Enterprise Products Partners L.P. EPD expanded its footprint through the acquisition of Occidental’s natural gas gathering systems and 200 miles of pipelines in the Midland Basin. This transaction gives the partnership access to more than 1,000 drillable sites, strengthens system connectivity, supports growing production and lays the foundation for sustainable long-term cash flow growth.

Beyond this, EPD’s scale and diversified asset base remain central to its success. The partnership operates an extensive network of more than 50,000 miles of pipelines, along with 300 million barrels of storage capacity for NGLs, crude oil, petrochemicals and refined products, as well as 14 billion cubic feet of natural gas storage. This integrated structure drives high utilization rates and efficiency across the value chain, from production and processing to transportation, storage and exports.

Another major advantage is the partnership’s reliance on fee-based contracts, which have consistently accounted for 78-82% of the gross operating margin in recent years. Covering pipeline tariffs, fractionation, storage and terminal services, these contracts generate stable, predictable cash flows that are largely insulated from commodity price swings.

Will KMI & MPLX Benefit From Their Fee-Based Revenue Streams?

Similar to Enterprise Products, Kinder Morgan KMI and MPLX LP MPLX derive advantages from their fee-based revenue streams.

Kinder Morgan generates roughly 26% of its cash flow from fee-based revenues, providing steady income insulated from commodity price swings. Over 40% of these revenues come from stable refined product operations, reinforcing its capacity to fund growth projects and shareholder returns.

MPLX benefits from long-term, fee-based contracts across its gathering, processing and NGL infrastructure. Its Northwind Midstream acquisition, supported by 13-year average volume commitments and enhanced returns from higher CO2 and H2S treatment, strengthens cash flow resilience. This foundation supports mid-single-digit EBITDA growth and consistent distribution increases.

EPD’s Price Performance, Valuation & Estimates

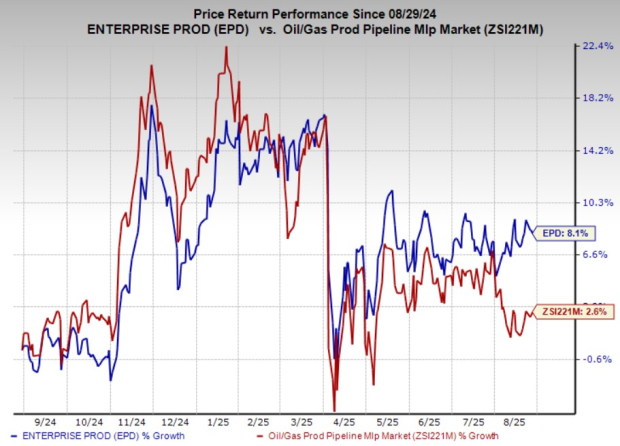

EPD units have gained 8.1% over the past year, outpacing 2.6% growth of the composite stocks belonging to the industry.

Image Source: Zacks Investment Research

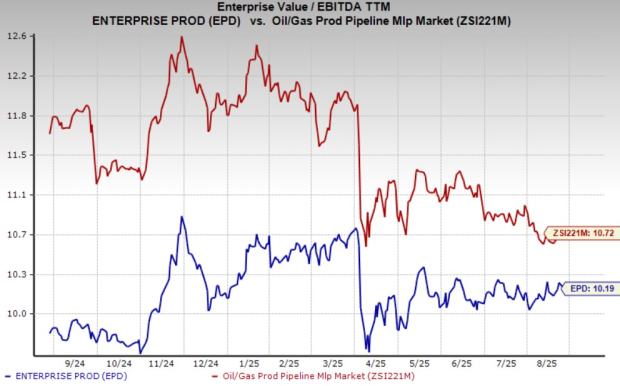

From a valuation standpoint, EPD trades at a trailing 12-month enterprise value to EBITDA (EV/EBITDA) of 10.19X. This is below the broader industry average of 10.72X.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for EPD’s 2025 earnings has been revised downward over the past seven days.

Image Source: Zacks Investment Research

EPD currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Quantum Computing Stocks Set To Soar

Artificial intelligence has already reshaped the investment landscape, and its convergence with quantum computing could lead to the most significant wealth-building opportunities of our time.

Today, you have a chance to position your portfolio at the forefront of this technological revolution. In our urgent special report, Beyond AI: The Quantum Leap in Computing Power, you'll discover the little-known stocks we believe will win the quantum computing race and deliver massive gains to early investors.

Access the Report Free Now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Enterprise Products Partners L.P. (EPD): Free Stock Analysis Report

Kinder Morgan, Inc. (KMI): Free Stock Analysis Report

MPLX LP (MPLX): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)