Clinical-stage biotech stocks carry significant risks, but also offer explosive upside potential. These companies are built around early stage innovations that, if successful, can evolve into billion-dollar therapies or entire treatment platforms. The company’s valuation at this stage is less dependent on fundamentals like revenue or profit and instead hinges on scientific milestones, meaning a single clinical trial result or regulatory approval can send the stock soaring.

Valued at $212 million, Tvardi Therapeutics (TVRD) is a clinical-stage biopharmaceutical company developing oral small-molecule drugs targeting STAT3, a protein linked to fibrosis and certain cancers when overactive. Following its merger with Cara Therapeutics, Tvardi has rapidly gained traction in the biotech space.

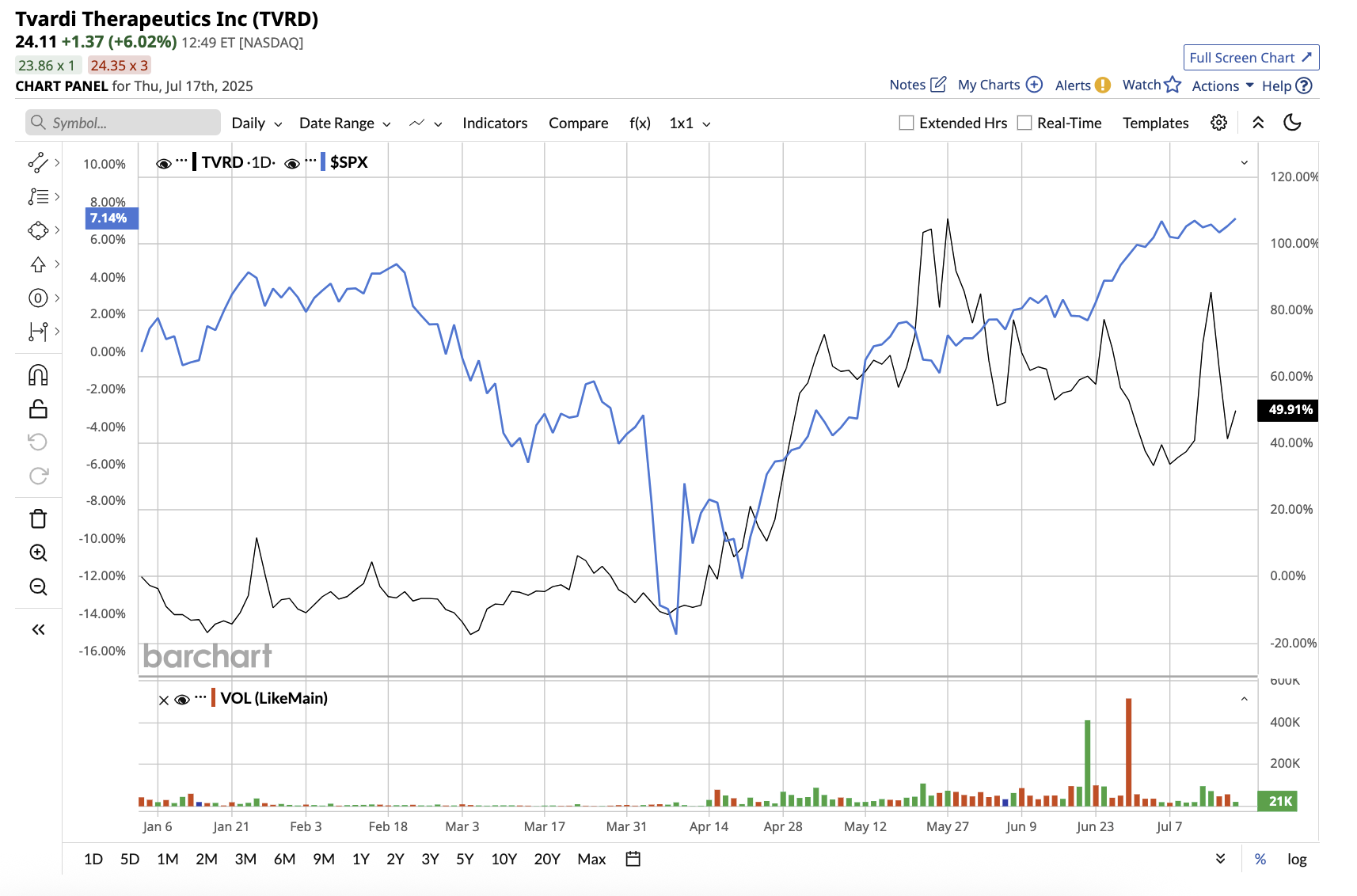

The stock is already up 32% in the year to date, and analysts believe it still has substantial room to run.

Setting the Stage for a Strong Pipeline

The company’s lead candidate, TTI-101, is an oral pill that is designed to block overactive STAT3. It is currently in Phase 2 trials for Idiopathic Pulmonary Fibrosis (IPF), a serious lung-scarring disease, and Hepatocellular Carcinoma (HCC), a type of liver cancer. The REVERT IPF Phase 2 trial is evaluating the efficacy of TTI-101 alone and in combination with the approved drug nintedanib to treat patients with IPF, a progressive and often fatal lung disease with few treatment options. The company completed enrollment for the Phase 2 trial at the end of May and expects top-line data by the fourth quarter of this year. Success in this trial would validate oral STAT3 as a therapeutic mechanism and provide momentum for additional indications such as HCC.

What’s noteworthy is that the U.S. Food and Drug Administration (FDA) has designated TTI-101 as an orphan drug in both IPF and HCC. This designation is given to drugs that treat rare diseases with significant unmet needs. The FDA has also granted TTI-101 Fast Track Designation for HCC only. This will speed up the candidate’s review process.

Tvardi also expects top-line data from its REVERT Liver Cancer Phase 1b/2 clinical trial for HCC in the first half of 2026. Additionally, Tvardi has TTI‑109, a next-generation STAT3 inhibitor, in the preclinical stage, which means it has not yet entered human trials. This suggests that it could enter clinical development within 12 months. If pursued, it would broaden Tvardi’s fibrosis-related disease portfolio and strengthen its long-term clinical pipeline.

The company’s products are still in the clinical stage and have not yet been approved for the market. As a result, it generates no revenue and requires external financing to run its operations. The merger with Cara was critical not only for securing a path to a Nasdaq listing, but also for strengthening its financing. With approximately $28.3 million in private placement funding and $23.8 million in net cash from Cara, Tvardi has secured a cash runway until late 2026, covering the critical readout periods of its lead candidate’s trials.

Tvardi Therapeutics stock represents a typical high-risk, high-reward biotech investment. With no revenue, its valuation is entirely dependent on clinical trial results. The company has breakout potential, which is why Wall Street is optimistic. Tvardi’s breakthrough IPF results may spark major collaborations. Furthermore, positive HCC outcomes would broaden its oncology portfolio.

On the flip side, risks include clinical trial or safety failures, as well as delays in regulatory approvals. This is why the stock is appropriate for investors who are comfortable with the volatility that comes with clinical-stage biotech stocks.

What Does Wall Street Say About Tvardi’s Stock?

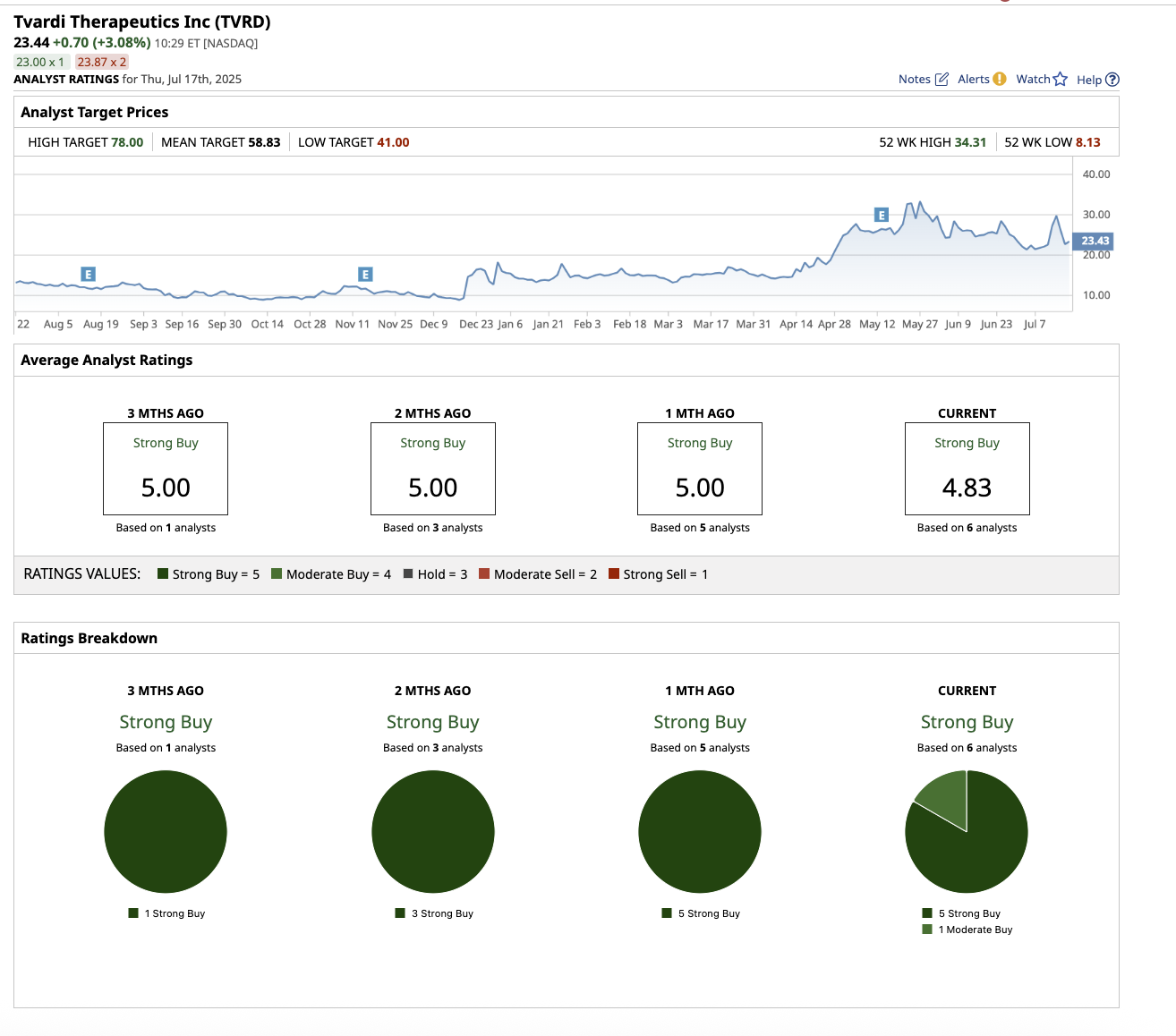

Overall, Wall Street rates the stock a “Strong Buy.”

Of the six analysts covering TVRD stock, five of them rate it as a “Strong Buy,” with one suggesting a “Moderate Buy.” The average price target is $58.33, which represents 151% upside from current levels. Its high target price of $78 implies the stock can surge 233% over the next 12 months.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)

/EV%20in%20showroom%20by%20Robert%20Way%20via%20Shutterstock.jpg)

/AI%20(artificial%20intelligence)/Businessman%20touching%20the%20brain%20working%20of%20Artificial%20Intelligence%20(AI)%20Automation%20by%20Suttiphong%20Chandaeng%20via%20Shutterstock.jpg)