Global insurance and risk advisory firm Arthur J. Gallagher & Co. AJG has acquired Equinox Agency, a Pennsylvania-based consultancy specializing in employee health and benefits solutions for businesses across the Lehigh Valley region. The deal strengthens AJG’s regional footprint in health and benefits consulting, though the terms of the transaction were not disclosed.

The Equinox team, headed by Thomas Groves and Dan Gagnier, will continue operating from their existing location, now under the leadership of Scott Sherman, who oversees AJG’s employee benefits consulting and brokerage operations in the Northeast region. Known for their strong client service and regional expertise, the addition of Equinox is set to enhance AJG’s capabilities. By integrating Equinox’s established client base and regional expertise, AJG can unlock new cross-selling opportunities and enhance service offerings, driving incremental revenues.

Arthur J. Gallagher maintains a well-diversified revenue base across both domestic and international markets. Some of the acquisitions that took place in 2025 included PIB Group, First Capital and Asperabroker. In the first quarter alone, the company completed 11 tuck-in acquisitions, which are projected to add roughly $100 million in annualized revenues, further reinforcing its expansion strategy and consistent top-line growth.

How Aon & MMC Are Expanding Their Footprint Through Acquisitions

Earlier this year, Marsh McLennan Agency, a subsidiary of Marsh & McLennan Companies, Inc. MMC, acquired Acumen Solutions Group, a New York-based firm specializing in employee benefits and risk management. The deal is expected to expandMarsh & McLennan’s Northeast presence and add to its capabilities across key industry verticals.

Aon plc AON, through its subsidiary NFP, acquired Lyons Insurance Agency in February 2025. The Delaware-based firm provides employee benefits and commercial insurance to mid-sized businesses. This acquisition expands Aon’s presence in the U.S. Northeast and supports the growth of its insurance and advisory services in the region.

AJG’s Price Performance, Valuation & Estimates

Over the past year, AJG’s shares have gained 10.6%, outperforming the industry and the Zacks S&P 500 Composite.

AJG’s YTD Price Performance

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

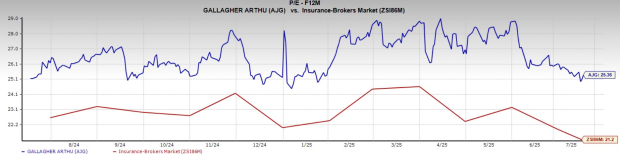

From a valuation standpoint, AJG trades at a forward price-to-earnings ratio of 25.4, up from the industry average of 21.2. The company carries a Value Score of F.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for Arthur J. Gallagher’s 2025 earnings implies 9.2% growth year over year, followed by a 22.6% increase next year.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Arthur J. Gallagher stock currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the favorite stock to gain +100% or more in the months ahead. They include

Stock #1: A Disruptive Force with Notable Growth and Resilience

Stock #2: Bullish Signs Signaling to Buy the Dip

Stock #3: One of the Most Compelling Investments in the Market

Stock #4: Leader In a Red-Hot Industry Poised for Growth

Stock #5: Modern Omni-Channel Platform Coiled to Spring

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor. While not all picks can be winners, previous recommendations have soared +171%, +209% and +232%.

Download Atomic Opportunity: Nuclear Energy's Comeback free today.Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Marsh & McLennan Companies, Inc. (MMC): Free Stock Analysis Report

Aon plc (AON): Free Stock Analysis Report

Arthur J. Gallagher & Co. (AJG): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

/Super%20Micro%20Computer%20Inc%20logo%20on%20building-by%20Poetra_RH%20via%20Shutterstock.jpg)