/AI%20(artificial%20intelligence)/AI%20technology%20-%20by%20Wanan%20Yossingkum%20via%20iStock.jpg)

Nebius (NBIS) shares opened nearly 50% up this morning after announcing a $19.4 billion cloud-computing deal with the Redmond-headquartered Microsoft (MSFT).

Nebius will supply dedicated AI infrastructure to Microsoft from its new data center in Vineland, New Jersey, helping the behemoth meet surging demand for generative AI workloads.

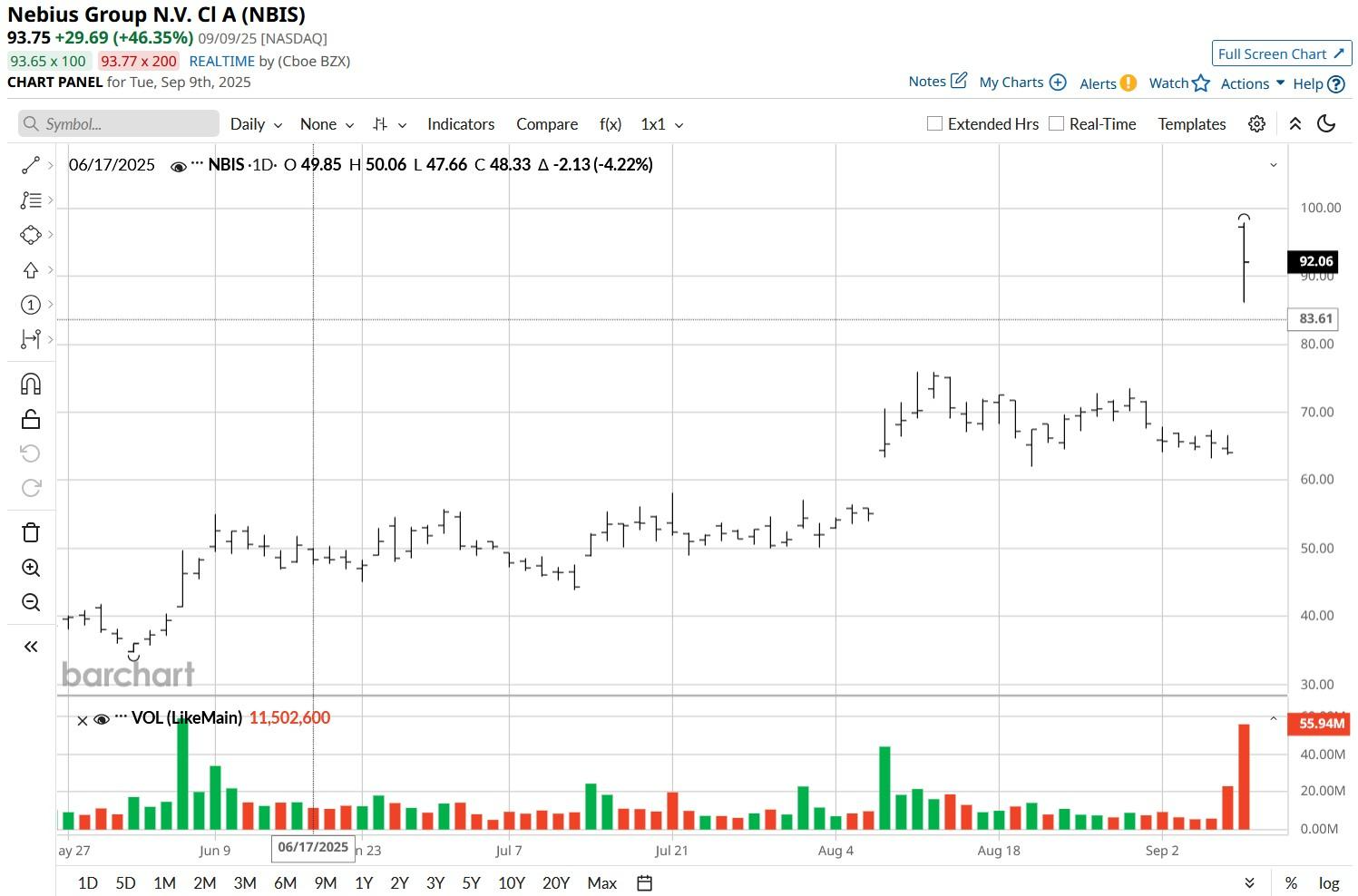

Nebius stock has been a lucrative investment over the past five months. At the time of writing, the artificial intelligence company is trading roughly 395% above its year-to-date low set in early April.

Significance of Microsoft Deal for Nebius Stock

The announced transaction with Microsoft is super constructive for NBIS stock given it boosts the company’s visibility among hyperscalers and secures multi-year revenue certainty.

MSFT-driven cash flows, reduced execution risk, and the potential for follow-on contracts with other tech titans could unlock further upside in Nebius shares through the remainder of 2025.

The deal reinforces management’s commitment to positioning Nebius as a critical supplier amidst rising demand for artificial intelligence workloads.

All in all, a vote of confidence from an influential client like Microsoft strengthens confidence in the NBIS’ growth trajectory, margin expansion, and its strategic relevance in the AI arms race.

NBIS Shares May Have Gone a Bit Too Far

Goldman Sachs analysts reiterated their “Buy” rating on Nebius shares following the AI company’s mega-deal with Microsoft on Tuesday.

According to them, the agreement is a major boost to the firm’s GPU-as-a-Service business and will, therefore, drive significant top-line growth for NBIS in the coming quarters.

However, Goldman Sachs maintained its $77 price target on NBIS shares today, agreeing that they are meaningfully expensive to own at current levels.

After all, Nebius tock is currently going for a price-sales (P/S) multiple of an alarming 131x.

Nebius Has Rallied Past Wall Street Expectations

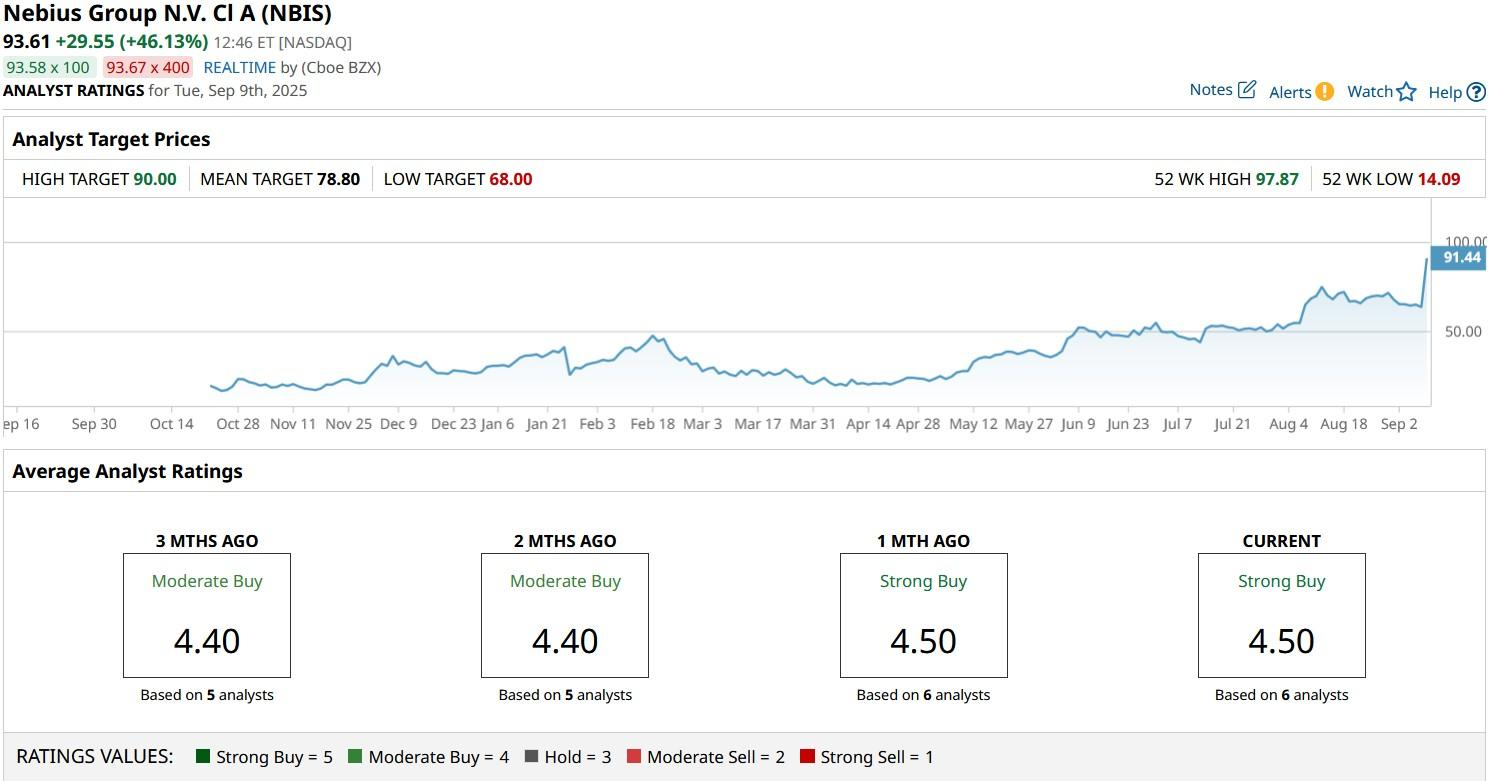

Investors should note that the mean price target on NBIS shares also suggests they should wait for a pullback before initiating a new position in the Nasdaq-listed firm.

While the consensus rating on Nebius stock remains at “Strong Buy” at writing, the mean target of about $79 indicates potential downside of nearly 20% from current levels.

/Intel%20Corp_%20logo%20on%20mobile%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/Nvidia%20logo%20by%20Konstantin%20Savusia%20via%20Shutterstock.jpg)