/Masco%20Corp_%20logo%20on%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Masco Corporation (MAS), headquartered in Livonia, Michigan, has carved its niche in producing and marketing a broad range of branded home improvement and building products. Its portfolio spans Behr paints, Delta and Hansgrohe faucets and bath fixtures, Liberty decorative hardware, and HotSpring spas.

With a market capitalization of approximately $15.1 billion, the company firmly sits in the “large-cap” arena, delivering faucets, showerheads, bath accessories, water systems, paints, coatings, and related supplies, maintaining a presence in both residential and light commercial markets.

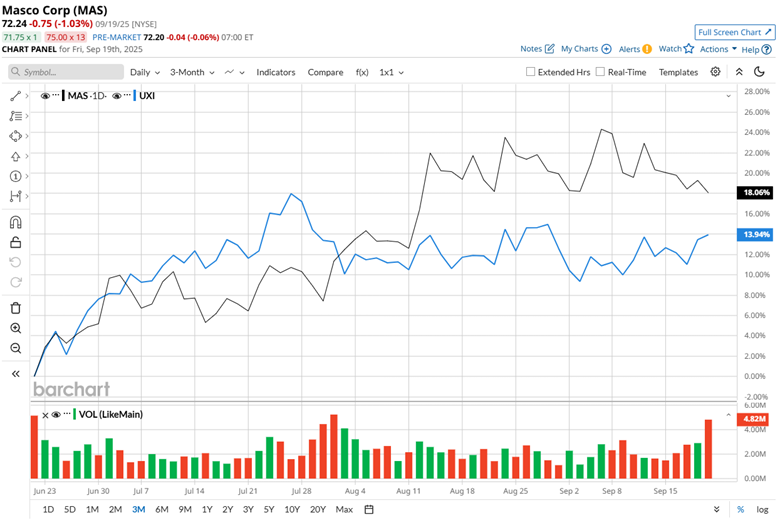

Despite these strong offerings, MAS stock has faced a bumpy ride in recent months. Shares currently trade about 16.7% below their October 2024 peak of $86.70. Over the past three months, however, the stock has clawed back nearly 18.6%, slightly outpacing the ProShares Ultra Industrials ETF (UXI), which rose 14.2% in the same period.

Looking at the bigger picture, MAS stock has struggled to keep pace with broader industrial momentum. Over the past 52 weeks, the stock has slipped 13.2%, while year-to-date, it has seen a marginal drop. In comparison, UXI surged 20.7% in that stretch and has jumped 25.6% year-to-date in 2025.

Yet, a silver lining emerges as MAS shares have maintained trading above their 50-day moving average of $70.86 and 200-day moving average of $70.10 since late August, signaling that investor confidence has not completely wavered.

A notable spark came on July 31, when the stock jumped 3.7% following stronger-than-expected second-quarter fiscal 2025 results. Revenue for the period reached $2.05 billion. Although down 1.9% year over year, it surpassed the Street’s forecast of $2 billion. Adjusted EPS came in at $1.30 per share, beating the anticipated $1.08 and showing an 8.3% year-over-year increase.

Looking ahead, Masco’s management has laid out ambitious plans. For the second half of 2025, it expects full-year sales to generally mirror the prior year when adjusted for divestitures and currency fluctuations. The company anticipates maintaining market outperformance, projecting adjusted EPS between $3.90 and $4.10 for the year.

Yet, the path remains challenging when benchmarked against its rival, Armstrong World Industries, Inc. (AWI), which has posted a remarkable 49.1% gain over the past 52 weeks and witnessed a further year-to-date jump of 39.1%, highlighting MAS’ relative underperformance in the sector.

Analysts are keeping a balanced view on the company’s prospects. Among 21 analysts covering the stock, the consensus rating stands at “Moderate Buy,” with a mean price target of $74.88, suggesting a premium of 3.7% from current levels.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)

/AI%20(artificial%20intelligence)/Data%20Center%20by%20Caureem%20via%20Shutterstock%20(2).jpg)

/Nvidia%20logo%20on%20phone%20screen%20with%20stock%20chart%20by%20xalien%20via%20Shutterstock.jpg)