Howdy market watchers!

After 43 long days, the US government is back in business. With the absence of critical programs and data, it has reminded us all how much we actually rely on the government, for better or worse. There is a huge backlog of data that started to be released this week with much more to come that will likely bring volatility to all markets as seen in the CBOE Volatility Index (VIX).

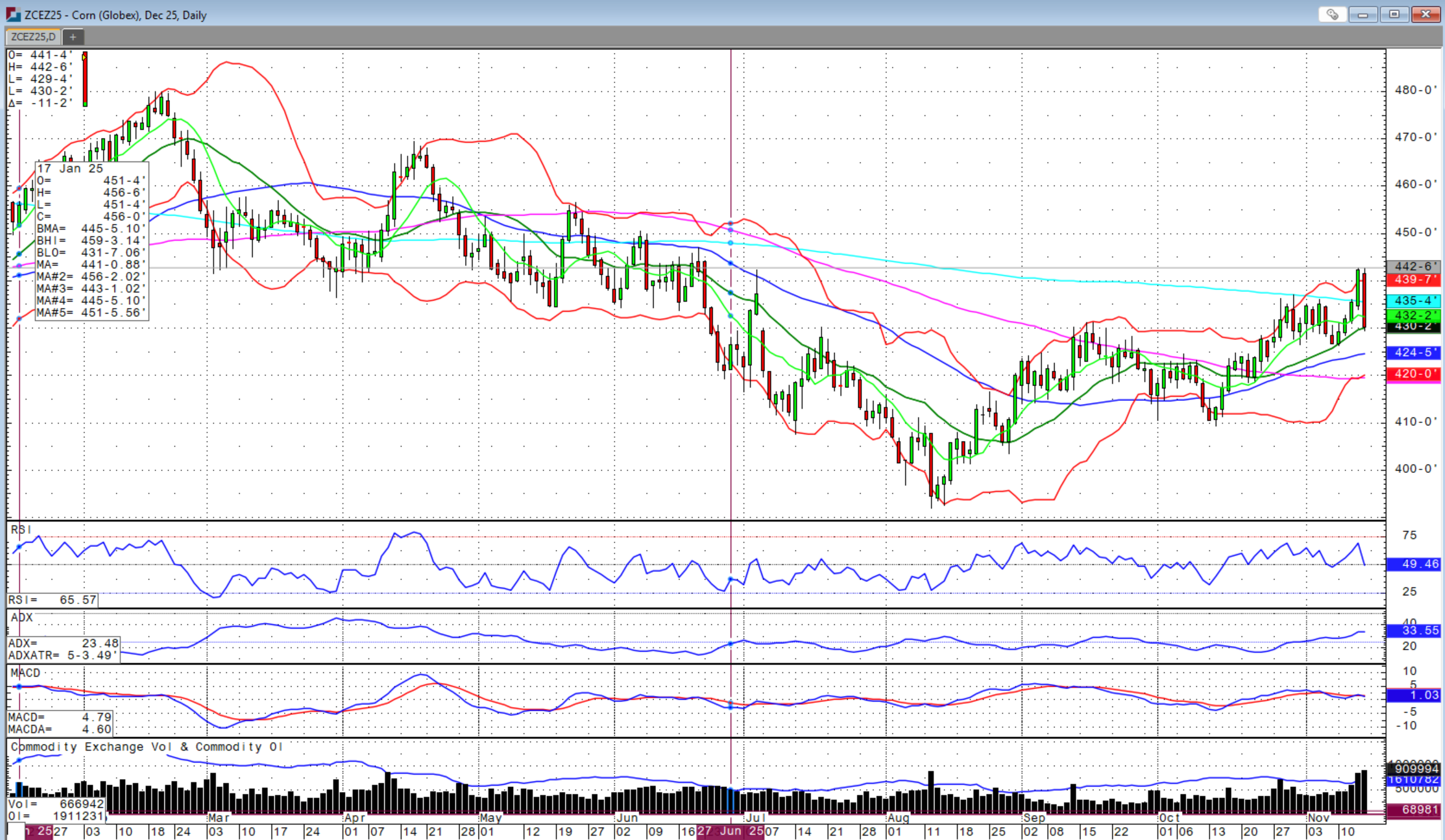

After a two-month hiatus, the USDA released its first round of data on Friday being the USDA’s monthly WASDE and Crop Production reports. Grain and oilseed futures have staged an impressive rally since the 3rd week of October with fresh data from the USDA to end the week met with selling pressure. While corn and soybean yield and production cuts were widely expected, it never seems to be as deep as market hopeful expectations.

US corn yields were pegged at 186.0 bushels per acre (bpa) versus average trade guesses of 183.8 bpa and September’s 186.7 bpa given there was no October report. This brought US corn production to 16.752 billion bushels versus 16.545 billion bushels expected and the previously estimated 16.814 billion bushels and last year’s crop size of 14.892 billion bushels. US soybean yields came in below expectations, but only by 0.1 bpa with the current yield seen at 53.0 bpa versus USDA’s previous figure of 53.5 bpa. US soybean production came to 4.253 billion bushels versus 4.262 billion bushels expected and last report’s call for 4.301 billion bushels and last year’s crop size of 4.374 billion bushels.

Shifting over to the stock side of the balance sheet, US ending stocks for corn were pegged at 2.154 billion bushels versus average trade guesses of 2.125 billion bushels and the previous 2.110 billion bushels, all well above last year’s 1.532 billion bushels. US soybean ending stocks came in lower than expected at 290 million bushels versus guesses of 315 million bushels, USDA’s previous figures of 300 million bushels and last year’s 317 million bushels.

With unknown China export numbers, there was huge range for soybean ending stocks with the lowest at 187 million bushels and the highest at 494 million bushels! In true China fashion, the PRC announced a $10 billion ag purchase agreement with Brazil this week to remind us all that they will keep their options very open with bias towards South America. For what it’s worth, all these trade agreements apparently have a clause that if prices are cheaper elsewhere, the purchase commitments are negated. Wheat ending stocks came in larger than expected at 901 million bushels versus guesses of 868 million bushels, last report’s 844 million bushels and last year’s 858 million bushels.

On a global level, corn ending stocks were reduced slightly to 281.3 million metric tons versus average trade guesses of 282.6 MMT, USDA’s previous 281.4 MMT and last year’s 291.7 MMT. Soybean ending stocks came in below expectations at 122.0 MMT versus guesses of 124.6 MMT, prior estimates of 124.0 MMT and last year’s 123.3 MMT. Global wheat stocks came in above expectations at 271.4 MMT versus pre-report estimates of 266.3 MMT, prior guesses at 264.1 MMT and last year’s 261.4 MMT due to increases in wheat production in Argentina, Australia, Canada, the EU and Russia.

Overall, this report leaned bearish for corn, but more so wheat and bullish for soybeans. I believe the corn yield and production could be revised lower in future reports, especially if exports continue at a strong pace. Regardless, Friday’s price action suggested that bullish expectations were already priced into the market and the fresh data should be sold.

December corn futures touched Thursday’s high and sold down through the 200- and 9-day moving averages to the 20-day moving average, down 12 cents on the day closing at $4.30 ¼.

Wheat contracts also took it on the chin, putting in a large outside reversal lower day selling through the 9- and 100-day moving averages, also down and actually through the 20-day moving average for a close at $5.26 ¾ on December Chicago wheat and $5.15 ¼ on December KC wheat. With the new data weighing on the wheat complex, there is potential that we now aim to fill those gaps below on the charts. For Chicago wheat, that gap would be filled at $5.15 ½ and for KC wheat, the gap will fill at $5.04 ½.

There is rain for the Southern Plain wheat areas next week that could also lead to price pressure. However, rising tensions in the Black Sea area with Russia and Ukraine exchanging large attacks could bring some of the risk premium back to the wheat complex if port infrastructure is impacted, but that is likely a stretch to expect as we’ve seen in recent years. With other countries talking about improved wheat production estimates, I think our best hope for the wheat rally to continue once support is found will come from demand for US corn.

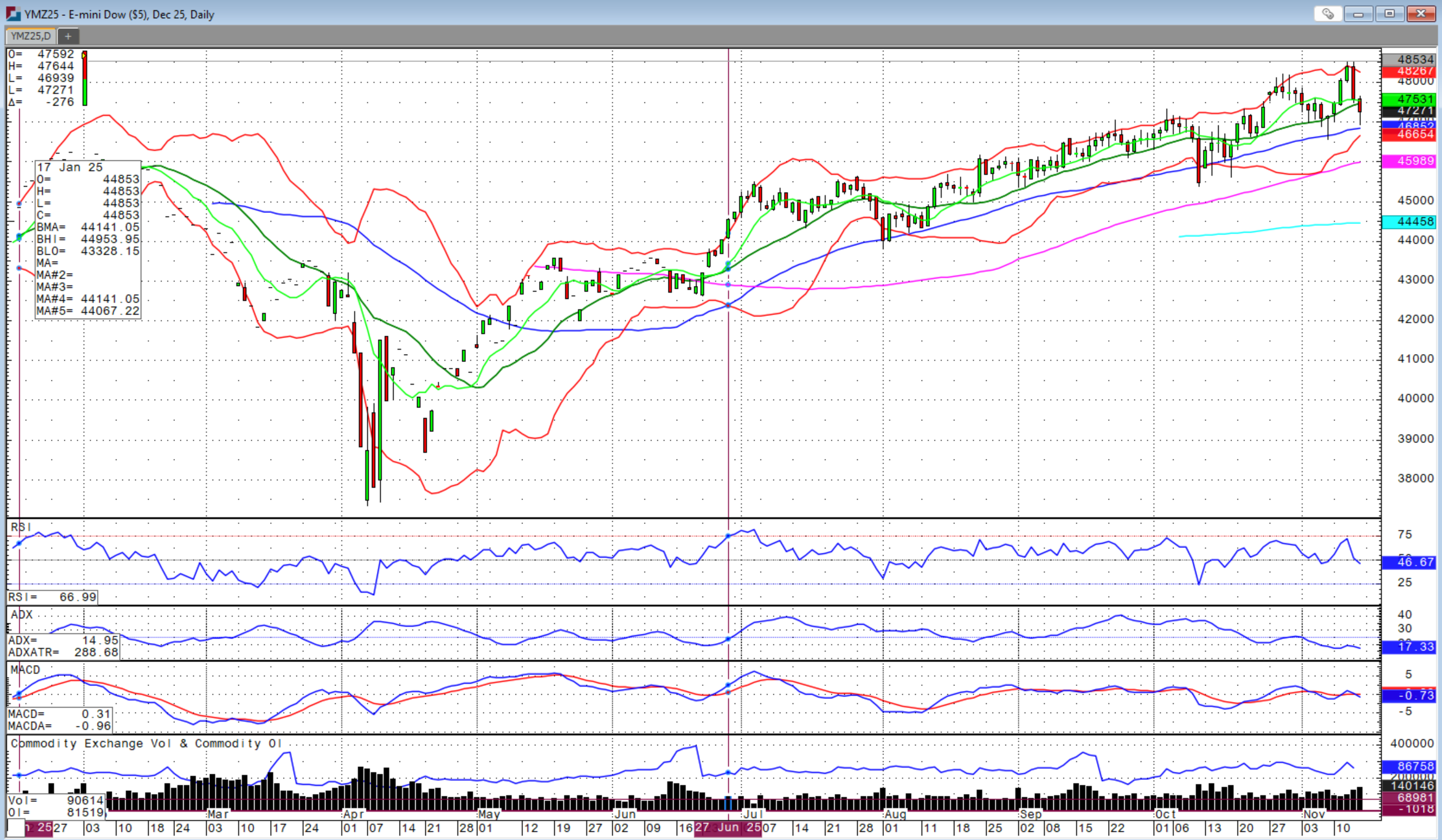

The US dollar bounced higher on Friday after Fed comments that another rate cut is not a certainty. Inflationary concerns remain for the US economy despite weaker job numbers expected once official data returns.

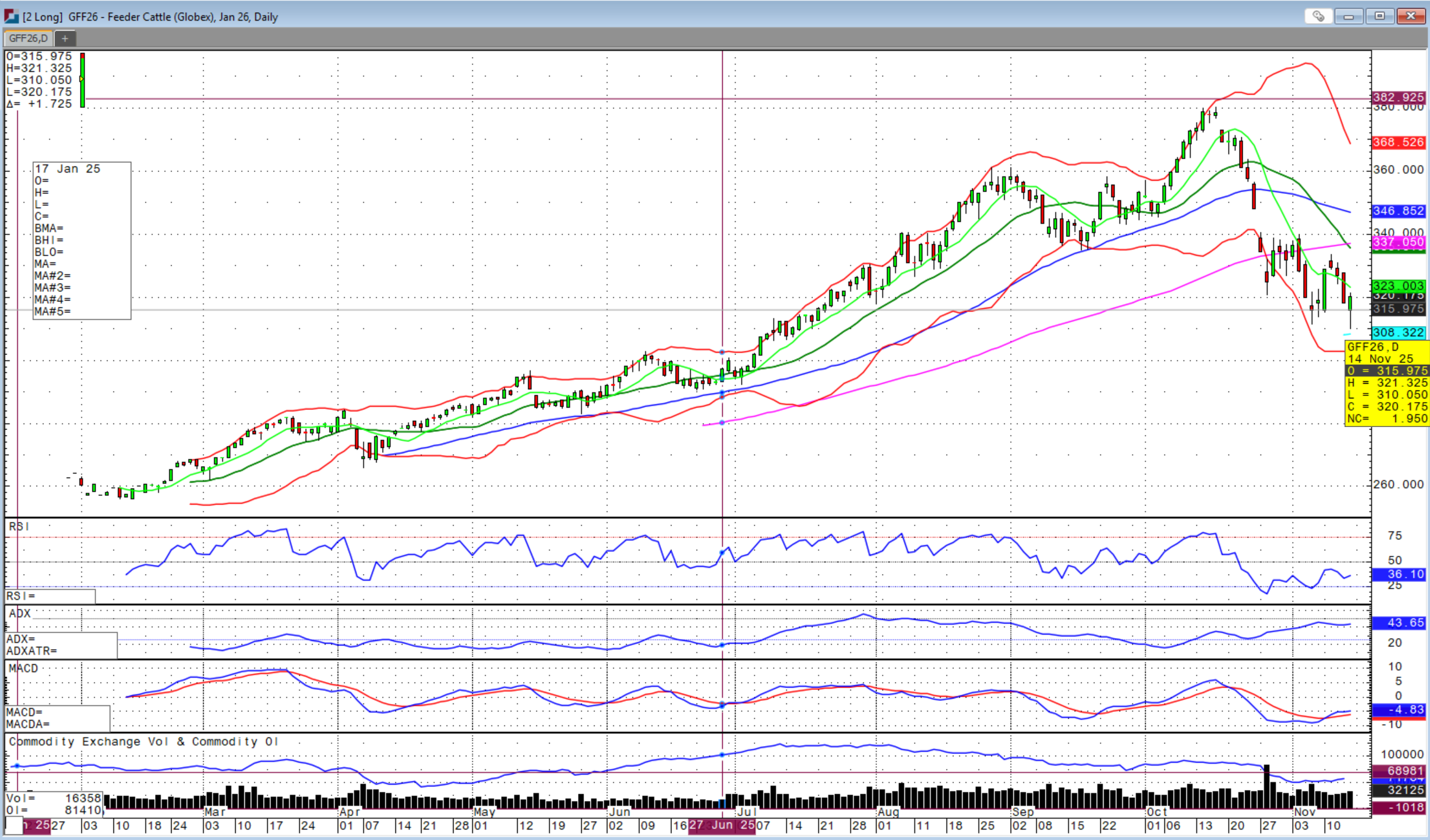

After markets closed on Friday, the Trump Administration did announce that reciprocal and possibly other tariffs would be exempted for certain agricultural product imports in an attempt to bring down the price of products. This was hinted earlier in the week for products that the US does not produce in large quantities, but did include beef once the official announcement came out at the end of day on Friday. I am sure hopeful that this is already priced into the market after the major correction we’ve had with a new low for the move put in early Friday with the market gapping lower at the open. Link to announcement: Fact Sheet: Following Trade Deal Announcements, President Donald J. Trump Modifies the Scope of the Reciprocal Tariffs with Respect to Certain Agricultural Products – The White House

With January feeder futures trading down near the 200-day moving average at $308.320, that market found support to rebound all the way to close above $320.00. Friday’s high-low trading range on January feeders was $11.275! November feeder futures expire Thursday followed by USDA’s monthly Cattle-on-Feed report to be released next Friday at 2 PM, after the close.

It was another wild week in CME cattle futures with Monday’s limit up day followed by Thursday’s limit down day, on most feeder contracts. USDA announced the opening of a sterile fly facility in Tampico, Mexico, on Thursday that led to heavy selling that day, but followed by Friday’s further selloff, but impressive recovery and close. Link to this announcement: USDA Announces Opening of Sterile Fly Dispersal Facility in Tampico, Mexico | USDA

Equity markets have also been extremely volatile this week making new highs, but then coming under selling pressure, but recovering by Friday’s close. Uncertainty abounds across all markets with cautious optimism balanced by a lack of government data. The fundamentals in the beef market remain bullish, but the barrage of negative news on consumer pricing continues to whipsaw this market relentlessly.

From the high on January feeders of $380.20 on October 16th to Friday’s low trade of $310.05, the market has corrected over $70.00 per cwt lower. There are numerous chart gaps above that I believe this market will chop back towards once we get some of these announcements behind us. In fact, it seems these rumors and tweets are worse that the facts of eliminated tariffs and reopening of the Mexican border. The US slaughters around 680,000 head of cattle per week, every week, making the numbers from Mexico and imports of beef trimmings for ground beef a drop in the bucket. Yet, the market is whipsawing all around on news of import changes. It seems like an ocean away, but I still believe we could see front-month feeder markets rebound to the $345-350 level at which point downside protection is highly recommended. Unfortunately however, it is going to be extremely choppy between here and there.

Sidwell Strategies is the one-stop shop to protect cattle with futures, puts, LRP or a combination of all, which is probably the best strategy overall. If you’re ready to trade commodity markets, give me a call at (580) 232-2272 or stop by my office to get your account set up and discuss risk management and marketing solutions to pursue your objectives. Self-trading accounts are also available. It is never too late to start and there is no operation too small to get a risk management and marketing plan in place.

Wishing everyone a successful trading week! Let us know if you'd like to join our daily market price and commentary text messages to stay informed!

Brady Sidwell is a Series 3 Licensed Commodity Futures Broker and Principal of Sidwell Strategies. He can be reached at (580) 232-2272 or at brady@sidwellstrategies.com. Futures and Options trading involves the risk of loss and may not be suitable for all investors. Review full disclaimer at https://www.sidwellstrategies.com/fccp-disclaimer-21951.

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)