Alibaba BABA has joined the global race to scale AI infrastructure, as the demand for generative AI reshapes enterprise and cloud computing needs. Alibaba Cloud is becoming a key pillar of the company’s long-term growth strategy, with its expanding network of data centers positioned to deliver the scale and reliability customers now expect.

In the fourth quarter of fiscal 2025, Alibaba’s Cloud Intelligence Group generated RMB 30.1 billion ($4.15 billion) in revenues, up 18% year over year, contributing around 12.7% of total revenues.

Alibaba has committed to a RMB 380 billion ($52.7 billion) investment over three years to strengthen its global cloud infrastructure. As part of this expansion, Alibaba Cloud opened its third data center in Malaysia on July 1 and plans to launch a second facility in the Philippines by October 2025. These moves directly respond to growing regional demand for AI and cloud services across Southeast Asia.

The expansions build on earlier infrastructure investments in Thailand, Mexico and South Korea announced in the first half of 2025. With these additions, Alibaba Cloud’s global infrastructure will reach 90 availability zones across 29 regions, reinforcing its position as a major player in the international cloud market.

This expanding network enables Alibaba Cloud to address the increasing global demand for secure and scalable cloud solutions amid the rapid acceleration of AI adoption across industries.

BABA’s Stiff Competition in the Data Center Buildout Race

Alibaba Cloud faces mounting competition from Amazon AMZN and Microsoft MSFT as both accelerate global infrastructure investments.

Amazon plans to invest billions across Australia, Pennsylvania, Georgia and many more regions to expand AI-ready data centers and cloud infrastructure. Amazon spans 117 availability zones within 37 regions, with announced plans for 13 more availability zones.

Microsoft, meanwhile, opened a new data center region in Austria and expanded its AI cloud network in Taiwan to meet rising enterprise demand. The Microsoft network connects more than 60 datacenter regions, 300 datacenters, 190 points of presence, and over 175,000 miles of terrestrial and subsea fiber worldwide.

BABA’s Share Price Performance, Valuation and Estimates

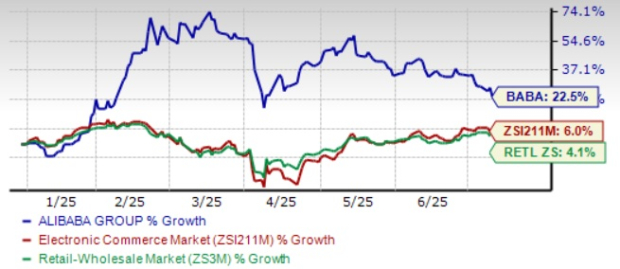

BABA shares have gained 22.5% in the year-to-date (YTD) period, outperforming the Zacks Internet – Commerce industry and the Zacks Retail-Wholesale sector’s growth of 6% and 4.1%, respectively.

BABA’s YTD Price Performance

Image Source: Zacks Investment Research

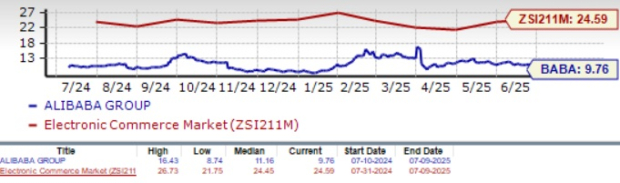

From a valuation standpoint, BABA stock is currently trading at a forward 12-month Price/Earnings ratio of 9.76X compared with the industry’s 24.59X. BABA has a Value Score of A.

BABA’s Valuation

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for first-quarter fiscal 2026 earnings is pegged at $2.48 per share, which has remained unchanged over the past 30 days, indicating 9.73% year-over-year growth.

Alibaba currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Higher. Faster. Sooner. Buy These Stocks Now

A small number of stocks are primed for a breakout, and you have a chance to get in before they take off.

At any given time, there are only 220 Zacks Rank #1 Strong Buys. On average, this list more than doubles the S&P 500. We’ve combed through the latest Strong Buys and selected 7 compelling companies likely to jump sooner and climb higher than any other stock you could buy this month.

You'll learn everything you need to know about these exciting trades in our brand-new Special Report, 7 Best Stocks for the Next 30 Days.

Download the report free now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Alibaba Group Holding Limited (BABA): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

/AI%20(artificial%20intelligence)/Hands%20of%20robot%20and%20human%20touching%20on%20big%20data%20network%20connection%20by%20PopTika%20via%20Shutterstock.jpg)

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)