Here are three stocks with buy rank and strong value characteristics for investors to consider today, August 27th:

Jackson Financial Inc. JXN: This insurance company which provides a suite of annuities to retail investors carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 5.9% over the last 60 days.

Jackson Financial has a price-to-earnings ratio (P/E) of 4.78, compared with 10.60 for the industry. The company possesses a Value Score of A.

Columbia Banking System, Inc. COLB: This bank holding company for Umpqua Bank carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 8.6% over the last 60 days.

Columbia Banking has a price-to-earnings ratio (P/E) of 9.27, compared with 23.97 for the S&P 500. The company possesses a Value Score of A.

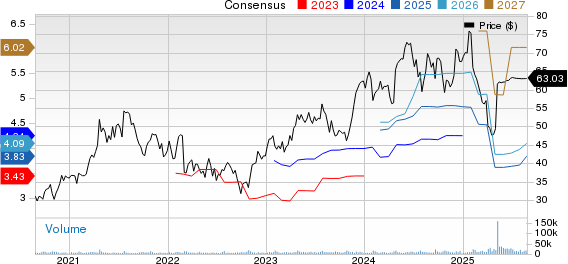

Skechers U.S.A., Inc. SKX: This footwear designer and manufacturer carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 4.4% over the last 60 days.

Skechers has a price-to-earnings ratio (P/E) of 16.44, compared with 19.40 for the industry. The company possesses a Value Score of A.

See the full list of top ranked stocks here.

Learn more about the Value score and how it is calculated here.

Beyond Nvidia: AI's Second Wave Is Here

The AI revolution has already minted millionaires. But the stocks everyone knows about aren't likely to keep delivering the biggest profits. Little-known AI firms tackling the world's biggest problems may be more lucrative in the coming months and years.

See "2nd Wave" AI stocks now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Skechers U.S.A., Inc. (SKX): Free Stock Analysis Report

Columbia Banking System, Inc. (COLB): Free Stock Analysis Report

Jackson Financial Inc. (JXN): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

/Alphabet%20(Google)%20Image%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)