With a market cap of $27 billion, Fox Corporation (FOXA) is a leading U.S.-based media company that delivers news, sports, and entertainment content through its well-known brands, including FOX News, FOX Sports, the FOX Network, and Tubi. Operating across four segments: Cable Network Programming, Television, Credible, and FOX Studio Lot, the company reaches audiences through broadcast, cable, digital platforms, and production services.

Companies valued over $10 billion are generally described as “large-cap” stocks, and Fox Corporation fits right into that category. Fox Corporation combines traditional media with digital innovation to serve diverse viewers and advertisers.

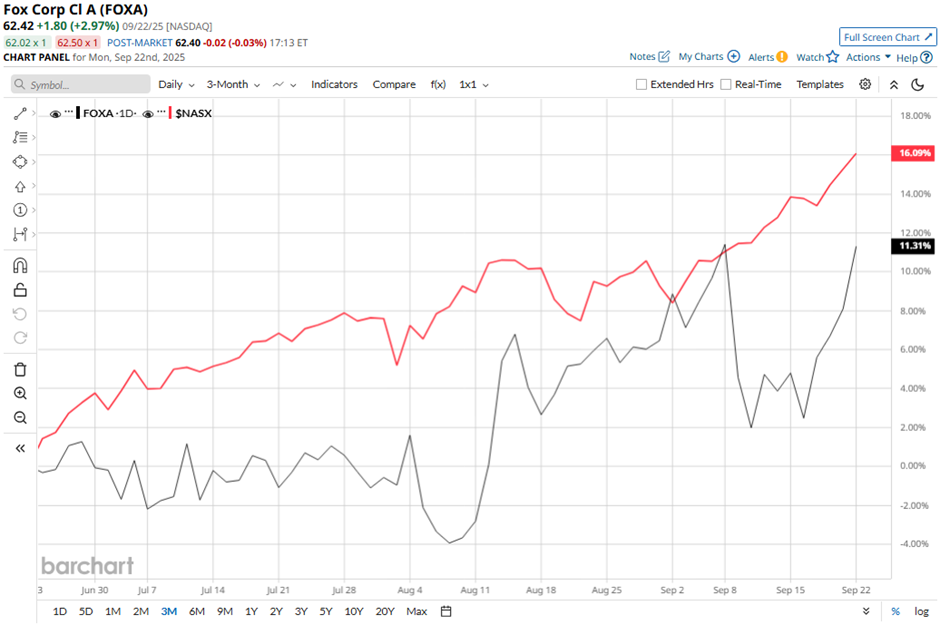

Despite this, shares of the New York-based company have declined marginally from its 52-week high of $62.69. FOXA stock has increased nearly 13% over the past three months, underperforming the Nasdaq Composite’s ($NASX) 17.2% return over the same time frame.

In the longer term, FOXA stock is up 28.5% on a YTD basis, surpassing NASX’s over 18% gain. Moreover, shares of the TV broadcasting company have climbed 55.2% over the past 52 weeks, compared to NASX’s over 28% surge over the same time frame.

Despite a few fluctuations, the stock has been trading above its 50-day and 200-day moving averages since last year.

Despite reporting better-than-expected Q4 2025 adjusted EPS of $1.27 and revenue of $3.29 billion, shares of FOXA fell 3.7% on Aug. 5 due to investor concerns over rising SG&A expenses, which climbed 9.5% year-over-year and pressured margins. Advertising growth was viewed as less durable, given tough year-over-year comparisons tied to the absence of UEFA and Copa América broadcasts.

In contrast, rival Live Nation Entertainment, Inc. (LYV) has slightly lagged behind FOXA stock on a YTD basis, rising 27.5%. However, LYV stock has returned 59.4% over the past 52 weeks, outpacing FOXA stock.

Despite the stock’s outperformance relative to the Nasdaq over the past year, analysts remain cautiously optimistic on FOXA. It has a consensus rating of “Moderate Buy” from the 20 analysts in coverage, and as of writing, the stock is trading above the mean price target of $60.29.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Apple%20Inc%20logo%20on%20Apple%20store-by%20PhillDanze%20via%20iStock.jpg)

/Elon%20Musk%2C%20founder%2C%20CEO%2C%20and%20chief%20engineer%20of%20SpaceX%2C%20CEO%20of%20Tesla%20by%20Frederic%20Legrand%20-%20COMEO%20via%20Shutterstock.jpg)