/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)

Datavault AI (DVLT) shares are up over 30% on Monday after the artificial intelligence (AI)-enabled blockchain infrastructure firm partnered with Max International AG to launch a Swiss Digital RWA Exchange.

The strategic positioning in Switzerland – which currently handles 70% of global gold (GCZ25) refining and trading – provides DVLT with a notable competitive advantage in the real-world asset tokenization market.

Following today’s meteoric rally, DVLT shares are trading up more than 800% their price in the first week of September.

Does the Max International Deal Warrant Buying Datavault Stock?

The Max International deal leverages Switzerland’s sophisticated digital regulatory frameworks to address three primary barriers to institutional adoption: regulatory uncertainty, tech scalability, and fiduciary trust.

It offers access to established financial networks and infrastructure, potentially ramping up market adoption and revenue generation.

The immediate implementation plan to execute the first regulatory-compliant trade on stablecoin platforms, independent of U.S. regulations, demonstrates practical viability and market readiness.

With tokenized assets projected to exceed $1 trillion by the end of this decade, DVLT stock appears well-positioned to capture significant market share through its compliant, automated solutions.

What Else Makes DVLT Shares Attractive to Own in 2025

Datavault’s strategic entry into the Swiss market, combined with its comprehensive technological capabilities and strong regulatory foundation, creates a compelling growth trajectory.

The firm’s proprietary AI-powered technology suite, including its DataValue and DataScore systems, targets critical market inefficiencies through transparent algorithmic valuations for illiquid assets.

This technological foundation, combined with DVLT’s extensive global patent portfolio covering secure data tokenization, digital twins, and automated compliance, provides extensive intellectual property protection across major markets.

Datavault reported a more than 5x year-over-year increase in revenue for its latest reported quarter in August, which adds to the list of reasons to own DVLT shares at current levels.

How Wall Street Recommends Playing DVLT at Current Levels

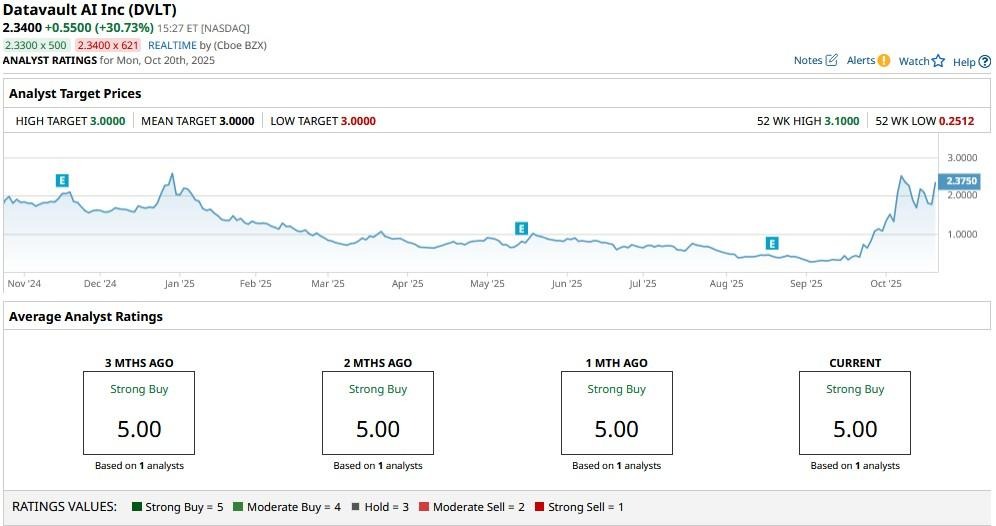

Note that Datavault stock currently receives coverage from only one Wall Street firm, which does warrant caution.

However, investors can take heart in the fact that at least that one firm rates DVLT shares at “Buy” with a price target of $3 indicating potential upside of another 25% from here.

/Broadcom%20Inc%20HQ%20photo-by%20Sundry%20Photogrpahy%20via%20iStock.jpg)

/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)

/Super%20Micro%20Computer%20Inc%20logo%20on%20building-by%20Poetra_RH%20via%20Shutterstock.jpg)