I am Stephen Davis, senior market strategist at Walsh Trading, Inc., in Chicago, Illinois. You can reach me at 312-878-2391 and sdavis@walshtrading.com.

China reportedly just bought a significant amount of U.S. soybeans, signaling a commitment to a trade agreement with the United States.

According to a farmdocDAILY article, the trade deal between the United States and China, announced this month, ends the suspension of soybean imports. It includes a commitment for China to purchase 12 million metric tons of U.S. soybeans in the last two months of 2025 and at least 25 million metric tons annually through 2028. The agreement follows six months of near-zero U.S. soybean exports to China amid retaliatory trade measures.

In my opinion, the time to buy soybeans is when the price is lower because the price will not stay lower for long. With fundamental data available again from the U.S. Department of Agriculture (USDA), it will easier to track Chinese demand for soybeans. The fact that China and the U.S are still in negotiations is positive.

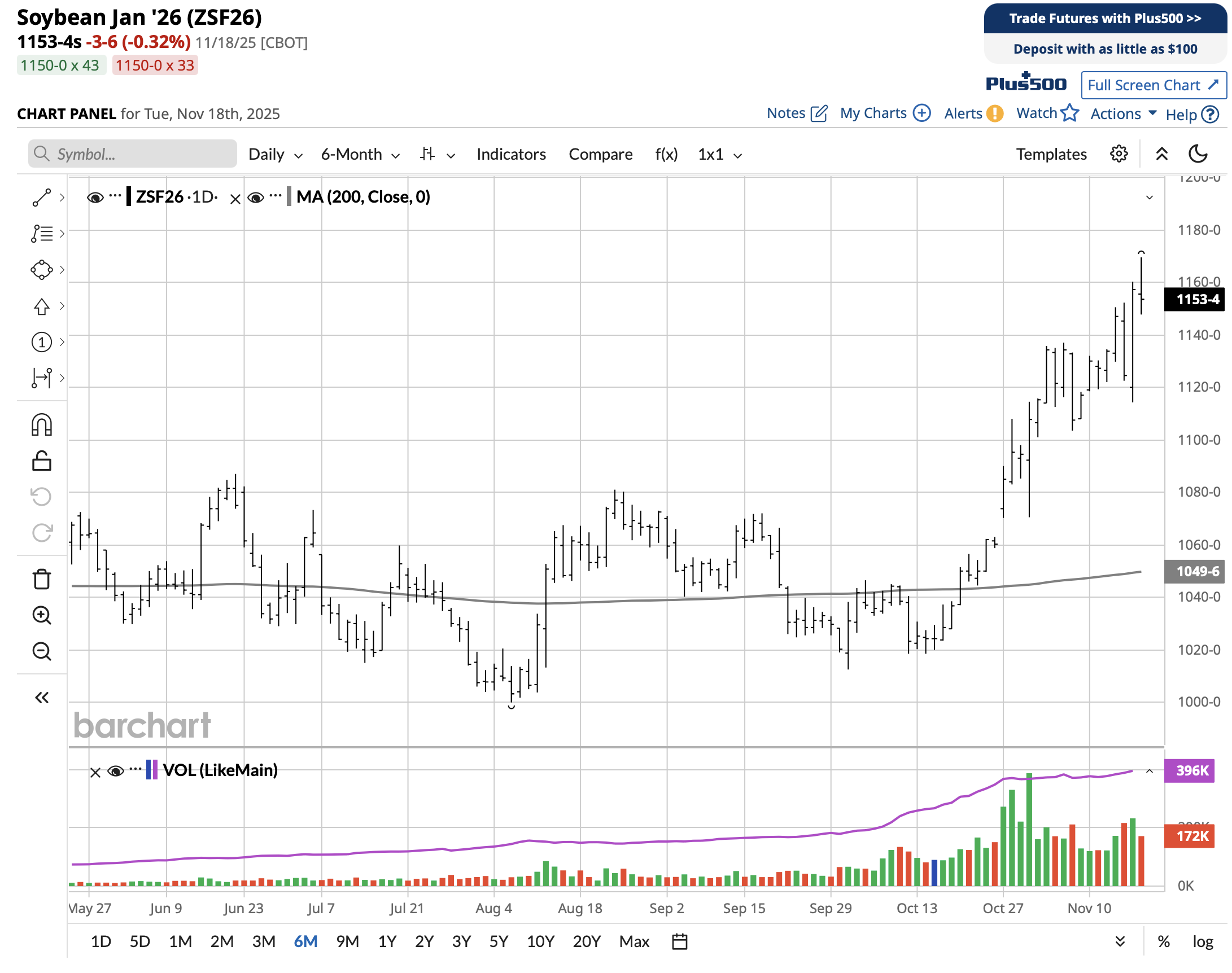

Below are the daily, weekly and monthly chart patterns. All three tell me that soybeans are likely to trade higher.

An option trade strategy is to sell three January 2026 soybean at 13.0 ($650). With that premium in your account, buy one March 2026 soybean 1170 call at 38. The January puts expire December 26, 2025. The harvest is over and it's traditionally the time for soybeans to trade higher. I like to sell options in 20 days or less so this strategy is somewhat risky due to a longer time period. Call me for support and advice on this strategy.

Have an excellent day.

Stephen Davis

Senior Market Strategist

Walsh Trading, Inc.

Direct 312 878 2391 Toll Free 800 556 9411

sdavis@walshtrading.com

www.walshtrading.com

Use this link to join my email list: SIGN UP NOW

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

/Nvidia%20logo%20on%20phone%20screen%20with%20stock%20chart%20by%20xalien%20via%20Shutterstock.jpg)

/Quantum%20Computing/A%20concept%20image%20of%20a%20green%20and%20yellow%20motherboard_%20Image%20by%20Gorodenkoff%20via%20Shutterstock_.jpg)