/A%20Lucid%20Motors%20vehicle%20parked%20in%20front%20of%20a%20showroom_%20Image%20by%20Michael%20Berlfein%20via%20Shutterstock_.jpg)

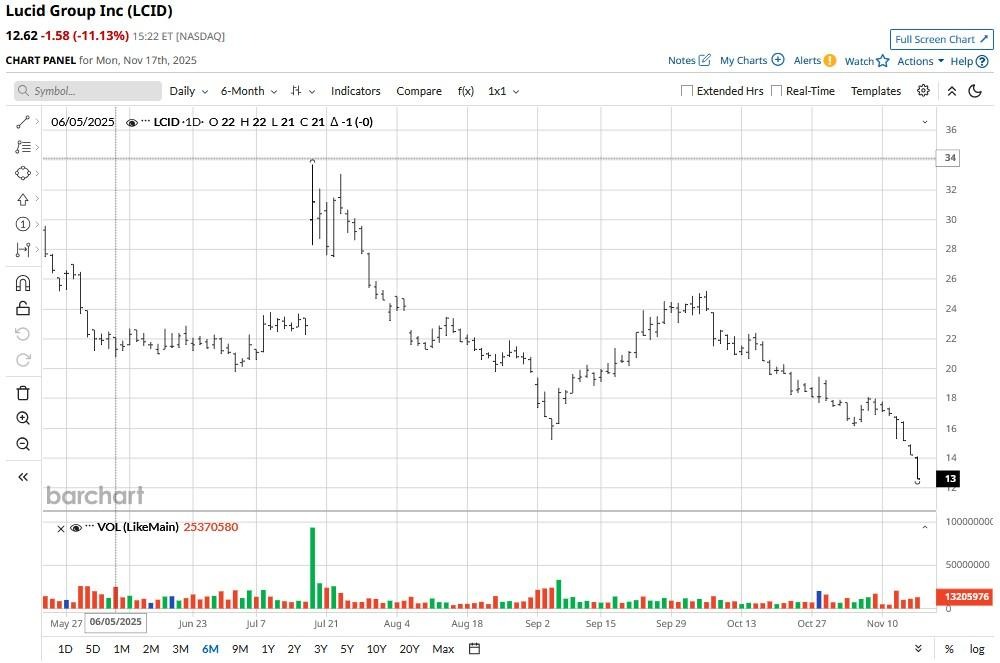

Lucid Group (LCID) shares lost over 10% on Nov. 17 after Stifel analysts reduced their price target on the electric vehicle (EV) firm, citing concerns about future capital requirements.

While the investment firm’s downwardly revised estimates still indicate significant upside in LCID stock to $17, several major headwinds warrant caution in playing the EV stock at current levels.

Following today’s decline, Lucid stock is trading at a new all-time low of about $12.58.

Why Lucid Stock Isn’t Worth Owning Heading into 2026

Despite a historically low valuation, LCID shares remain rather unattractive to own partly because the company has recently announced an $875 million convertible notes offering.

For shareholders, this raises the risk of future dilution and suggests the Newark-headquartered firm may be struggling to fund operations without turning to debt or equity markets.

Lucid has delivered seven consecutive quarters of record deliveries.

Its revenue in Q3 jumped a remarkable 68% on a year-over-year basis, but a much broader-than-expected per-share loss of $3.31 highlighted continued challenges in reaching profitability.

Macro Headwinds Stand to Hurt LCID Shares as Well

Investors should practice caution in playing Lucid shares at current levels also because production challenges continue to hamper the company’s growth trajectory.

Earlier this month, its management narrowed the full-year production guidance to 18,000 vehicles, down from up to $20,000 it had previously forecast.

Additionally, the elimination of the $7,500 federal EV tax credits under President Donald Trump has created demand uncertainty across the sector as well.

Market data shows electric vehicle sales dropped dramatically from 12.9% in September to 6.0% of new vehicle sales following tax credit expiration, demonstrating heavy reliance on government incentives.

Meanwhile, competitive pressure from the likes of BYD (BYDDY) and Xpeng (XPEV) further strains the case for buying the dip in this EV stock.

Wall Street Still Sees Massive Upside in Lucid Group

Despite the aforementioned risks, Wall Street analysts, nonetheless, view Lucid stock as undervalued at current levels.

While the consensus rating on LCID shares remains at “Hold” only, the mean target of roughly $20 indicates potential upside of an exciting 60% from here.

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)