%20by%20CL%20STOCK%20via%20Shutterstock.jpg)

This is sponsored content. Barchart is not endorsing the websites or products set forth below.

In today’s fast-moving market environment, active traders need tools that match the speed and volatility of the stocks they follow. T-REX Single Stock Leveraged ETFs offer a tactical way to gain magnified daily exposure to some of the most dynamic names in the market—without the complexities of margin or options trading.

Seek to Enhance Daily Exposure

T-REX 2X Leveraged Long ETFs are designed to offer twice the daily return of their underlying stock, providing traders with a way to express short-term bullish views using traditional brokerage accounts. These ETFs are intended for use on a short-term basis and are not suitable for long-term investing.

These Funds seek to provide 2x the daily performance, but there is no assurance the Funds will achieve this objective on any given day. Performance over longer periods may differ significantly due to the effects of compounding.

Target Inverse Exposure—Without Margin or Shorting

For traders anticipating short-term declines in a specific stock, T-REX Short ETFs are structured to deliver -2x the daily performance of the target security—without the need to borrow shares or establish a margin account.

As with leveraged products, inverse ETFs reset daily and are not designed to achieve their objectives over periods longer than one day.

Access Through Traditional Brokerage Accounts

T-REX Single Stock ETFs are available to trade like any other stock or ETF, offering traders an efficient and flexible way to implement tactical strategies.

No margin required

No options approval

Directional tools designed with active traders in mind

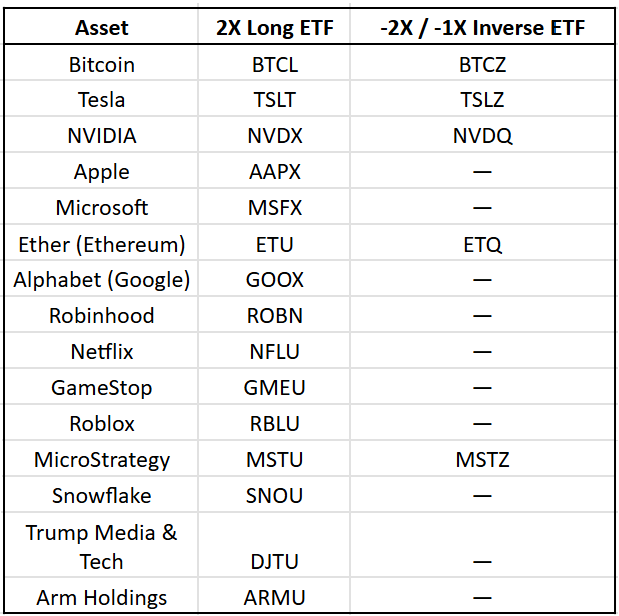

Covering the Names Traders Watch Most

T-REX ETFs focus on high-volatility, high-interest stocks and crypto assets—the same names that drive market momentum and trader attention.

These ETFs are designed to track daily performance objectives only. They are not intended for buy-and-hold investing or for tracking the underlying stock over periods longer than one day.

![]() Built with Active Traders in Mind

Built with Active Traders in Mind

Whether you’re managing short-term positions, reacting to earnings catalysts, or expressing tactical views, T-REX Single Stock ETFs are purpose-built to support your strategy. They combine accessibility, speed, and targeted exposure—all in a single share.

T-REX: Strategic Trading Tools for Short-Term Market Moves.

Visit rexshares.com/trex to learn more.

Important Information:

Shares of the REX Shares ETFs are bought and sold at market price (not NAV) and are not individually redeemed from a Fund. Market Price returns are based upon the midpoint of the bid/ask spread at 4:00 pm EST (when NAV is normally calculated) and do not represent the returns you would receive if you traded shares at other times. Brokerage commissions will reduce returns. Fund returns assume that dividends and capital gains distributions have been reinvested in the Fund at NAV. Some performance results reflect expense reimbursements or recoupments and fee waivers in effect during certain periods shown. Absent these reimbursements or recoupments and fee waivers, results would have been less favorable.

AFTER-TAX AND AFTER-TAX, POST SALES RETURNS

Tax-adjusted returns and tax cost ratio are estimates of the impact taxes have had on a fund. We assume the highest tax rate in calculating these figures. These returns follow the regulatory guidelines for calculating returns before sale of shares. Tax-adjusted returns show a fund’s annualized after tax total return for the one, three and five year periods, excluding any capital-gains effects that would result from selling the fund at the end of the period. To determine this figure, all income and short-term capital gains distributions are taxed at the maximum federal rate at the time of distribution. Long-term capital gains are taxed at a 15% rate. The after tax portion is then assumed to be reinvested in the fund. State and local taxes are not included in our calculations. For more information, please consult your tax consultant.

INVESTMENT RISKS

Investing in the Funds involves a high degree of risk. As with any investment, there is a risk that you could lose all or a portion of your investment in the Funds.

An investor should carefully consider a Fund’s investment objective, risks, charges, and expenses before investing. A Fund’s prospectus and summary prospectus contain this and other information about the REX Shares. To obtain a Fund’s prospectus and summary prospectus call 844-802-4004. A Fund’s prospectus and summary prospectus should be read carefully before investing.

Investing in a REX Shares ETF may be more volatile than investing in broadly diversified funds. The use of leverage by a Fund increases the risk to the Fund. The REX Shares ETFs are not suitable for all investors and should be utilized only by sophisticated investors who understand leverage risk, consequences of seeking daily leveraged, or daily inverse leveraged, investment results and intend to actively monitor and manage their investment.

Fixed Income Securities Risk. When the Fund invests in fixed income securities, the value of your investment in the Fund will fluctuate with changes in interest rates. Typically, a rise in interest rates causes a decline in the value of fixed income securities owned by the Fund.

Effects of Compounding and Market Volatility Risk. The Fund has a daily leveraged investment objective and the Fund’s performance for periods greater than a trading day will be the result of each day’s returns compounded over the period, which is very likely to differ from the Fund performance, before fees and expenses.

Leverage Risk. The Fund obtains investment exposure in excess of its net assets by utilizing leverage and may lose more money in market conditions that are adverse to its investment objective than a fund that does not utilize leverage.

Derivatives are financial instruments that derive value from the underlying reference asset or assets, such as stocks, bonds, or funds (including ETFs), interest rates or indexes. Investing in derivatives may be considered aggressive and may expose the Fund to greater risks, and may result in larger losses or small gains, than investing directly in the reference assets underlying those derivatives, which may prevent the Fund from achieving its investment objective.

Sector Concentration Risk. The trading prices of the Fund’s underlying securities may be highly volatile and could continue to be subject to wide fluctuations in response to various factors. The stock market in general, and the market for technology companies in particular, where applicable, has experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of those companies. Liquidity Risk. Some securities held by the Fund, including options contracts, may be difficult to sell or be illiquid, particularly during times of market turmoil.

High Portfolio Turnover Risk. The Fund may actively and frequently trade all or a significant portion of the Fund’s holdings. A high portfolio turn over rate increases transaction costs, which may increase the Fund’s expenses.

Options Contracts. The use of options contracts involves investment strategies and risks different from those associated with ordinary portfolio securities transactions. The prices of options are volatile and are influenced by, among other things, actual and anticipated changes in the value of the underlying instrument, including the anticipated volatility, which are affected by fiscal and monetary policies and by national and international political, changes in the actual or implied volatility of the underlying reference security, the time remaining until the expiration of the option contract and eco nomic events.

Reference Asset Investing Risk. Issuer-specific attributes may cause an investment held by the Fund to be more volatile than the market generally. The value of an individual security or particular type of security may be more volatile than the market as a whole and may perform differently from the value of the market as a whole.

New Fund Risk. The Fund is a recently organized management investment company with no operating history. As a result, prospective investors do not have a track record or history on which to base their investment decisions.

Non-Diversification Risk. Because the Fund is non-diversified, it may invest a greater percentage of its assets in the securities of a single issuer or a smaller number of issuers than if it was a diversified fund.

Market Price: The current price at which shares are bought and sold. Market returns are based upon the last trade price.

NAV: The dollar value of a single share, based on the value of the underlying assets of the fund minus its liabilities, divided by the number of shares outstanding. Calculated at the end of each business day.

Distributor: Foreside Fund Services, LLC, member FINRA, not affiliated with REX Shares or the Funds’ investment advisor.

The above is sponsored content. Barchart was paid up to forty two thousand dollars for placement and promotion of the content on this site and other forms of public distribution covering the period of April - September 2025. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/Ai%20chip%20by%20Quality%20Stock%20Arts%20via%20Shutterstock.jpg)

/Netflix%20on%20tv%20with%20remote%20by%20freestocks%20via%20Unsplash.jpg)

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)