Howdy market watchers!

It has been a week of major developments, but we’re going to start with the wildfires that have devastated ranchers in the Oklahoma and Texas Panhandles into southern Kansas. The speed and ferocity of the fires fueled by strong winds scorched 200,000 plus acres. We do not have a head count on the number of cows and calves that have been lost, but sure the numbers are in the thousands. Several firefighters were injured, but are said to be okay, but the loss of livestock and livelihoods is almost unquantifiable. The value of the livestock lost is significant and I just hope that those ranchers had insurance coverage to help compensate for the losses.

The fact that many of these fires are fought by volunteer firefighters from small, surrounding communities is a true testament of the humanity of people here. Keep the families, communities and firefighters in your prayers and seek ways to support them in this time of great need.

In other news, there were plenty of newsworthy headlines this week, but the one that trumps them all was the US Supreme Court’s decision released Friday morning ruling against President Trump’s emergency tariffs announced on Liberation Day in a 6-3 vote! We have been expecting this for weeks and months and it came without notice. Markets paused in their tracks from shock, then weakened broadly, but then recovered. I was expecting more selling pressure to ensue with profit taking given recent reaction to headlines and the fact that it was the end of the trading week.

There is much to digest from this news, but markets are seeing lower tariffs as positive as well as certainty from finally having this decision released. President Trump held an expectedly angry press conference announcing alternative means to levying tariffs including a 10 percent ‘Global Tariff’, which brings about more uncertainty.

It is really hard to say what this all means and what lies ahead for the market, but it seems that it will result in more uncertainty over international trade and foreign policy than certainty from finally getting a ruling. This should make for a much more interesting State of the Union address scheduled for February 24th with the US Supreme Court Justices perched on the front row. The political implications of this are tremendous with the Mid-Term election cycle getting started with much ammunition for the opposing party.

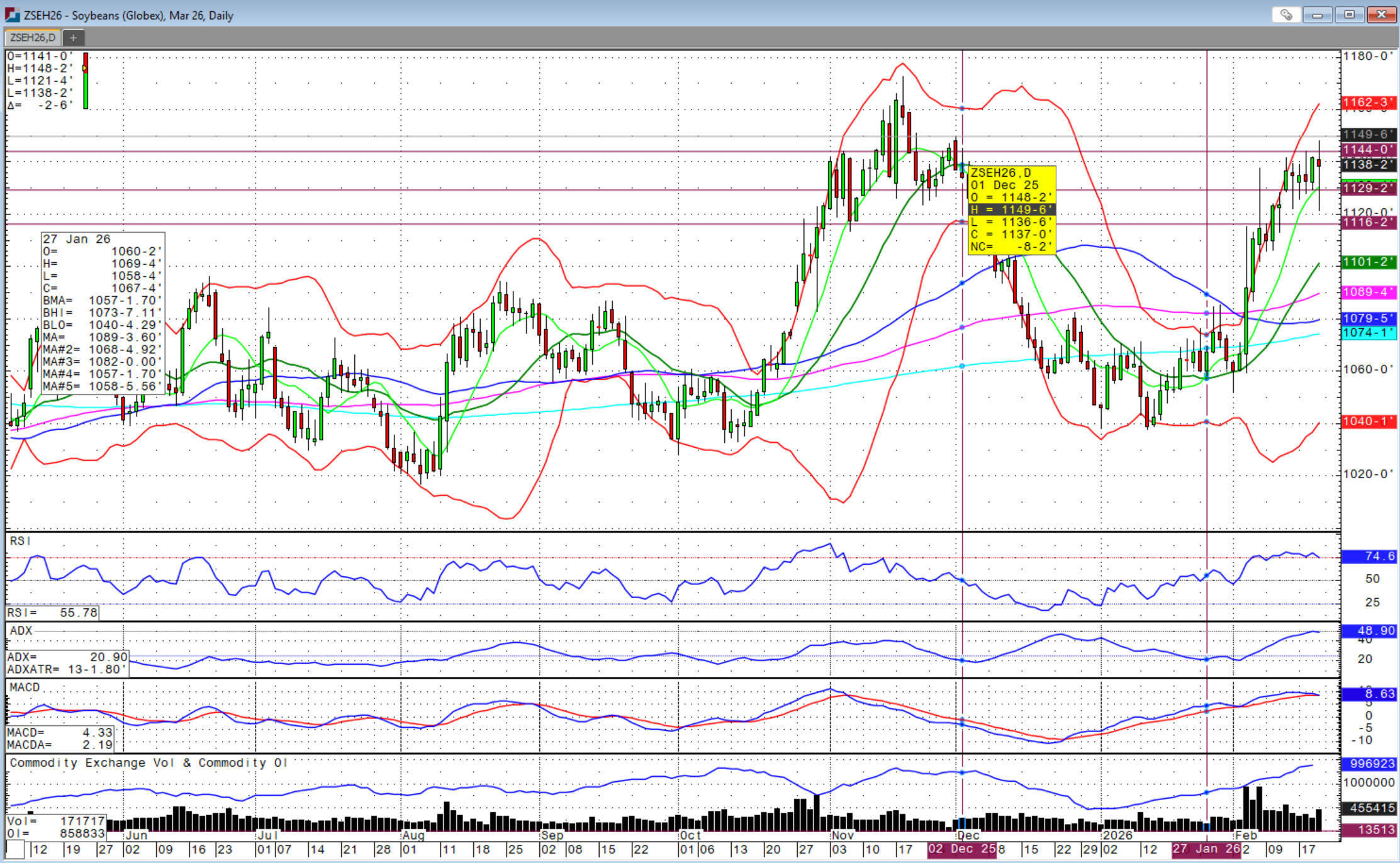

Soybean futures were hit hardest on the news with increasing doubts that China will buy more US soybeans in the absence of tariff leverage, but prices recovered into the close putting in a large, outside trading pattern on the chart, but closing in the upper half.

Despite the stronger US dollar this week, commodities generally recovered with the agriculture rally led by wheat and soybeans. Metals also staged a major reversal higher into Friday’s close after some very borderline trading this week with many traders calling for more liquidation. Gold and silver closed right at the highs in Friday’s trade with more upside looking likely.

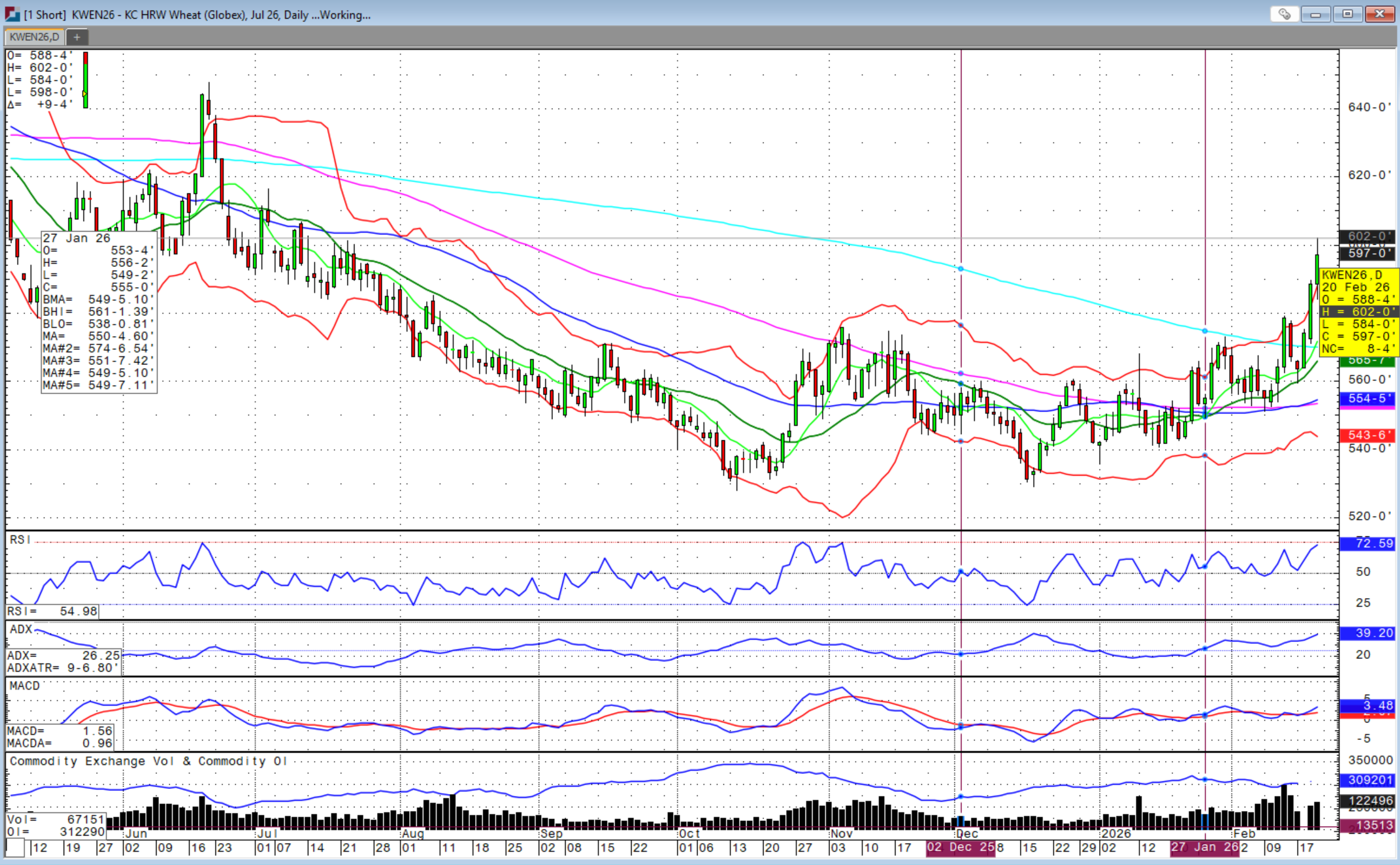

By far the story in agriculture contracts this week was the surge in wheat futures in a shortened trading week given markets were closed Monday for President’s Day. After weaker trade on Tuesday that looked like we would see more slippage to the bottom of the recent channel near $5.30, wheat contracts rallied on Wednesday with the surge gaining momentum into Thursday and Friday, breaking above the 200-day moving average and above recent resistance to the highest levels since July 2025. For March KC wheat, $5.63 was a target, followed by $5.72 with some calling for $5.93. Remember, bull markets need to continue to be fed or risk collapsing on themselves.

Chicago wheat closed near Friday’s highs while Kansas City wheat around 5 cents off session highs. The July new crop Chicago wheat contract peaked at $5.89 while the July Kansas City contract reached $6.02. The reason for the rally points to dryness in the Southern US Plains, freeze concerns in the Ukraine, both of which accelerated short covering. Note that the highest price on wheat contracts in 2025 was reached this exact week last year. I believe it wise to reward this rally in some way. Interestingly, Friday was also expiration of the March grain options, which benefited a lot of clients holding March wheat call options.

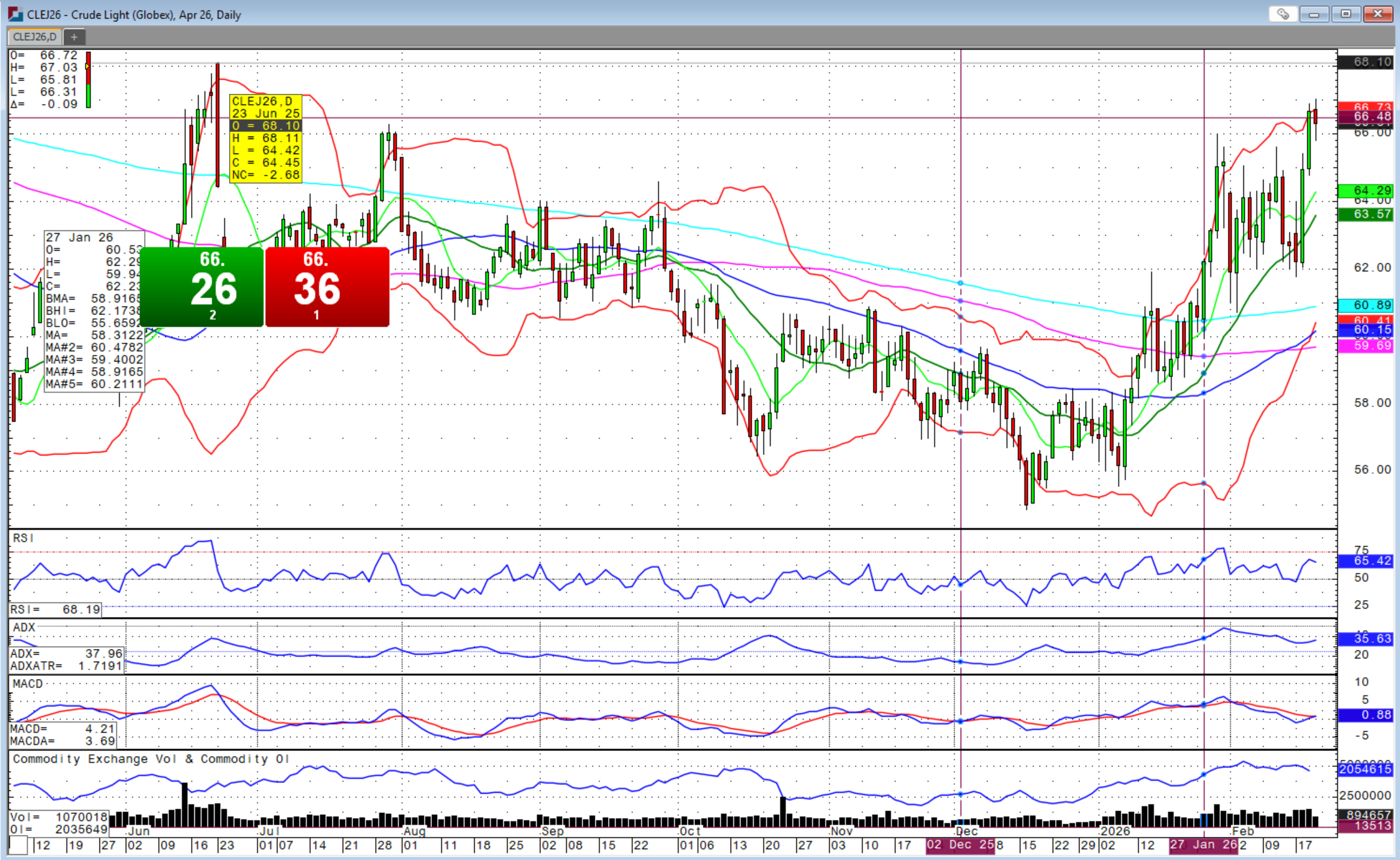

The preeminent US attack on Iran also fueled impulsive fears to short cover. With US military presence continuing to build in the region while Iran announced closing part of the Strait of Hormuz, anything could happen at any time. President Trump said Friday that he will make a decision in 10-15 days, but it could be as early as this weekend.

Crude oil prices surged this week to the highest level since June 2025 from escalating tensions and restricted channel access, but eased some into Friday’s close with hints that progress was being made in diplomatic dialogue. Fuel prices have also surged as a result of the overall energy complex spike. Should tensions simmer with Iran, I believe we could see a quick collapse in energy markets, which will also bring down fuel prices.

Fourth quarter US GDP was also released Friday morning, but before the Supreme Court ruling. The GDP for the last quarter of 2025 was disappointing, coming in at just 1.4 percent compared to the prior quarter’s growth of 4.4 percent. Overall, there are plenty of reasons for markets to be nervous going into the weekend.

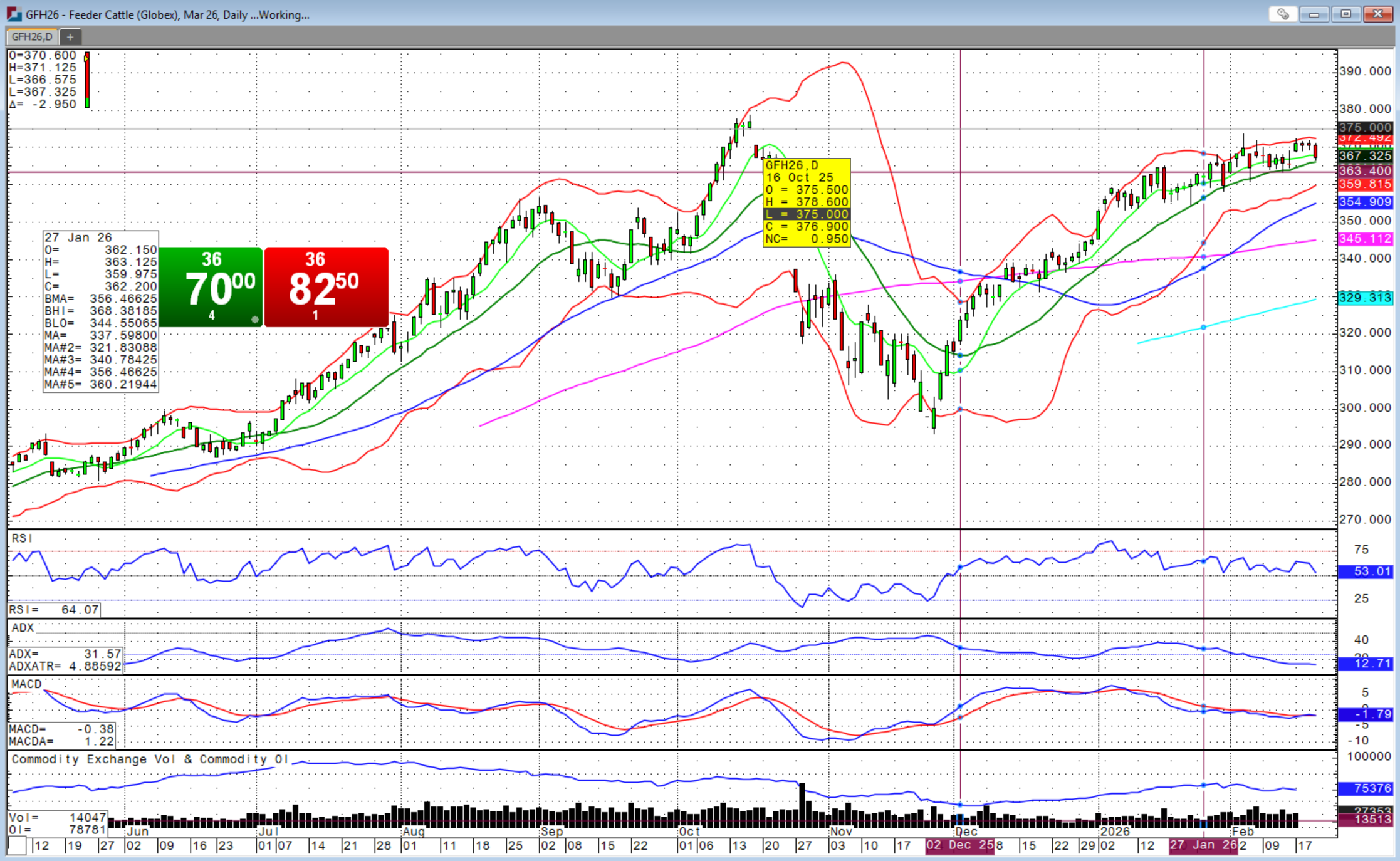

The cattle complex held up relatively better than expected through all of Friday’s headlines. While it did close on a weaker tone with feeders near the 20-day moving average and below the 9-day moving average, it was still well within the recent range. Live cattle futures closed right near the 9-day moving average helped by fed cash cattle trade developing Friday and equaling last week’s new record at $249 in Texas, Kansas and Nebraska.

Also, Friday’s USDA Cattle-on-Feed report released at 2 PM, after the market close, came in with a slightly more bullish bias than the trade was expecting. February 1st on-feed numbers came in at 98.2 percent versus trade expectations for 98.4 percent of last year’s count. This was the lowest on-feed number in 9 years. January placements were the most bullish figures coming in at 95.3 percent versus 96.5 percent expected. This was the lowest number in 19 years and was considerably more bullish than already bullish expectations. Marketings for January were also bullish at 87.0 percent versus 87.1 percent expected and were the lowest in 10 years.

Spring is coming soon and demand at which time demand will improve. I feel there is more up in this market with the chart gap above remaining unfilled. We could see selling pressure once the chart gaps are filled, but there may then be opportunity to make new highs. However, there is so much ‘noise’ in the broader market and there will only be more fighting after this tariff ruling and the election cycle and so be ready for more volatility than we observed in recent weeks. The market will be closely watching what this tariff decision does to beef imports to the US from Brazil in terms of tariffs. There is no LRP on USDA Cattle-on-Feed report days.

While there may be more upside, just remember that the last time we were near these highs, we corrected $80 per cwt in 6-weeks amid intact bullish fundamentals. Babe Ruth had the most home runs, but also the most strikeouts.

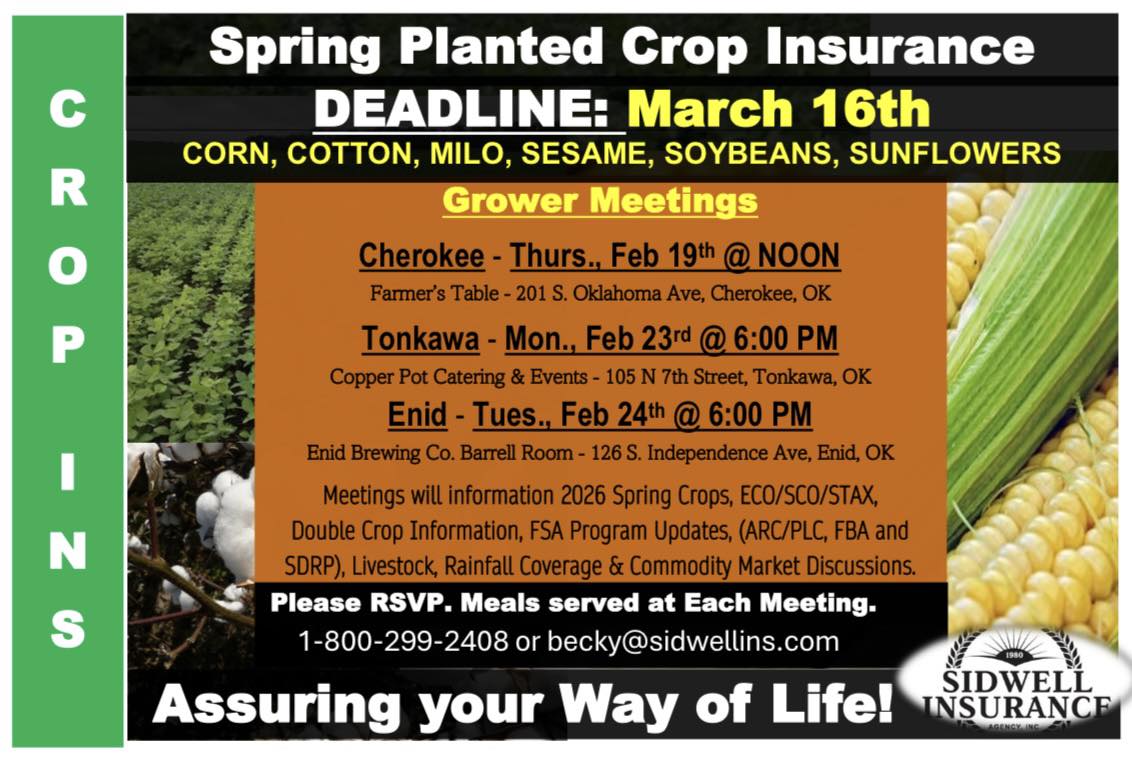

To hear more about the latest updates on the markets and crop insurance, join Sidwell Insurance and Sidwell Strategies in Tonkawa, OK, at 6 PM next Monday or in Enid at 6 PM on Tuesday. RSVP to Sidwell Strategies required.

Sidwell Strategies is the one-stop shop to protect cattle with futures, puts, LRP or a combination of all, which is probably the best strategy overall. If you’re ready to trade commodity markets, give me a call at (580) 232-2272 or stop by my office to get your account set up and discuss risk management and marketing solutions to pursue your objectives. Self-trading accounts are also available. It is never too late to start and there is no operation too small to get a risk management and marketing plan in place.

Wishing everyone a successful trading week! Let us know if you'd like to join our daily market price and commentary text messages to stay informed!

Brady Sidwell is a Series 3 Licensed Commodity Futures Broker and Principal of Sidwell Strategies. He can be reached at (580) 232-2272 or at brady@sidwellstrategies.com. Futures and Options trading involves the risk of loss and may not be suitable for all investors. Review full disclaimer at https://www.sidwellstrategies.com/fccp-disclaimer-21951.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Alphabet%20Inc_%20and%20Google%20logos%20seen%20displayed%20on%20a%20smartphone%20by%20IgorGolovniov%20via%20Shutterstock.jpg)

/Phone%20and%20computer%20internet%20network%20by%20Pinkypills%20via%20iStock.jpg)

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)