Steel Dynamics, Inc. STLD logged second-quarter 2025 earnings of $2.01 per share, down from $2.72 in the year-ago quarter. The bottom line missed the Zacks Consensus Estimate of $2.05.

Net sales in the second quarter were down around 1.5% year over year to $4,565.1 million. The metric missed the Zacks Consensus Estimate of $4,627 million.

Steel prices stabilized at higher levels in the second quarter, resulting in a sequential improvement in margins. However, trade uncertainties, with respect to tariffs, added to the inventory overhang of coated flat rolled steel, slowing down steel and steel fabrication shipments in the reported quarter.

STLD’s Segment Highlights

Net sales for steel operations were $3,275.6 million in the reported quarter, up around 4.6% year over year. STLD registered steel shipments of roughly 3.3 million tons in the quarter compared with our estimate of 3.34 million tons.

STLD's steel operations reported an average external product selling price of $1,134 per ton, down from $1,138 in the year-ago quarter and up from $998 in the previous quarter. The figure was above our estimate of $1,061 per ton.

Net sales of Metal’s recycling operations were $522.7 million in the quarter under review, up around 1.1% from the year-ago quarter. STLD registered ferrous shipments of around 1.59 million gross tons in the quarter, up 5.7% year over year. The figure lagged our estimate of 1.78 million gross tons.

The company's steel fabrication operations reported sales of around $340.6 million, down roughly 28% year over year. Steel Dynamics recorded steel fabrication shipments of 135,347 tons in the quarter, down around 14.9% year over year. The figure missed our estimate of 150,193 tons.

STLD’s Financial Position

Steel Dynamics ended the quarter with cash and cash equivalents of $458 million, down around 44.8% year over year. Long-term debt was $3,779.6 million, up roughly 70.8% from the year-ago quarter.

The company generated cash flow from operations of $301.6 million in the reported quarter, down around 21.2% year over year.

STLD’s Outlook

The company expects trade uncertainties and tax impacts to mitigate. It remains hopeful that the interest rate environment will improve, unfairly traded imports will decline and the manufacturing sector will keep growing in the United States. As such, scenarios will directly support pricing and demand. Outlook remains positive. U.S. International Trade Commission’s preliminary determinations on coated flat rolled steel are also poised to improve its operating platforms, although final determinations are yet to come out.

The aluminum teams are also expected to push volumes, anticipating an exit utilization rate of 40-50% in 2025 and 75% in 2026. The company is focused on delivering diversified and sustainable solutions.

STLD’s Price Performance

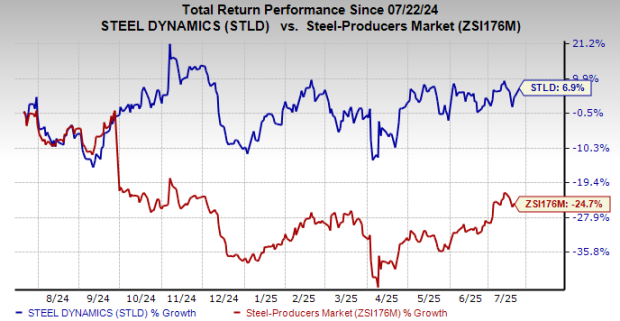

Shares of Steel Dynamics have gained 6.9% over the past year against a 24.7% decline in its industry.

Image Source: Zacks Investment Research

STLD’s Zacks Rank & Key Picks

STLD currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks worth a look in the basic materials space are Royal Gold, Inc. RGLD, Kinross Gold Corporation (KGC) and Agnico Eagle Mines AEM.

Royal Gold is slated to report second-quarter results on Aug. 6. The Zacks Consensus Estimate for earnings is pegged at $1.70 per share. RGLD’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, with the average surprise being 9%. Royal Gold flaunts a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Kinross is scheduled to report second-quarter results on July 30. The Zacks Consensus Estimate for KGC’s second-quarter earnings is pegged at 27 cents per share. KGC’s earnings beat the Zacks Consensus Estimate in three of the last four quarters, with the average surprise being 16.1%. Kinross currently sports a Zacks Rank #1.

Agnico Eagle is slated to report second-quarter results on July 30. The consensus estimate for AEM’s earnings is pegged at $1.66 per share. AEM flaunts a Zacks Rank #1 at present. Agnico Eagle’s earnings beat the consensus estimate in each of the last four quarters, with the average surprise being 12.3%.

Zacks' Research Chief Names "Stock Most Likely to Double"

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is a little-known satellite-based communications firm. Space is projected to become a trillion dollar industry, and this company's customer base is growing fast. Analysts have forecasted a major revenue breakout in 2025. Of course, all our elite picks aren't winners but this one could far surpass earlier Zacks' Stocks Set to Double like Hims & Hers Health, which shot up +209%.

Free: See Our Top Stock And 4 Runners UpWant the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Steel Dynamics, Inc. (STLD): Free Stock Analysis Report

Kinross Gold Corporation (KGC): Free Stock Analysis Report

Agnico Eagle Mines Limited (AEM): Free Stock Analysis Report

Royal Gold, Inc. (RGLD): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

/Cisco%20Systems%2C%20Inc_%20HQ-by%20Sundry%20Photography%20via%20iStock.jpg)