/A%20SoFi%20logo%20on%20an%20office%20building%20by%20Tada%20Images%20via%20Shutterstock.jpg)

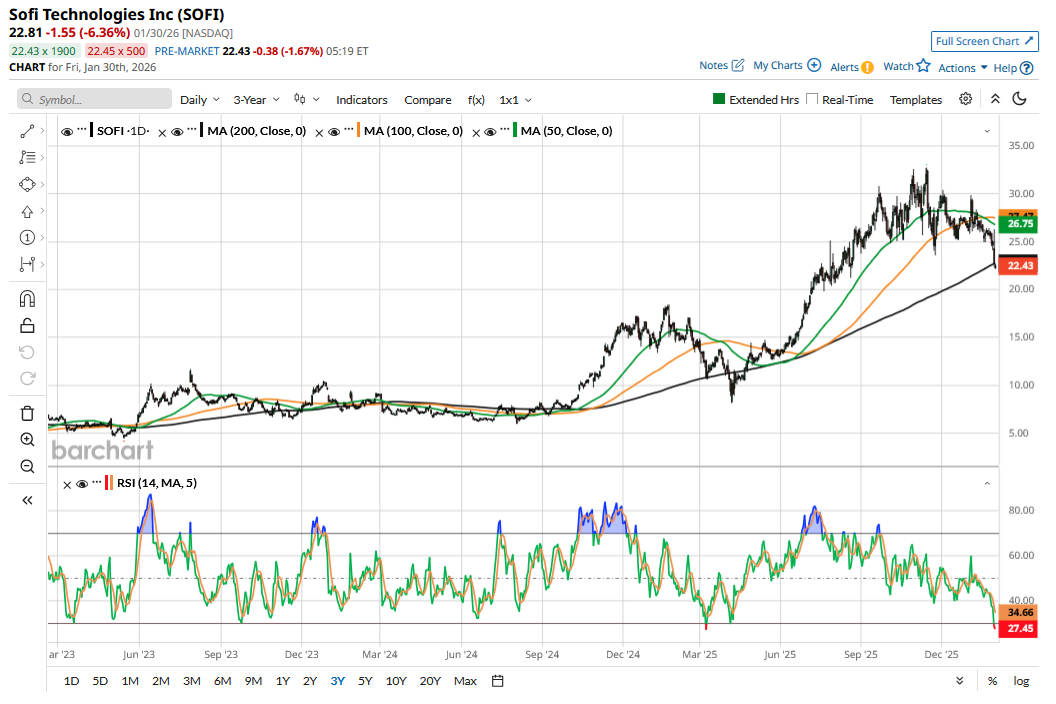

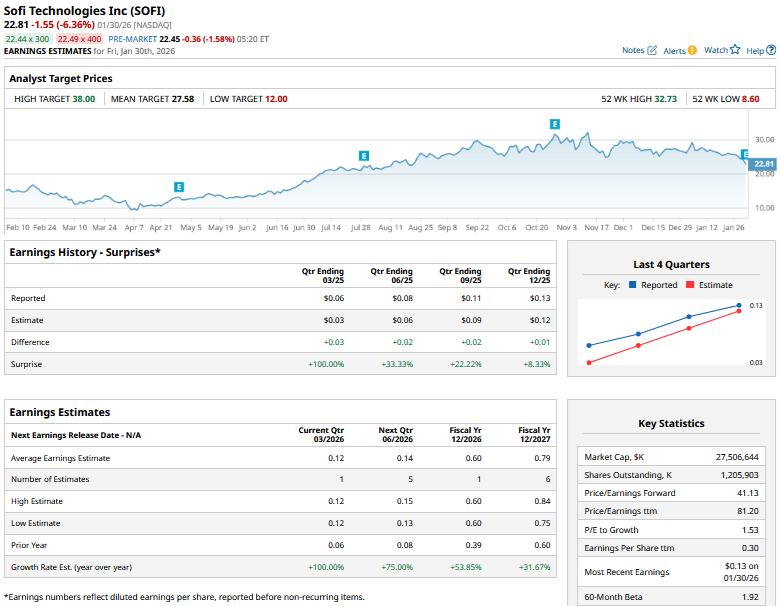

SoFi (SOFI) has outperformed markets handsomely for the last three years, but shares have looked weak in recent weeks. SOFI stock is down 19% year-to-date (YTD) and has lost more than 30% from its record highs hit in November. The selloff only gained traction last week despite a better-than-expected fourth-quarter 2025 earnings report.

I previously noted that SoFi's Q4 confessional could help SOFI stock break free from its narrow trading range. The earnings came in better than expected, but the market’s reaction was contrary to my expectations, with shares plunging more than 6% on Jan. 30. With that in mind, let's take a look at the key takeaways from SoFi's Q4 earnings and analyze whether it makes sense to buy the dip.

SoFi Reported Stellar Q4 Earnings

To begin, let’s look at a few key numbers from the company's Q4 earnings and guidance.

For starters, SoFi added over 1 million new members in Q4 and ended the year with 13.7 million members. For context, that figure is more than 20 times its member count at the end of 2018. The fourth quarter of 2025 also marked the first quarter in which SoFi added over 1 million members, and the growth flywheel is far from over, with the company guiding for the metric to rise by at least 30% this year.

Sofi reported revenue of over $1 billion in Q4, which was 37% higher year-over-year (YOY) and the first time the company’s quarterly revenues topped $1 billion. For Q1 2026, SoFi forecast revenue of $1.04 billion, while projecting the full-year number at $4.65 billion, implying 30% growth versus the previous year.

Cross-selling has been key to SoFi’s success, and the cross-sell rate increased to 40% in Q4 — a rise of 7 percentage points over the preceding year. SoFi’s brand-building measures are also bearing fruit, and unaided brand awareness rose to an all-time high of 9.6% in Q4.

SoFi generated adjusted EBITDA of $318 million in Q4 and more than $1 billion in the full year. It was incidentally the first time that the company’s annual adjusted EBITDA topped $1 billion. For 2026, SoFi expects to generate adjusted EBITDA of $1.6 billion, which represents a healthy margin of 34%. Management forecast full-year adjusted EPS at $0.60, which is 53% higher than the $0.39 it posted last year. However, the 2026 guidance is toward the lower end of the previous forecast of $0.55 to $0.80.

All said, while a bit rhetorical, I wouldn’t disagree with CEO Anthony Noto’s observation during the Q4 2025 earnings call. “Despite these exceptionally strong results, I know that we are just getting started," Noto said. "We are still just scratching the surface of the opportunity that exists across each of our existing products and the newer areas like crypto.”

What Could Drive the Next Leg of SoFi's Growth?

Both from a member growth perspective and a new product addition perspective, there is a substantial growth potential for SoFi. The firm has doubled down on the blockchain and cryptocurrency after starting crypto trading for its members last November. The company plans to launch secured lending backed by cryptocurrency, and while that is a riskier business given the volatility in digital assets, it could open up a new revenue opportunity for SoFi.

SoFi is also looking to offer institutional crypto trading and business banking, which would further increase its target market. Refinancing credit card debt with relatively low-cost personal loans is another market that the firm is aggressively targeting.

The loan platform business, where SoFi originates loans for third parties, is another key driver of growth. According to the company, it is unable to lend to loan applications worth $100 billion annually. These are customers who do not meet SoFi’s credit standards. But by originating loans for other lenders, SoFi gets low-risk, high-margin revenues. During Q4, the loan platform segment generated adjusted net revenue of $194 million, and looking at its growth trajectory, it could soon become a $1 billion annualized revenue business.

There are concerns over SoFi losing Chime (CHYM) as a tech platform customer. The company's capital raise last year wasn’t received well by markets, either. However, I believe these concerns are overblown, and the capital raise helped SoFi strengthen its balance sheet and enabled it to fully repay high-cost warehouse debt and save millions in annualized costs. The annualized savings offset the dilutionary impact of new share issuance.

From a valuation perspective, SOFI stock trades at around 41 times forward earnings, which I find quite attractive considering the kind of growth the company brings to the table — both in 2026 and beyond.

On the date of publication, Mohit Oberoi had a position in: SOFI. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/Ai%20chip%20by%20Quality%20Stock%20Arts%20via%20Shutterstock.jpg)

/Palantir%20by%20rblfmr%20via%20Shutterstock.jpg)