/A%20Lucid%20Motors%20vehicle%20parked%20in%20front%20of%20a%20showroom_%20Image%20by%20Michael%20Berlfein%20via%20Shutterstock_.jpg)

Lucid (LCID) shares closed lower as they started trading on a split-adjusted basis on Tuesday, Sept. 2.

Investors remained cautious on the electric vehicle firm as its 1-for-10 reverse stock split aimed at regaining compliance with Nasdaq Exchange’s minimum listing requirements did nothing to address its fundamental business challenges.

Lucid stock has been a huge disappointment for investors in 2025. At the time of writing, it’s down roughly 50% versus its year-to-date high in mid-February.

Why Is Lucid Stock Out of Favor With Investors

Investors are steering clear of LCID shares on Tuesday mostly because the company’s operational performance presents serious concerns for long-term investors.

Production scaling has been particularly problematic, with Lucid delivering only 9,000 EVs last year compared to an initial forecast of 90,000.

More importantly, the automaker has recently reduced its 2025 forecast and now expects to deliver between 18,000 and 20,000 electric vehicles only.

These missed targets, combined with delayed product launches like the Gravity SUV and persistent supply chain issues, indicate significant execution challenges that may continue to weigh on Lucid stock.

Lack of Profitability Continues to Weigh on LCID Shares

Lucid maintains substantial cash reserves of $2.8 billion at the time of writing, but the EV maker may still need to raise fresh capital, diluting its existing shareholders in the process.

Why? Because LCID continues to lose money at an alarming rate. Its losses exceeded $1.5 billion in the first half of 2025 alone, reinforcing sustainability concerns.

Other notable challenges facing Lucid shares include a limited dealer network, intense competition, and infrastructure limitations, which further complicate the company’s path to profitability.

Market sentiment toward this EV stock also remains decidedly bearish, as evidenced by the high short interest of approximately 30% from major financial institutions.

While this could create a squeeze opportunity, it basically reflects widespread skepticism about the firm’s near-term prospects.

How Wall Street Recommends Playing Lucid Shares

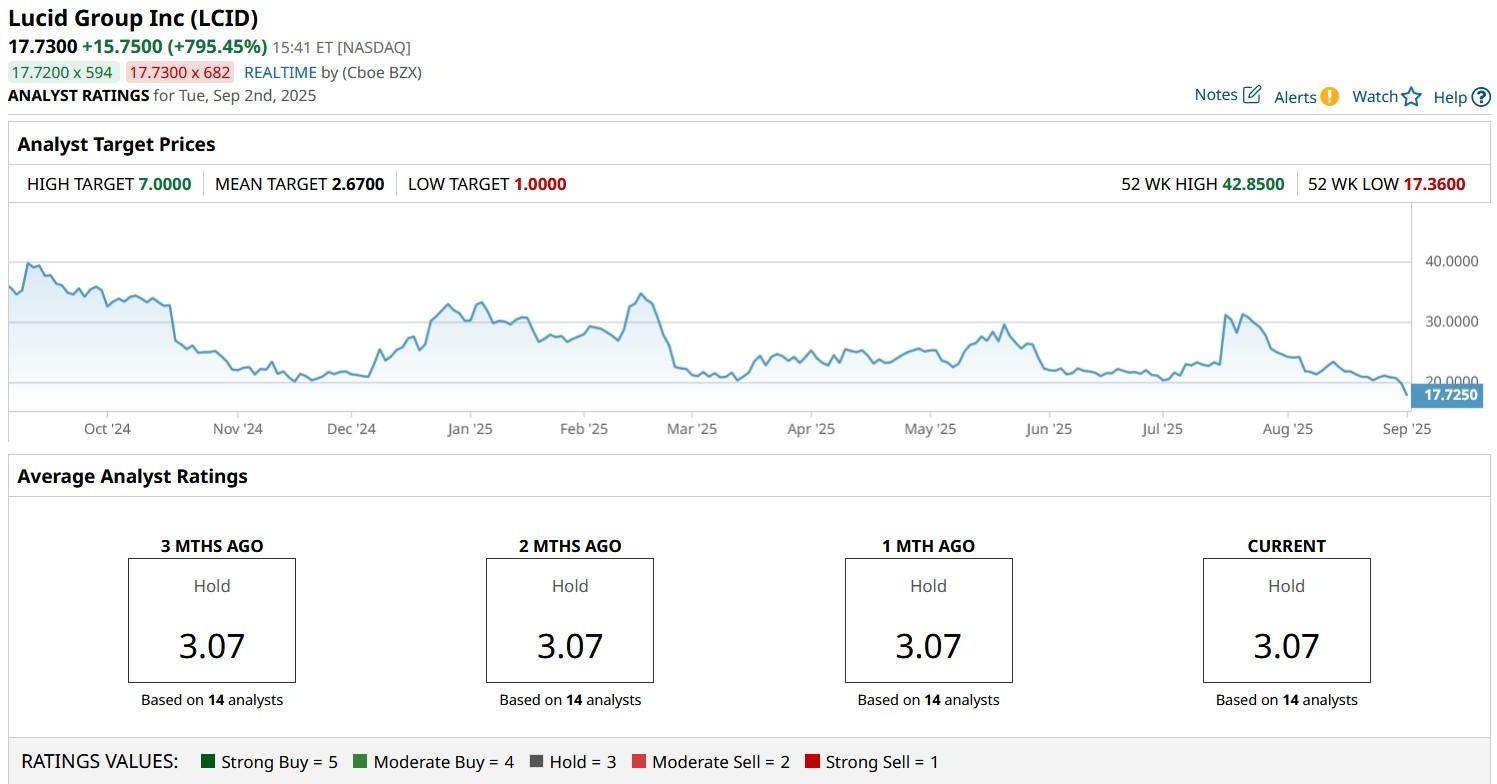

Wall Street analysts also recommend caution in buying Lucid stock after its 1-for-10 reverse stock split.

The consensus rating on LCID shares currently sits at “Hold” only with price targets going as low as $10 only on a split-adjusted basis, indicating potential downside of another 43% from here.

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)

/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock.jpg)

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)