/An%20image%20of%20a%20hand%20holding%20a%20smartphone%20with%20the%20Pinterest%20logo%20and%20app%20background_%20Image%20by%20FellowNeko%20%20via%20Shutterstock_.jpg)

Pinterest (PINS) has come a long way from being a digital mood board to becoming a powerhouse in visual search and artificial intelligence (AI)-driven discovery. Today, it is more than just a place for inspiration – it is a platform that doubles as a personal shopping assistant for millions, turning imagination into action with a single tap.

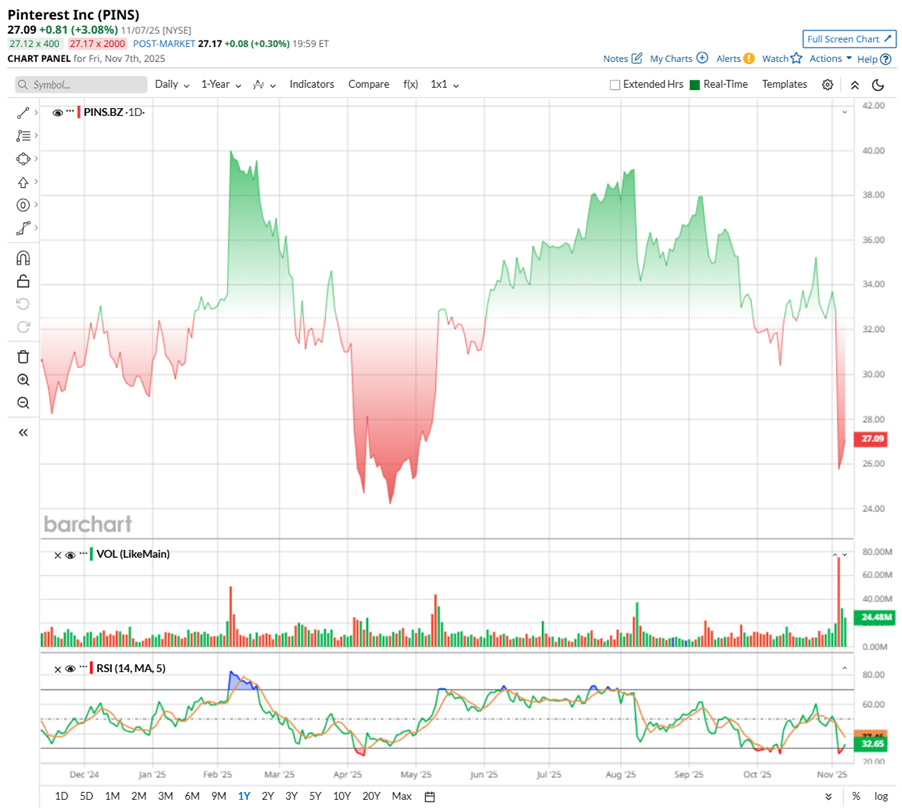

After staging an impressive rebound over the summer, shaking off April’s tariff-driven slump, Pinterest’s latest earnings report pulled the rug again. The stock plunged over 20% last week on Nov. 5, after missing earnings expectations and issuing soft guidance for the crucial holiday quarter. Despite a third quarter marked by solid user growth and modest revenue gains, management’s cautious outlook cast a shadow over the company’s near-term prospects.

So, with shares back in the bargain bin and sentiment running low, does this post-earnings dip offer a smart entry point, or is there more turbulence ahead for Pinterest?

About Pinterest Stock

San Francisco-based Pinterest began its journey in 2008 as Cold Brew Labs Inc. before rebranding in 2012. Valued at around $18.4 billion by market capitalization, the platform has evolved into a global hub for visual discovery and inspiration, helping users find everything from home ideas to fashion, recipes, and travel.

Over the years, Pinterest has leaned deeply into AI innovation, enhancing personalization, visual search, and inclusive content recommendations. Under CEO Bill Ready, it has become a Gen Z favorite – blending discovery, creativity, and shopping in one seamless experience. Catering to users with a “discovery mindset,” Pinterest offers advertisers a rare edge – an audience open to ideas and ready to act. Its Verified Merchants Program and AI-powered ad tools allow brands to showcase shoppable content and retarget efficiently, creating one of the most effective digital ad ecosystems for lifestyle and retail brands.

With growing engagement, new verticals like men’s fashion and wellness, and a sharper focus on actionable content, Pinterest continues to carve out its niche in the competitive social commerce landscape.

Shares of the social commerce platform have been on a wild ride this year – full of highs, dips, and sharp turns that mirror investor sentiment. The volatility stems from a familiar tech tale – overpromising, underdelivering, and trying to carve space beside heavyweights like Meta (META), TikTok, and Google (GOOGL).

After peaking near $40.90 in February, shares slipped to an April low of $23.68, weighed down by post-earnings disappointments and cautious guidance. Despite bouncing 14.4% off those lows, PINS still trades 33% below its year-to-date (YTD) highs, underscoring how fragile confidence remains. The pullbacks after Q2 and Q3 earnings hit hardest, with the latest report sparking a nearly 20% post-earnings drop.

Over the past 52 weeks, PINS has fallen 10.55%, including a steep 21.2% slide in the last three months alone. Technically, Pinterest’s 14-day RSI dropped into oversold territory on Nov. 5 – sliding from 51 just two days earlier – but it’s now hovering slightly above 34, hinting at stabilizing momentum. For now, Pinterest’s chart reads like a tug-of-war between fading momentum and hopeful bargain hunters waiting for a rebound.

Pinterest’s stock tells a mixed story, priced at about 15.5 times forward adjusted earnings and 4.3 times sales, it sits above sector peers but below its own historical averages. The setup suggests investors are paying a mild premium for growth, yet the stock still carries an undertone of value when viewed through a longer lens.

Pinterest’s Shares Dip After Q3 Results

Pinterest’s third-quarter results had all the right visuals, but just not the perfect filter Wall Street wanted. On Nov. 4, the visual discovery platform posted modest Q3 results that painted a mixed picture. Revenues climbed 17% year-over-year (YOY) to $1.049 billion, slightly beating expectations. But non-GAAP EPS of $0.38, up 18.8% from last year, fell short of analyst forecasts, dimming what could have been a standout quarter.

Growth was widespread across regions, though uneven in pace. U.S. and Canada revenue rose 9% annually, marking the slowest growth since late 2023, while Europe surged 41% and the rest of the world jumped 66%, underscoring Pinterest’s growing global appeal. Behind the scenes, AI continues to play a starring role – its Pinterest Performance+ suite is resonating with advertisers, driving smarter targeting, higher engagement, and smoother conversions from inspiration to purchase.

User growth was another bright spot. Global monthly active users rose 12% YOY to a record 600 million, reflecting solid momentum worldwide. The platform’s base expanded 4% in the U.S. and Canada, 8% in Europe, and 16% across the rest of the world.

Financially, Pinterest’s engine remains strong – net cash provided by operating activities hit $321.6 million, and its cash reserves swelled to $1.13 billion, leaving the company well-positioned for its next growth phase.

And yet, investors were not exactly pinning their hopes on the stock. The reason was that Pinterest’s Q4 guidance landed on the softer side. Management expects revenue between $1.313 billion and $1.338 billion, representing a growth between 14% and 16%. Last year’s Q4 revenue grew 18% YOY. Meanwhile, adjusted EBITDA is estimated to be between $533 million and $558 million – representing nearly 16% annual surge and way lower than last year’s 28% EBITDA growth. Plus, CFO Julia Donnelly warned of continued “market uncertainty” and tariff pressures weighing on categories like home furnishings.

Still, CEO Bill Ready’s optimism shone through. He highlighted how Pinterest’s AI now “anticipates what users will love next,” essentially turning the platform into a predictive shopping assistant. That kind of foresight could prove to be a game-changer as e-commerce leans deeper into personalization.

Meanwhile, analysts monitoring Pinterest expect the company’s fiscal 2025 EPS to be around $0.61, up 41.9% annually, and rise by another 37% to $0.84 in fiscal 2026.

What Do Analysts Expect for Pinterest Stock?

Wall Street’s reaction to Pinterest’s Q3 report was a mix of concern and cautious optimism. Jefferies analyst James Heaney noted that the 9% YOY growth in the U.S. and Canada marked the platform’s weakest pace since late 2023. He kept a “Hold” rating, saying investors are likely to “stay on the sidelines” until one of Pinterest’s growth bets pays off.

Wedbush’s Scott Devitt was more upbeat – though he cut his price target from $44 to $34, he maintained an “Outperform” rating, calling Pinterest’s valuation “attractive for a digital ad platform with considerable monetization potential ahead.”

Barclays trimmed its target to $36 from $40, keeping an “Equal Weight” stance. The brokerage firm feels the stock’s getting a harsher beating than it deserves, arguing that Pinterest’s challenges are confined to a few weak spots rather than a full-blown industry problem.

Monness Crespi Hardt’s Brian White took the harshest stance, calling Pinterest’s quarter “uninspiring” and its outlook “muted.” He downgraded the stock to “Neutral” from a “Buy,” citing a tougher ad climate, tariff-related pressures, and intensifying competition in the AI-driven digital space. White described management’s tone on the earnings call as “downtrodden,” noting cautious commentary from large U.S. retailers and what he called Pinterest’s tendency to “tap dance” around its long-term revenue goals. Despite that, he acknowledged one silver lining – robust user growth to 600 million MAUs, even if weaker ad pricing dulled the impact.

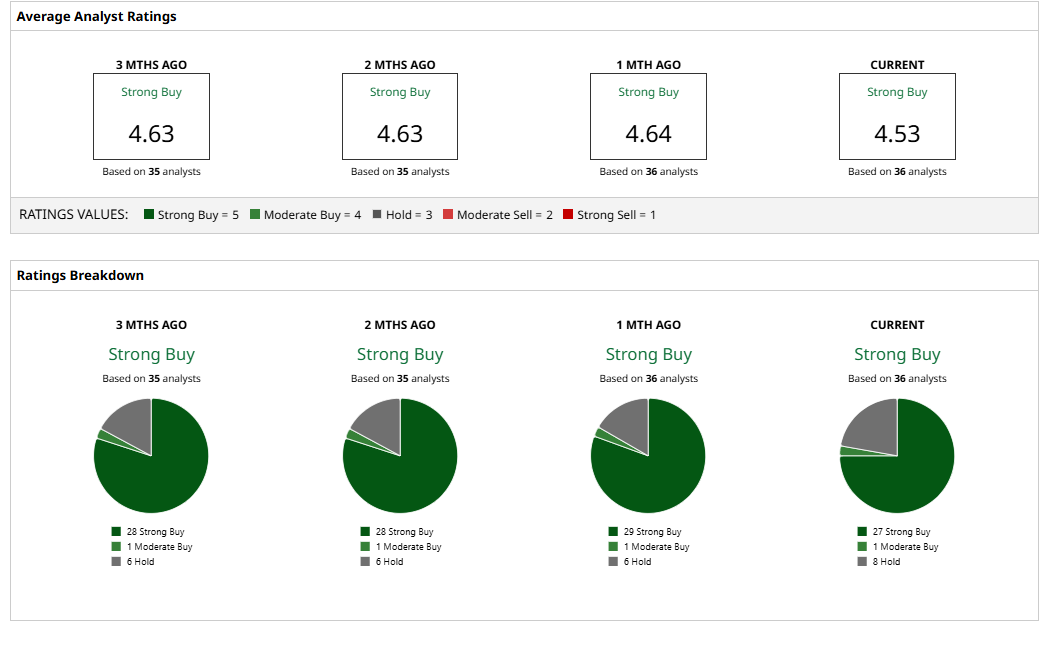

Despite all the hand-wringing after earnings, Wall Street still has not given up on Pinterest. Sure, a few analysts trimmed their price targets and flagged near-term challenges, but the broader mood remains surprisingly upbeat. PINS has a consensus “Strong Buy” rating overall. Out of the 36 analysts offering recommendations for the stock, 27 suggest a “Strong Buy,” one advises a “Moderate Buy,” and the remaining eight give a “Hold” rating.

The average analyst price target of $38.26 indicates 40% potential upside from the current price levels. However, the Street-high price target of $48 suggests that the stock could rally as much as 78%.

Does Pinterest’s Dip Deserve a Second Look?

Pinterest’s post-earnings slide might seem overdone, but a little context explains why investors are uneasy. Competing in the same digital arena as Meta, TikTok, and Google means Pinterest has little room for error. Growth must be fast, user numbers must climb, and ad dollars need to flow steadily, or Wall Street starts doubting its staying power.

The holiday quarter, usually Pinterest’s big season, didn’t help ease those nerves. Management’s cautious tone, paired with soft guidance, hit confidence hard. CFO Julia Donnelly flagged “pockets of moderating ad spend” in the U.S. and Canada as large retailers wrestled with tariff pressures. There was a silver lining – international markets are showing some momentum – but it wasn’t enough to lift sentiment.

On the bright side, Pinterest’s AI is quietly rewriting the playbook. On the Q3 earnings call, CEO Bill Ready hinted at a bigger vision – one where the platform doesn’t just respond to users but intuitively knows what they’ll want next. If Pinterest can scale that vision and hit over a billion monthly users, its story could change dramatically.

Until then, the stock may look cheap, but in this fiercely competitive landscape, “cheap” doesn’t always mean safe. Sometimes, the smartest move is to watch and wait for the next spark.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Tesla%20Inc%20logo%20by-%20baileystock%20via%20iStock.jpg)

/Salesforce%20Inc%20logo%20on%20building-by%20Sundry%20Photography%20via%20Shutterstock.jpg)