/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

Palantir (PLTR) shares closed higher on Monday after the Denver-headquartered firm announced a partnership with Poland’s Defense Ministry, marking a notable expansion of its European footprint.

The collaboration strengthens Palantir’s position in NATO’s eastern flank amidst growing regional security concerns and increased defense spending across Europe.

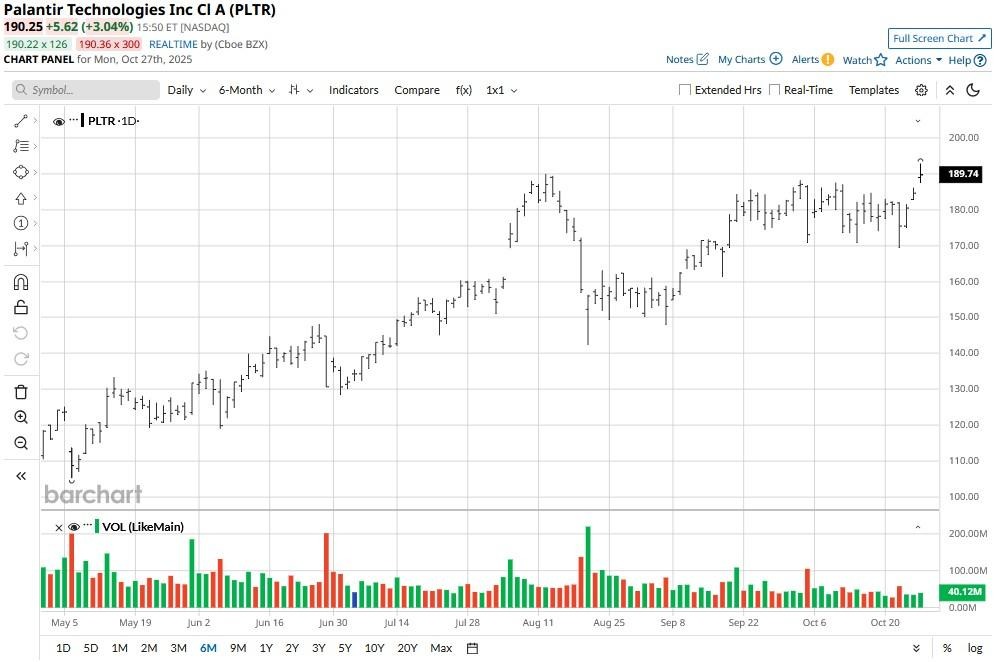

Following today’s gains, Palantir stock is trading roughly 200% above its year-to-date low.

Significance of Poland’s Contract for Palantir Stock

The timing of Poland’s contract is noteworthy as it coincides with broader military modernization initiatives across Europe, setting the stage for similar partnerships with other EU nations.

While the contract value remains undisclosed, Poland's accelerated spending on defense suggests a substantial commitment that could provide Palantir with stable, long-term revenue streams.

The announcement arrives only days after Palantir signed a multi-year deal with Lumen (LUMN) on improving artificial intelligence (AI) deployment infrastructure.

Together, these developments could help sustain the momentum in the company’s revenue growth that came in at 48% year-over-year in its latest reported quarter, potentially driving PLTR stock higher in 2026.

Caution Is Still Warranted in Owning PLTR Shares

While Palantir has established its relevance in the age of artificial intelligence, with some even calling it the “future operating system for AI,” valuation remains a major overhang on PLTR shares.

At the time of writing, they’re trading at a forward price-earnings (P/E) ratio of more than 400x, well above the best-of-breed AI stocks like Nvidia (NVDA) that’s currently going for 43x only.

Moreover, Palantir continues to derive more than half of its revenue from government contracts with a large chunk tied to the U.S. Department of Defense (DoD).

Any budget reallocation or political shift could, therefore, materially impact its revenue. Note that Palantir shares don’t currently pay a dividend to incentivize ownership despite valuation concerns either.

Wall Street Rates Palantir Technologies at ‘Hold’ Only

Wall Street analysts also believe Palantir’s stock price rally this year has gone a bit too far.

According to Barchart, the consensus rating on PLTR shares currently sits at “Hold” only, with the mean target of roughly $159 indicating potential downside of more than 15% from here.

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Tesla%20Inc%20logo%20by-%20baileystock%20via%20iStock.jpg)

/Salesforce%20Inc%20logo%20on%20building-by%20Sundry%20Photography%20via%20Shutterstock.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)