3M Company’s MMM Safety and Industrial segment continues to play an important role in its overall growth. In the second quarter of 2025, the segment’s organic revenues grew for the fifth consecutive quarter, increasing 2.6% year over year. It contributed approximately 45% of MMM’s total revenues during the quarter.

This growth was driven by solid momentum in personal safety, roofing granules, industrial adhesives and tapes, abrasives and electrical markets. Another key contributor to this upward trend was stable demand for electrical infrastructure products like medium voltage cable accessories and insulation tapes.

3M also witnessed increased traction in industrial and electronics bonding solutions, supported by new product innovation and commercial excellence. The company’s commercial excellence initiative, first launched in the US and now expanding across Europe and Asia, played an important role in improving its business performance. It enhanced sales team efficiency, increased sales and improved customer retention level by focusing on customer needs.

However, ongoing weakness in the automotive aftermarket and soft demand across certain industrial end markets remain concerning. Also, macroeconomic uncertainties including inflationary pressures and unfavorable trade policies could weigh on the segment’s near-term performance. Despite these risks, increased demand for personal safety, electrical infrastructure and bonding solutions positions 3M’s Safety and Industrial segment to deliver consistent growth in the coming quarters.

Segmental Snapshot of MMM’s Peers

Among 3M’s major peers, Honeywell International Inc. HON is witnessing solid momentum in its Building Automation segment, driven by ongoing strength in both the building solutions and building products businesses. In the second quarter of 2025, Honeywell’s segment’s revenues increased 16% year over year. It contributed approximately 18% of Honeywell’s total revenues during the quarter.

Its another peer, ITT Inc.’s ITT Connect and Control Technologies segment is benefiting from growth in component and connector sales within the defense and industrial markets. Also, the acquisition of kSARIA augurs well for ITT’s segment. Revenues from ITT’s unit surged 31.3% year over year on a reported basis in the second quarter of 2025.

The Zacks Rundown for MMM

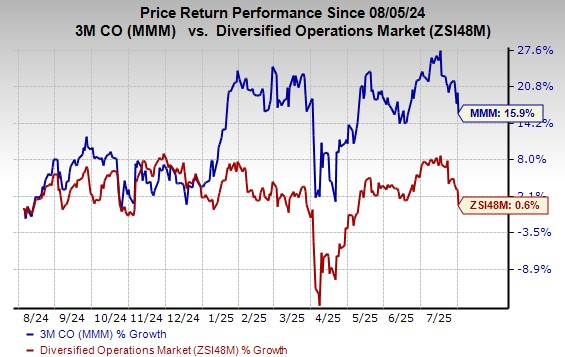

Shares of 3M have gained 15.9% in the past year compared with the industry’s growth of 0.6%.

Image Source: Zacks Investment Research

From a valuation standpoint, 3M is trading at a forward price-to-earnings ratio of 17.67X, above the industry’s average of 16.20X. MMM carries a Value Score of D.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for MMM’s earnings has increased over the past 60 days.

Image Source: Zacks Investment Research

MMM stock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Names #1 Semiconductor Stock

This under-the-radar company specializes in semiconductor products that titans like NVIDIA don't build. It's uniquely positioned to take advantage of the next growth stage of this market. And it's just beginning to enter the spotlight, which is exactly where you want to be.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $971 billion by 2028.

See This Stock Now for Free >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Honeywell International Inc. (HON): Free Stock Analysis Report

3M Company (MMM): Free Stock Analysis Report

ITT Inc. (ITT): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Tesla%20Inc%20logo%20by-%20baileystock%20via%20iStock.jpg)

/Salesforce%20Inc%20logo%20on%20building-by%20Sundry%20Photography%20via%20Shutterstock.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)