/First%20Solar%20Inc%20logo%20and%20stock%20price-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Based in Tempe, Arizona, First Solar, Inc. (FSLR) is a pioneering firm in renewable energy, producing thin-film solar modules and providing complete solar solutions. Its operations span module design, manufacturing, sales, and maintenance, with projects and facilities spread across the U.S., Asia, and beyond.

With a market capitalization of $21.63 billion, the company is considered a “Large cap” stock. First Solar’s advanced technology and global reach make it a trusted partner for utility-scale solar infrastructure, driving the global shift toward clean energy.

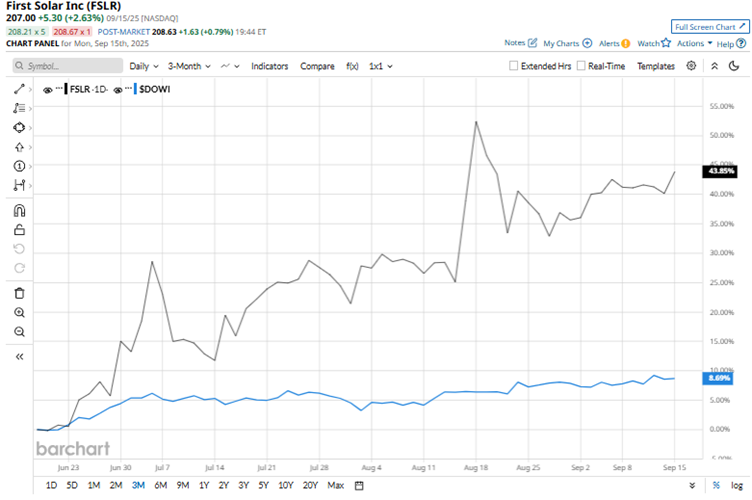

First Solar’s stock last reached a 52-week high of $262.72 in September 2024, but is now down 21.2% from this high. It had reached a 52-week low of $116.56 in April 2025, but is now up 77.6% from this low. Over the past three months, the company’s stock has gained 18.2%, while the broader Dow Jones Industrial Average ($DOWI) has been up 8.7% over the same period, which shows a clear outperformance.

As challenging market conditions impact the broader renewable energy sector, First Solar’s stock has declined by 9.5% over the past 52 weeks. On the other hand, the industrial index has gained 10.9%. This year, First Solar’s stock has experienced a resurgence, with its stock price up 17.5% year-to-date (YTD), outperforming the Dow Jones Industrial Average, which is up 7.9%.

Underscoring strong momentum, First Solar’s stock is trading higher than its 50-day and 200-day moving averages since late July.

On July 31, First Solar reported its second-quarter results for fiscal 2025. Its net sales increased by 8.6% year-over-year (YOY) to $1.10 billion. This figure exceeded the $1.03 billion that Wall Street analysts had expected. The topline growth was driven by an increase in the volume of modules sold to third parties. On the other hand, its net income per share declined from $3.25 to $3.18 YOY. However, this surpassed the $2.68 EPS that analysts had expected.

Despite the bottom-line decline, the company’s stock surged 5.3% intraday on Aug. 1. That was because, in addition to the topline increase, First Solar raised its full-year guidance. The guidance range for this year’s net sales was raised from $4.50 billion - $5.50 billion to a range of $4.90 billion to $5.70 billion. The EPS range was narrowed from $12.50 - $17.50 to $13.50 - $16.50.

While the stock is keeping pace with the Dow Jones Industrial Average, there are stocks in the industry that are outperforming First Solar. We see that one of its top rivals, Nextracker Inc. (NXT), has gained 79.6% over the past 52 weeks and 85.2% YTD.

Wall Street analysts are bullish on First Solar’s stock. The stock has a consensus rating of “Strong Buy” from the 30 analysts covering it. The mean price target of $220.65 shows a 6.6% upside compared to current levels. However, the Street-high price target of $287 indicates a 38.6% upside.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Alphabet%20(Google)%20Image%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)