Oklo (OKLO) closed higher on Nov. 12 after achieving a transformative regulatory milestone that outweighed its disappointing earnings for the third financial quarter (Q3).

The nuclear-tech firm has secured approval for its Aurora Fuel Fabrication Facility from the Department of Energy (DOE), marking the first authorization under the agency’s Advanced Nuclear Fuel Line Pilot Projects.

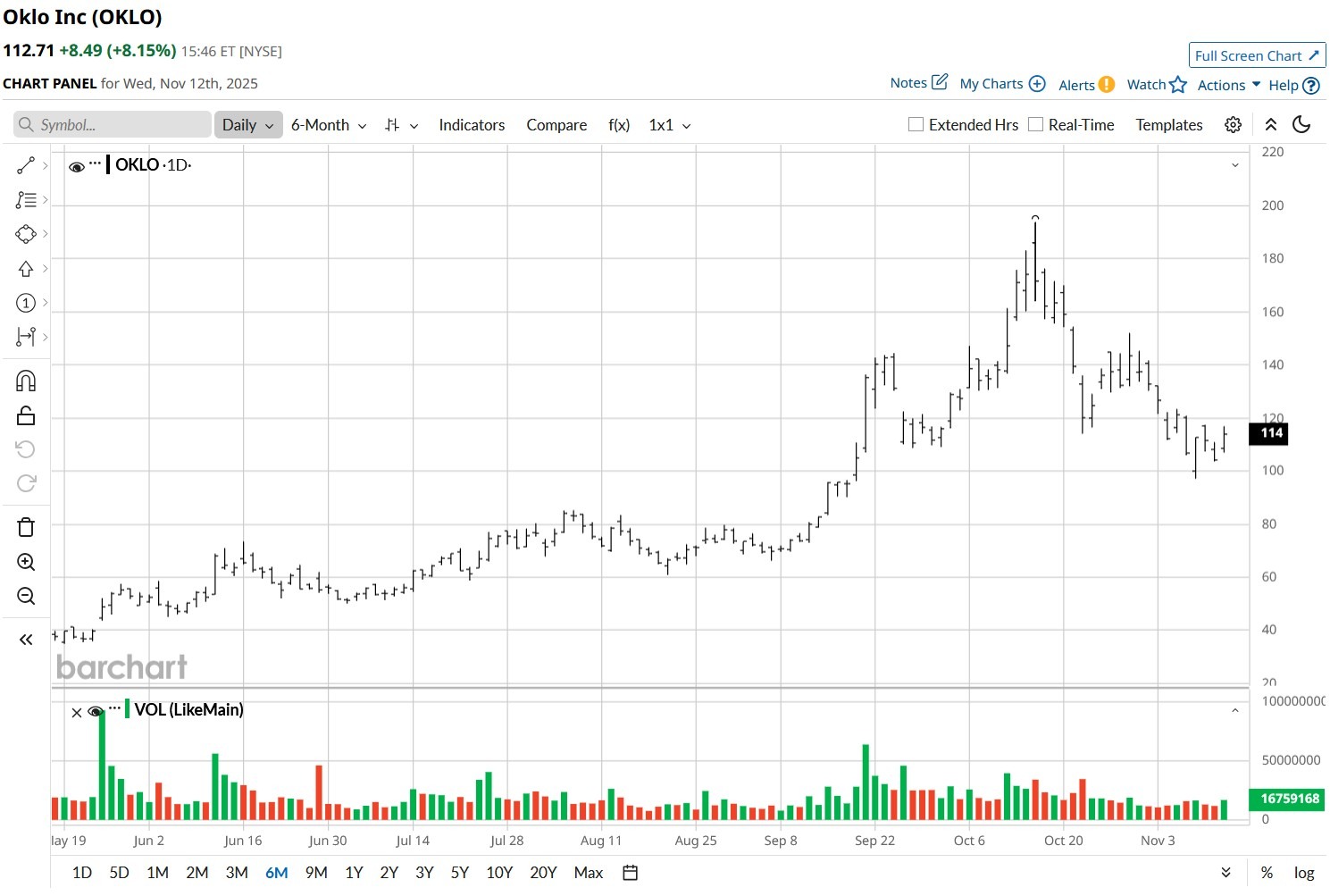

Despite today’s rally, OKLO shares are down some 43% versus their year-to-date high in October.

Why Is the DOE News Significant for OKLO Stock?

This regulatory breakthrough is largely constructive for OKLO stock since it provides a smoother licensing path compared to traditional Nuclear Regulatory Commission processes.

The streamlined approach enables the Nasdaq-listed firm to begin construction while maintaining parallel engagement with NRC, potentially accelerating commercial deployment timelines.

Moreover, it meaningfully reduces regulatory timeline risks that have historically plagued nuclear development projects as well.

OKLO has already broken ground on its first Aurora powerhouse at the Idaho National Laboratory, marking the first advanced reactor moving from design to build under DOE oversight.

Financial Weakness Warrants Caution in Buying OKLO Shares

While the DOE greenlight sure is significant for OKLO shares, the company’s financial challenges temper the overall investment outlook.

In its fiscal Q3, the Santa Clara-headquartered firm lost $0.20 on a per-share basis, well above the $0.13 a share of loss that analysts had forecast.

It remains pre-revenue and operates in an emerging market with no commercial advanced reactor projects currently operating, creating substantial execution and regulatory uncertainties.

Adding to the risk of owning this nuclear energy stock heading into 2026 is its alarmingly stretched valuation. OKLO trades at a stretched price-book ratio above 22x.

Wall Street Warns of Significant Downside in Oklo

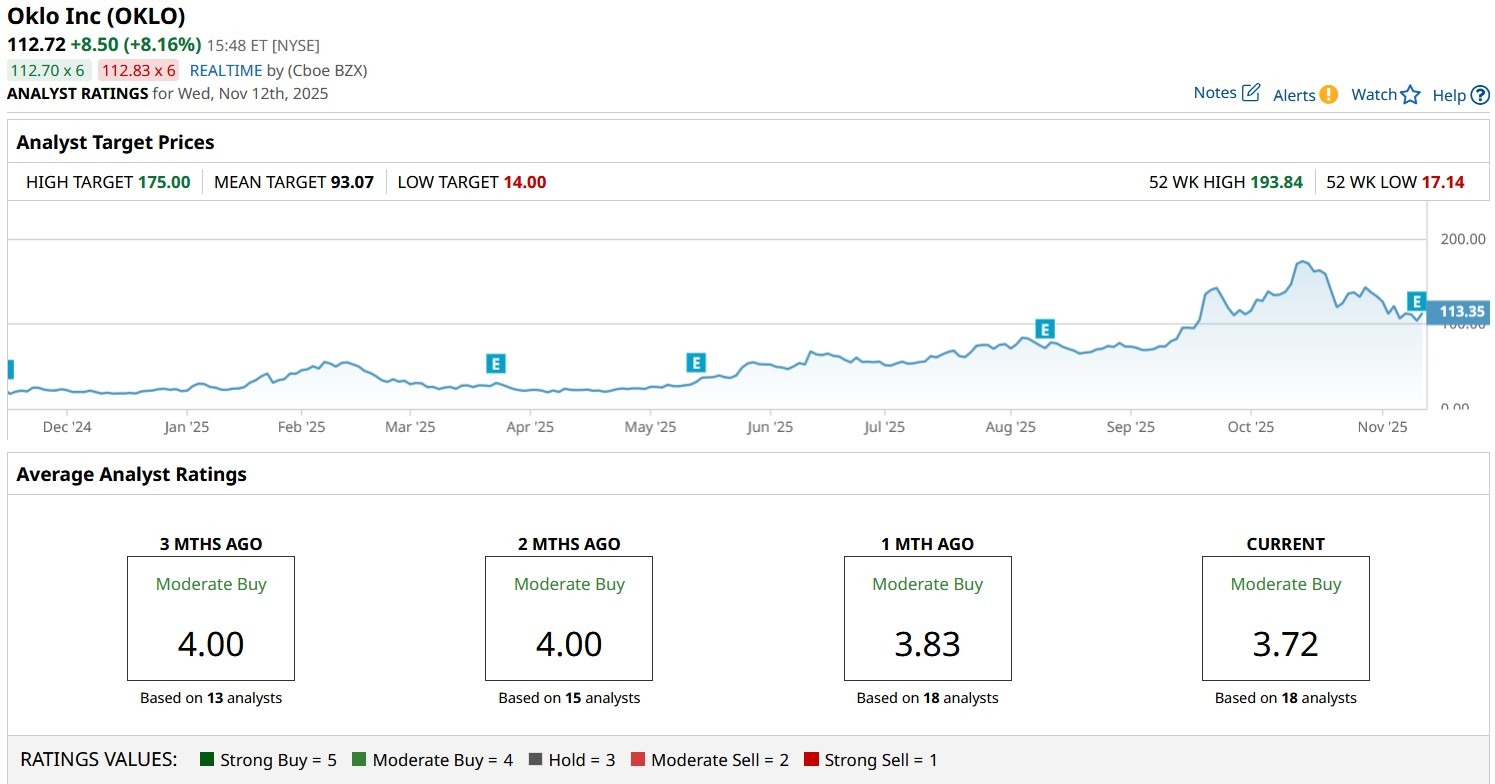

Wall Street analysts also agree that the explosive move in OKLO shares this year has gotten ahead of itself.

While the consensus rating on OKLO stock remains at “Moderate Buy,” according to Barchart, the mean target of about $93 indicates potential downside of roughly 16% from here.

/AI%20(artificial%20intelligence)/Artificial%20Intelligence%20technology%20concept%20by%20NicoEINino%20via%20Shutterstock.jpg)