Howdy market watchers!

We are days away from the official start to fall! It cannot come soon enough as long as the weather follows. We are also a week away from the end of the third quarter and into the final stretch of 2025. When and where did this year go! It is beyond a cliché to say so, but this year has definitely flown by and been one of the fullest years of constant, major headlines to absorb. The fourth quarter is sure to be filled with much more of the same with many loose ends undone when it comes to the economy, war-like conflicts and trade relations around the world.

This week ended with one of those major matters seeing some action as President Trump and Chinese President Xi connected for phone call to primarily discuss TikTok, but hint at coming to resolution on the laundry list of differences between the world’s two largest economies and trading partners. While nothing of substance came from the call other than “appreciation for TikTok approval,” the two sides did discuss meeting at the upcoming APEC meeting and suggestions that each President would visit the other’s country at some point in the future. I expect this deal to take longer than others, but do believe President Trump will try to bring a conclusion to this to boost “the markets” generally when the time is right.

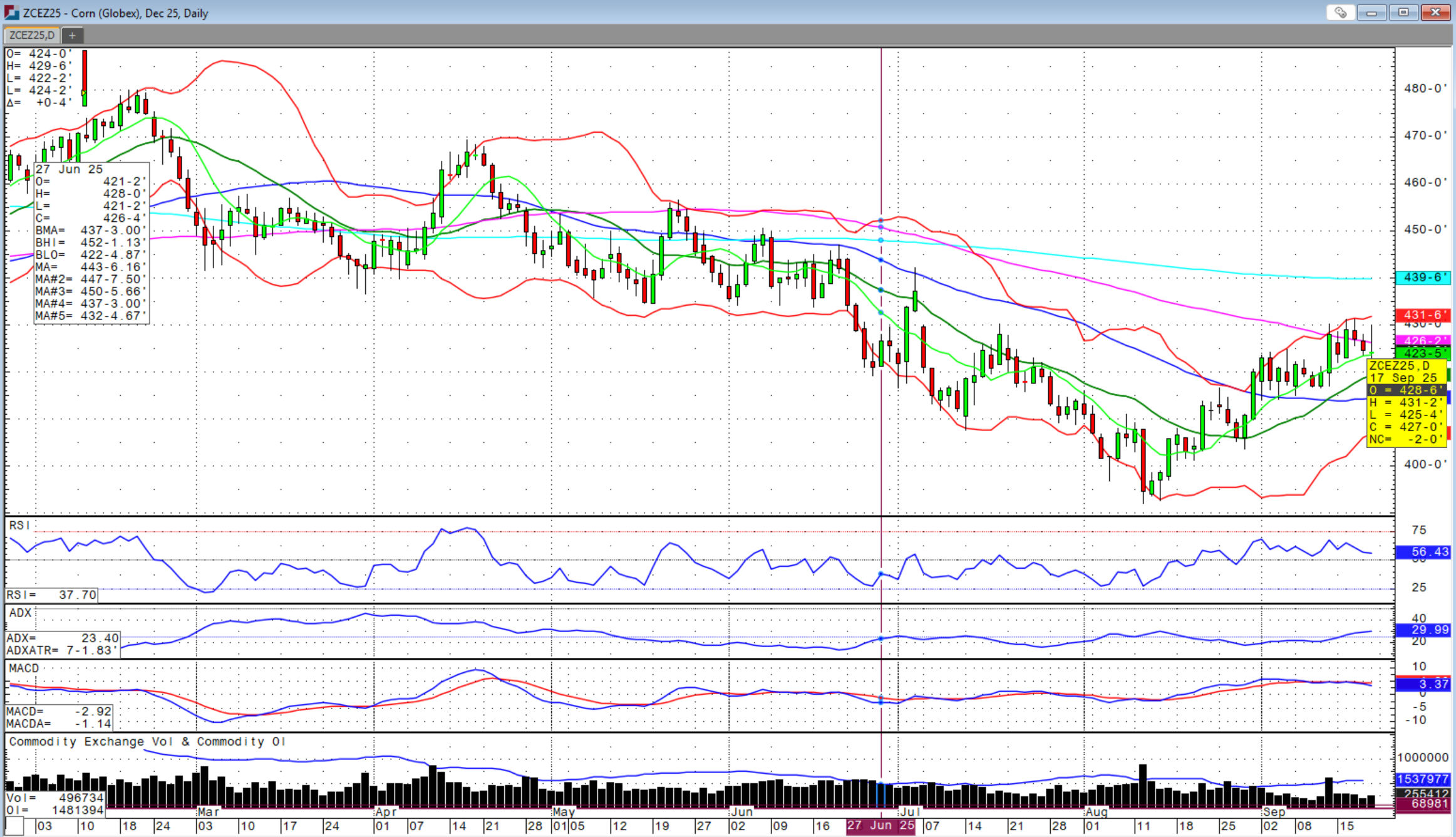

Ag markets originally rallied on the news of the presidential call following earlier week discussions in Madrid, but then sold off without any tangible progress. The rebound in the US dollar this week also added headwinds to the commodity complex, but US grain exports have still been firm given the overall currency weakness and lower futures prices that make US origin more competitive. This week’s US corn exports were reported at the top of expectations while soybeans and wheat exports were higher than expected.

On Wednesday, the Federal Reserve’s FOMC lowered interest rates for the first time in nine months by 25 basis points. With the US dollar starting that mid-week session at 2-month lows, it rebounded likely following Chair Powell’s comments in the Q&A that this could be seen as a risk management cut alluding to the weakness in the job market, but the lingering, underlying support to inflation. That reference suggests that several more cuts are far from a certainty.

This meeting was also watched closely given it was the first FOMC since Stephen Miran was confirmed just days before as a new Fed Governor who dissented with the 25-basis point decision, believing that the cut should have been 50 basis points. There was other division on the FOMC this time around that just shows the grey area we are in with some data showing a weakening job market while inflation is still sticky despite softening. All in all, I have said it before and will say it again that I believe the consumer is weaker than the data is currently suggesting. Consumer debt and delinquencies have also shown this in recent reports, but strength in the stock market that continue to make new highs seem to overshadow these sentiments at the present time. Spending at the upcoming holiday season will be telling.

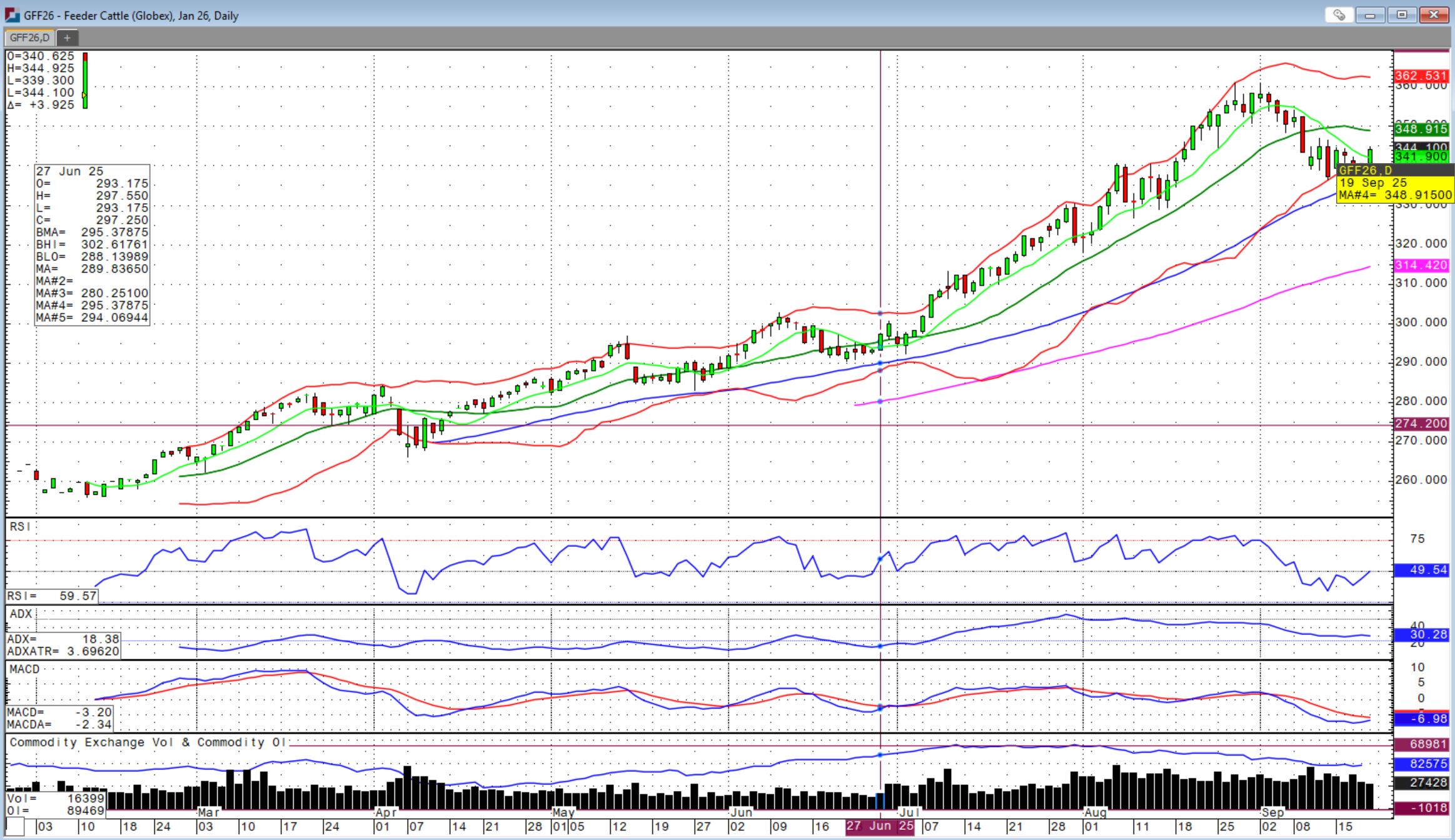

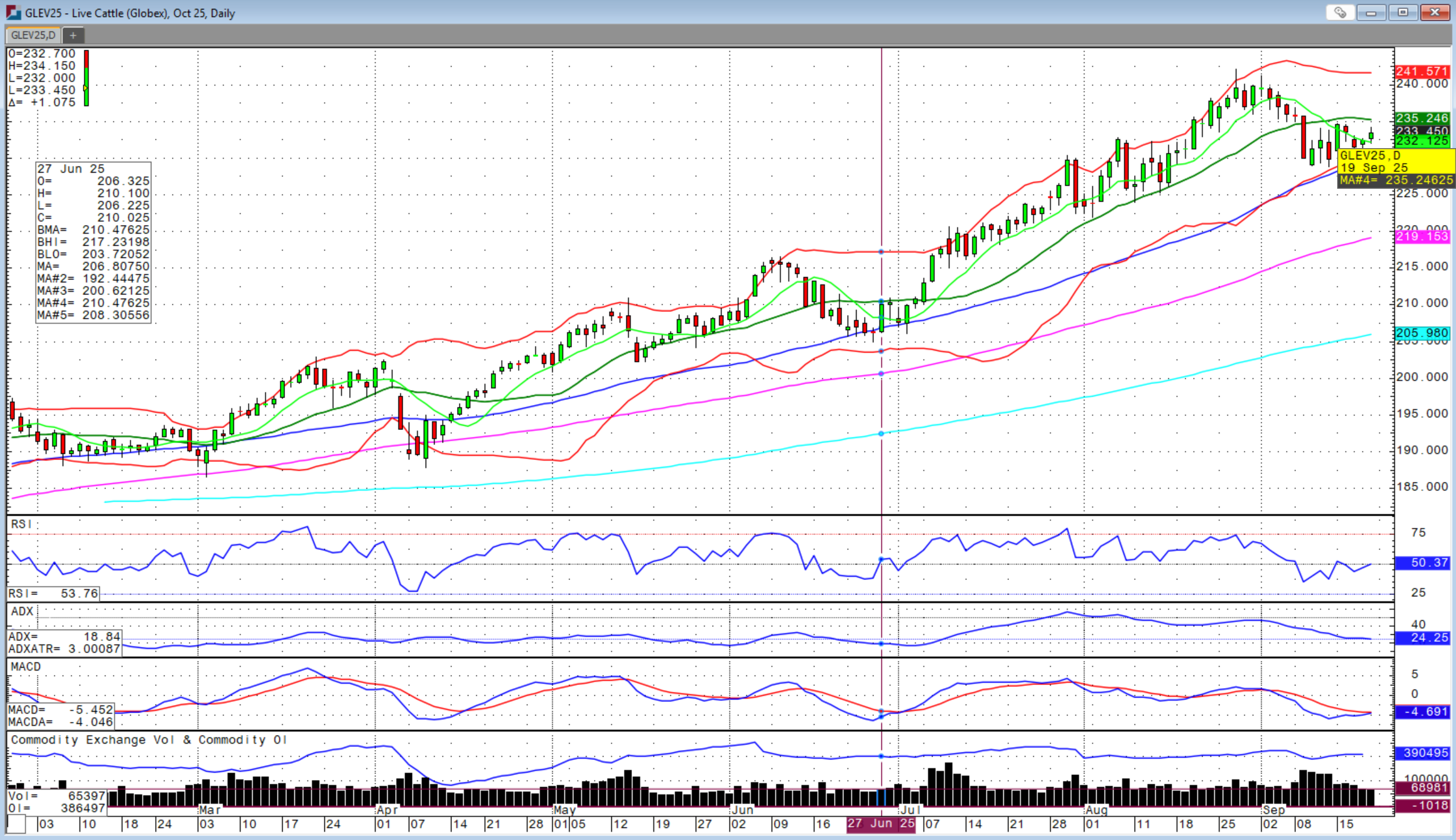

The strength in the cattle markets have much to do with consumer spending. As beef prices continue to climb and catching national attention, it just feels like we could begin to see more trading down to lower cost alternatives such as pork and poultry. However, this has so far been limited because of course beef is best, but also due to major retailers continuing to offer a wide array of beef options and cuts. Since the late August and early September highs in cattle futures, feeders have lost around $25 per cwt while fed cattle contracts slipped around $14 per cwt.

After early week weakness, cattle futures turned higher on Thursday that followed through with notable strength on report day Friday that favored deferred months to the September front-month which expires on September 25th. If you’re short the September feeder futures, the spread is narrowing and it is a good time to roll if you plan to stay short. Deferred contracts traded above the 9-day moving average on Friday and I believe we will see some upside follow-through early next week up to the 20-day moving average following the Cattle-on-Feed report released at 2 PM to finish the week. That 20-day moving average on October feeder futures is at $357.150.

There is a similar pattern in live cattle futures with trade above the 9-day moving average on Friday with the 20-day moving average above at $235.250 on October live cattle futures. Once we get to those levels, we will have to revaluate to see if it looks like we could break out higher again. Fed cash cattle trade varied this week with some $240 in Kansas and Oklahoma while there was some lower trades at $238 in Nebraska, which is usually higher given it is further north.

USDA’s Cattle-on-Feed report had a bullish tilt I would say with September 1st on-feed slightly lower than expected at 98.9 percent versus 99.1 percent expected and August placements also lower than expected at 90.1 percent versus 91.0 percent expected. August marketings, however, were also lower than expected at 86.4 percent versus 87.2 percent expected. I feel we could see some early week strength next week and then will have to see what the chart looks like when and if these contracts reach that 20-day moving average. Cash markets continue to remain buoyant and strength in the stock markets will keep outside support in place.

Having said all that, be vigilant. Funds are still back in buying mode, but when they exit, the door will not be big enough and things could get ugly in a hurry. The end of months and quarters can be such times when books rebalance.

The grain markets had just the opposite action as cattle this week with early week strength followed by end of week softness. With December corn coming so close to filling the chart gap last Friday, I was sure it would do so early this week and came within 1.5 cents, but didn’t get it done. We then sold off Friday, putting in a large, outside chart day, which looked more like a reversal lower, but managed to close slightly higher and right at the 9-day moving average. There are hopes that corn will rally due to the fungus pressures and lower yields. However, early yields can often be lower as less healthy corn often matures first.

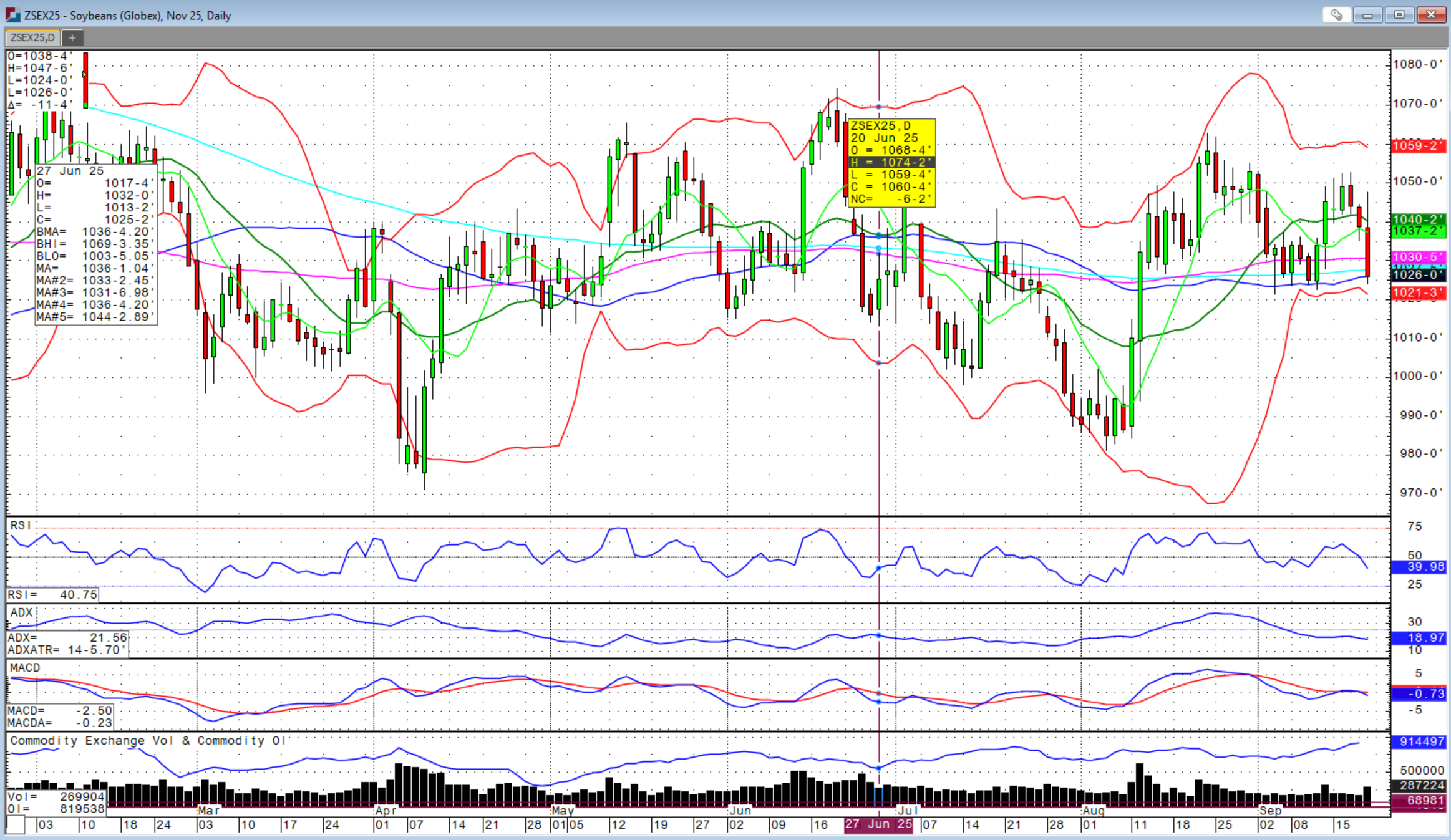

Early week support to soybeans selloff sharply to finish the week with early Friday strength from the call with China reversing and selling all the way down to the 50-day moving average. This is a major support area for soybean futures, but one that it needs to hold. If we see the 50-day moving average cross above the 200-day moving average, that is considered a golden cross and could mean more upside. However, if we break lower, there is a lot of room below.

On the demand front, NOPA soybean crush for August was sharply above expectations while soybean oil stocks were lower than expected. Strong demand will help absorb these larger crops. The EPA this week was going to announce allocation of small refiner blending waivers, but instead announced it was going for public comment and so that can is kicked down the road for now.

Soybean conditions this week were one percent lower than last week at 63 percent Good-to-Excellent while soybean harvest is now 5 percent complete. Corn conditions were 67 percent G/E, one percent below last week, but one percent above expectations. Corn harvest is now 7 percent complete, 2 percent behind expectations. Spring wheat harvest is ahead of schedule at 94 percent complete, but likely due to poor conditions. Winter wheat planting is now 11 percent complete versus 14 percent expected and just 5 percent last week.

There are army worms everywhere! If you are planting now, you need to apply seed treatment or be prepared to spray once if not more. The lush, green conditions throughout the late summer have given them every opportunity to keep life cycles turning. There is so much seed treatment being used that Corteva actually ran out of supplies this week for the entire United States! That is unheard of!

Finally, cotton conditions came in at 52 percent G/E this week, down 2 percent from last week, but futures sold off to finish the week pressured lower due to the selloff in energy markets.

Sidwell Strategies is the one-stop shop to protect cattle with futures, puts, LRP or a combination of all, which is probably the best strategy overall. If you’re ready to trade commodity markets, give me a call at (580) 232-2272 or stop by my office to get your account set up and discuss risk management and marketing solutions to pursue your objectives. Self-trading accounts are also available. It is never too late to start and there is no operation too small to get a risk management and marketing plan in place.

Wishing everyone a successful trading week! Let us know if you'd like to join our daily market price and commentary text messages to stay informed!

Brady Sidwell is a Series 3 Licensed Commodity Futures Broker and Principal of Sidwell Strategies. He can be reached at (580) 232-2272 or at brady@sidwellstrategies.com. Futures and Options trading involves the risk of loss and may not be suitable for all investors. Review full disclaimer at https://www.sidwellstrategies.com/fccp-disclaimer-21951.

/Technology%20abstract%20by%20TU%20IS%20via%20iStock.jpg)