Arm Holdings ARM has long been recognized for its power-efficient chip architecture, a key factor behind its dominance in the mobile computing space. However, its influence now extends well beyond smartphones and tablets. Renowned for powering sleek, energy-efficient designs in devices from industry giants like Apple AAPL, Qualcomm QCOM and Samsung, Arm Holdings is emerging as a foundational force in the rapidly evolving realms of artificial intelligence (AI) and the Internet of Things (IoT).

What sets ARM apart is its unmatched ability to deliver high performance with minimal power consumption, an increasingly critical requirement as the world becomes more connected and intelligent. From wearables to cloud data centers, AI workloads are proliferating across device categories, and Arm Holdings’ flexible, energy-efficient architecture is being adopted to meet these next-generation demands.

Apple continues to rely heavily on Arm Holdings’ architecture, using it as the backbone for its M-series chips and accelerating AI integration across its ecosystem. Qualcomm, a long-time partner, leverages Arm Holdings’ designs in its Snapdragon processors to fuel AI-driven innovations in smartphones and automotive platforms. Samsung, too, embeds Arm technology in its mobile and consumer electronics devices while advancing AI and IoT capabilities through its Exynos chipsets.

The reliance on ARM by these tech leaders isn’t just continuing — it’s deepening. As Apple, Qualcomm and Samsung scale up their AI ambitions and broaden their IoT strategies, Arm Holdings remains central to enabling this transformation through its scalable power efficiency. The company’s commitment to optimizing its architecture for machine learning and edge computing further strengthens its alignment with the strategic needs of its top clients.

In this light, Arm Holdings is no longer just a key player in mobile chip design — it is fast becoming an essential infrastructure layer powering the AI and IoT future for Apple, Qualcomm and Samsung. Its growing role cements its position as a critical enabler in the broader technology ecosystem.

ARM’s Price Performance, Valuation & Estimates

The stock has climbed 41% in the past three months, underperforming the industry’s 45% growth.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

From a valuation standpoint, ARM trades at a forward price-to-sales ratio of 30.92, well above the industry’s 8.64. It carries a Value Score of F.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

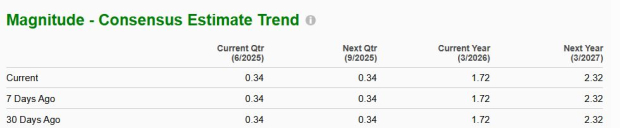

The Zacks Consensus Estimate for ARM’s earnings has remained unchanged over the past 30 days.

Image Source: Zacks Investment Research

ARM stock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the favorite stock to gain +100% or more in the months ahead. They include

Stock #1: A Disruptive Force with Notable Growth and Resilience

Stock #2: Bullish Signs Signaling to Buy the Dip

Stock #3: One of the Most Compelling Investments in the Market

Stock #4: Leader In a Red-Hot Industry Poised for Growth

Stock #5: Modern Omni-Channel Platform Coiled to Spring

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor. While not all picks can be winners, previous recommendations have soared +171%, +209% and +232%.

Download Atomic Opportunity: Nuclear Energy's Comeback free today.Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

QUALCOMM Incorporated (QCOM): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

ARM Holdings PLC Sponsored ADR (ARM): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

/Intel%20Corp_%20logo%20on%20mobile%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

/Nvidia%20logo%20by%20Konstantin%20Savusia%20via%20Shutterstock.jpg)