With markets becoming more volatile, investors might be more interested in generating income rather than capital gains.

Omega Healthcare (OHI) has long been a staple of dividend investors and with the stock showing a low Beta of 0.69 and a high yield of 6.07%, it provides an attractive opportunity for savvy investors.

Using options we can more than double the yield on our OHI shares by using a covered call strategy.

A covered call involves selling call options against a stock position.

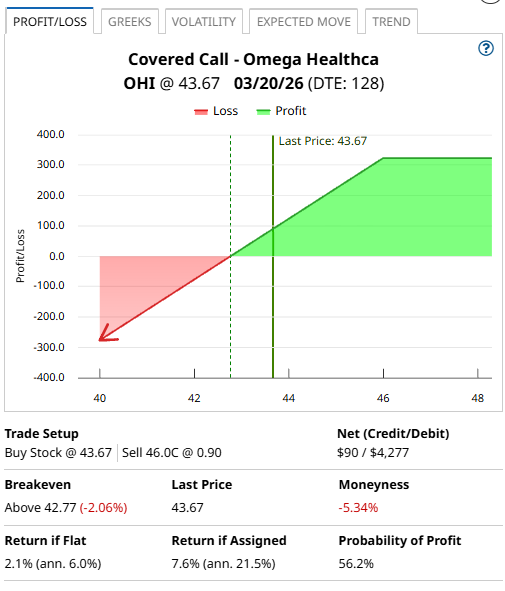

OHI Covered Call Example

Buying 100 shares of OHI would cost $4,367. The March 20, 2026 call option with a strike price of $46 was trading around $0.90 yesterday, generating $90 in premium per contract for covered call sellers.

Selling the call option generates an income of 2.1% in 128 days, equalling around 6.0% annualized.

Covered call traders also receive the yearly dividend of $2.68 which is a yield of 6.07%.

The covered call option premium brings the total yield up from 6.07% to 12.07%.

That’s a pretty attractive yield for a low-beta, defensive stock and almost double what regular shareholder receive.

That assumes the stock stays exactly where it is. What if the stock rises above the strike price of $46?

If OHI closes above $46 on the expiration date, the shares will be called away at $46, leaving the trader with a total profit of $323 (gain on the shares plus the $90 option premium received). That equates to a 7.6% return, which is 21.5% on an annualized basis.

Of course, the risk with the trade is that the OHI might drop, which could wipe out any gains made from selling the call.

Company Details

Omega Healthcare Investors, Inc. was incorporated in the State of Maryland.

It is a self-administered real estate investment trust (`REIT`), investing in income producing healthcare facilities, principally long-term care facilities located in the United States (`U.S.`) and the United Kingdom (`U.K.`).

The Company provide lease or mortgage financing to qualified operators of skilled nursing facilities (`SNFs`) and, to a lesser extent, assisted living facilities (`ALFs`), independent living facilities and rehabilitation and acute care facilities.

It has historically financed investments through borrowings under its revolving credit facilities, private placements or public offerings of its debt and equity securities, the assumption of secured indebtedness, retention of cash flow, or a combination of these methods.

Barchart Technical Opinion

The Barchart Technical Opinion rating is a 100% Buy with a Average short term outlook on maintaining the current direction.

Long term indicators fully support a continuation of the trend.

Implied volatility is at 25.65% compared to a 12-month low of 11.63% and a 12-month high of 37.40%.

Omega Healthcare rates as a Strong Buy according to 3 analysts with 1 Moderate Buy, 13 Hold and 1 Strong Sell rating.

Defensive stocks such as Omega Healthcare are a common component of most investment portfolios and now you know how to generate an extra income from your OHI position.

Please remember that options are risky, and investors can lose 100% of their investment. This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

On the date of publication, Gavin McMaster did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)