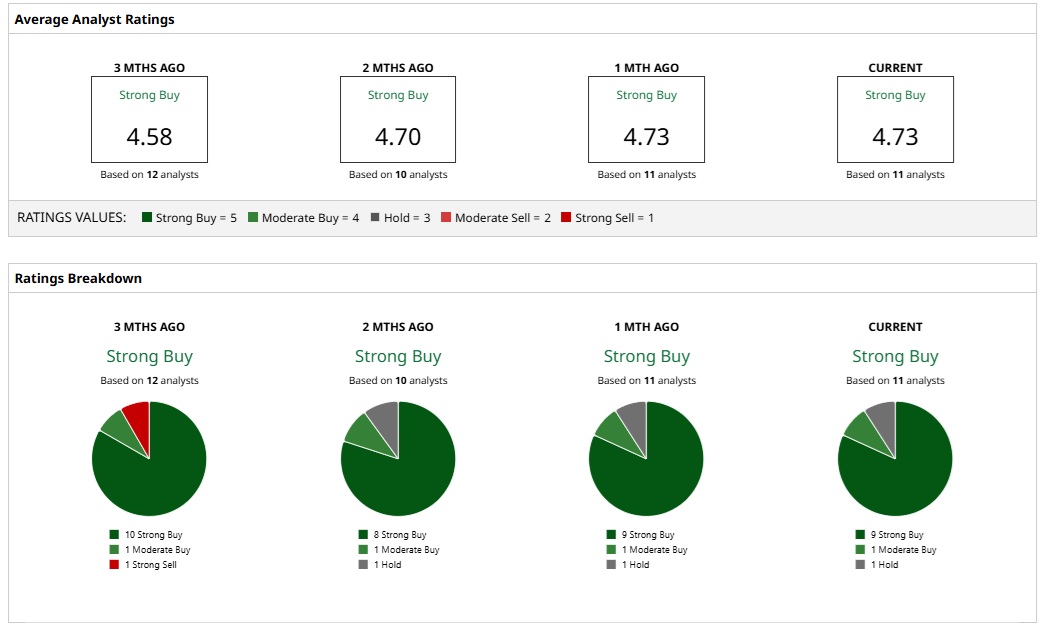

Based on the rating of 11 analysts, FTAI stock is a consensus “Strong Buy.”

An overwhelming majority of nine analysts have assigned a “Strong Buy” rating, with a “Moderate Buy” and “Hold” rating assigned by one analyst each.

Further, the mean stock price target of $224.60 implies an upside potential of 43%. It’s worth noting that the most conservative price target is $200, and it implies an upside potential of 28%.

The bullish view of analysts is supported by the point that earnings growth for FY 2025 and FY 2026 is expected at 116.4% and 41.8%, respectively.

Considering the forward price-earnings ratio of 32.1, the price-earnings-to-growth ratio is less than one and points to potential undervaluation.

It’s worth adding here that FTAI stock offers an annual dividend of $1.40 (0.88%) per share. Given the growth outlook, it’s likely that dividends will increase, and this supports value creation.

On the date of publication, Faisal Humayun Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)

/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

/A%20photo%20of%20a%20Sandisk%20Solid%20State%20Drive%20by%20Top%20Popular%20Vector%20by%20Shutterstock.jpg)