Oklo (OKLO) has teamed up with a UK-based startup, Newcleo, to invest $2 billion in America’s uranium fuel facilities. Shares of the nuclear technology company ended roughly flat on Friday.

This substantial investment represents a crucial step in securing the nuclear fuel supply chain and improving the United States’ vertical integration capabilities.

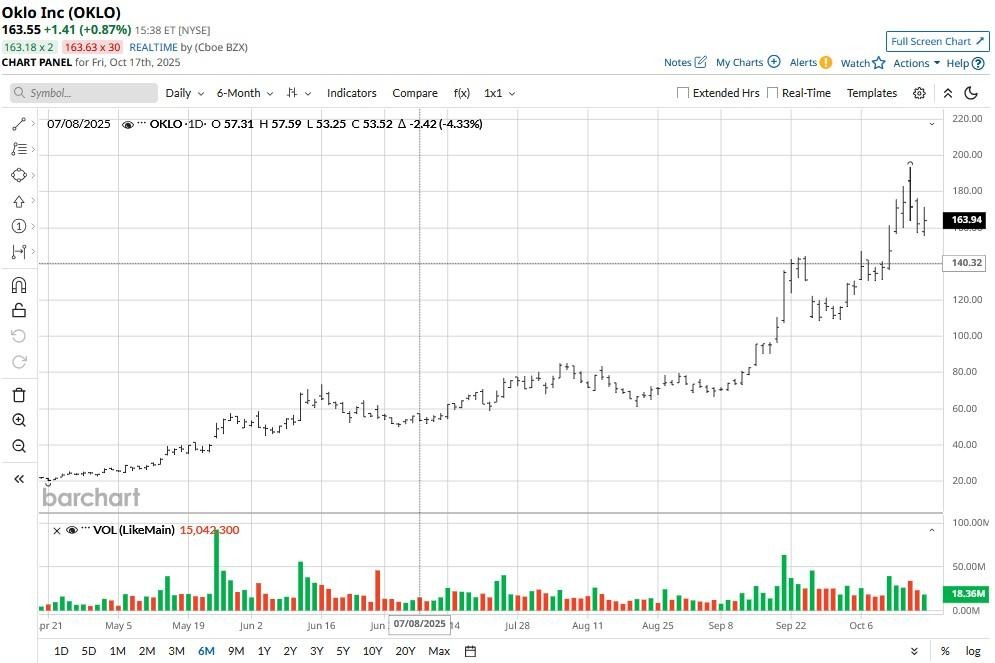

OKLO stock’s alignment with national security priorities has pushed its price up some 700% over the past six months.

Significance of Newcleo Partnership for OKLO Stock

The timing of this investment is particularly significant as it coincides with increasing global focus on nuclear energy as a reliable clean power source.

Partnering with Newcleo brings crucial capital for scaling operations and may also enable OKLO to access European markets and regulatory frameworks over time.

This international expansion opportunity could notably improve its growth prospects and market reach, which could over time unlock significant further upside in OKLO shares.

All in all, the announcement demonstrates strong institutional confidence in advanced nuclear tech and positions OKLO as a pivotal player in addressing growing demand for clean energy solutions.

Should You Load Up on OKLO Shares at Current Levels?

OKLO’s vertical integration strategy, combined with the new fuel plant investment, position the company to better control critical components of the nuclear fuel supply chain.

This approach could provide significant competitive advantages in terms of fuel security and cost control, potentially leading to improved profit margins once operations commence.

However, investors should carefully assess several factors. While OKLO stock has shown exciting momentum, it remains pre-revenue, and nuclear projects often face lengthy development timelines and rigorous regulatory oversight.

In fact, the NYSE-listed firm is not expected to report any revenue before 2028. What it signals is that the nuclear energy stock remains a great long-term holding, but investors may be better off buying it on the dips only.

How Wall Street Recommends Playing Oklo in 2025

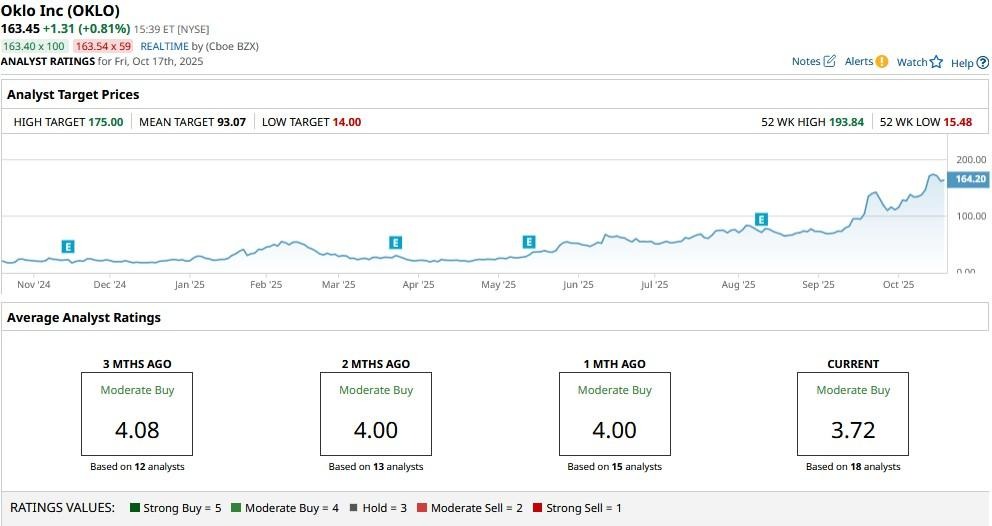

Note that Wall Street currently has a consensus “Moderate Buy” rating on OKLO shares, indicating continued confidence in their long-term potential.

For the next 12 months, though, even the Street-high price target of $175 on the nuclear technology stock signals about 8% upside potential only.

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)