Peloton (PTON) is down about 28% for the year and has fallen below $5, pushing it into the category of penny stocks. Hedge fund manager David Einhorn, who sold the bulk of his holdings in the company last year, is meanwhile buying the dip in the health equipment company. Let's look at Peloton’s outlook going forward after the stock bounced from its 52-week low.

Peloton Missed Earnings Estimates

Let’s begin by looking at Peloton’s most recent earnings report. The company reported revenues of $656.5 million in its fiscal Q2 2026, which was 3% lower than the corresponding period last year and fell short of both analysts’ estimates and its internal guidance. Its per-share loss of 9 cents was also ahead of the 6 cents that analysts expected.

For the current quarter, it forecasts revenues between $605 million and $625 million. The midpoint of the guidance implies a 1% annual decline and was short of the $638 million that analysts were modeling. It expects paid connected fitness subscribers at the end of the current fiscal quarter to be between 2.650 million and 2.675 million, whose midpoint is 8% lower than the corresponding period last year.

The company expects its adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) to rise to between $120 million and $135 million in the current quarter, a year-over-year (YoY) increase of 43% at the midpoint. It also raised its annual EBITDA guidance to between $450 million and $500 million.

Overall, Peloton’s fiscal Q2 earnings were no different from the trend we have seen over the last few quarters—falling subscribers and revenues, but improvement in adjusted EBITDA. Meanwhile, apart from the earnings miss, the announcement of CFO Liz Coddington leaving the company spooked investors and added fuel to the fire in the post-earnings sell-off. While she would take up a role outside the industry at a private clean tech energy company, the CFO's departure is seldom positive news for a stock.

PTON Stock Forecast

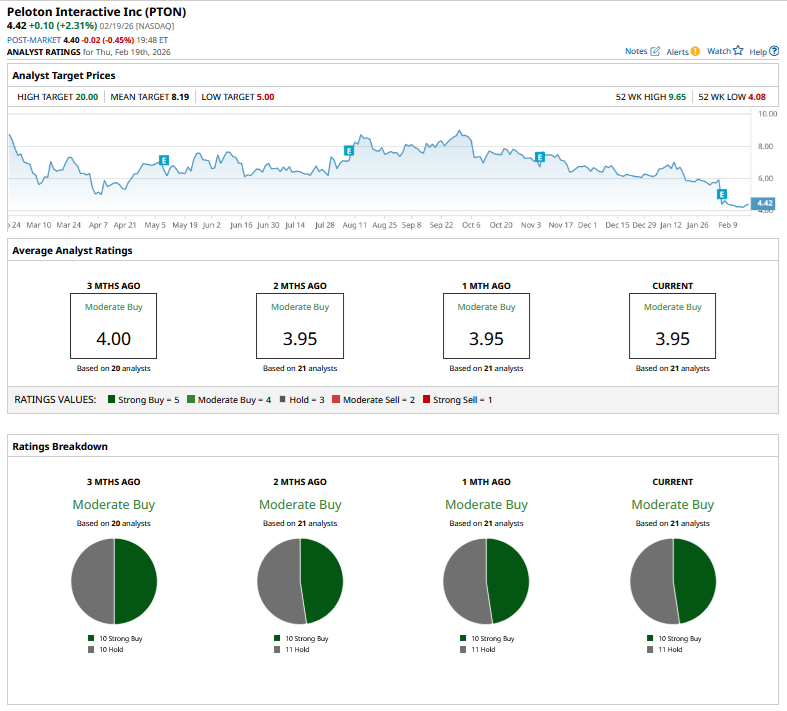

Brokerage did not take kindly to Peloton’s fiscal Q2 earnings, and analysts at Citigroup, J.P. Morgan, Truist, and Telsey lowered their target prices. Argus went a step further and downgraded the stock from a “Buy” to a “Hold.” Overall, analysts are quite divided on Peloton’s outlook, and roughly half of those covering the stock rate it as a “Strong Buy,” while the remaining half rate it as a “Hold.” The stock even trades below its Street low target price of $5, while the mean target price of $8.19 is over 85% higher.

Peloton Is Struggling for Growth

The at-home fitness market, which rose to prominence during the Covid-19 pandemic, is now a pale shadow. Far from reporting triple-digit revenue growth that helped its market capitalization top $50 billion at the peak, Peloton is now struggling for growth. Its equipment sales have been weak, and even the growth in commercial sales has failed to revive the overall growth. Subscriptions are now the key driver of the company’s revenues and far outstrip equipment sales. However, the company has been losing subscribers, which puts a question mark on that business.

Peloton launched its Cross Training Series of hardware and its artificial intelligence-enabled coaching platform, Peloton IQ, but these don’t seem to have cut ice with customers in the holiday season. The pivot to third-party sales, including selling its products on Amazon (AMZN), hasn’t been the kind of growth driver that it was expected to be.

One area where the company has made significant progress is improving its balance sheet. It has cut its net debt by over half in the last year, and the metric stood at $319 million at the end of January. While loss-making, Peloton is generating healthy cash flows and expects to generate at least $275 million in free cash flows this fiscal year despite a $45 million hit from tariffs. The company holds more cash than it needs on its balance sheet and is looking at opportunities to “optimize” its capital structure, which might mean further deleveraging.

Should You Buy PTON Stock

Peloton’s woes are no secret, and there is no magic recipe for it returning to topline growth, as at-home fitness is no longer as appealing as it was during the Covid-19 pandemic. However, I find the stock as a perfect fit into Howard Marks’ “It's not what you buy, it's what you pay” theory.

Peloton has a market cap under $2 billion and expects to generate revenues of $2.4 billion at the low end this fiscal year, which gives us a price-to-sales multiple below 1x. The price-to-free cash-flow multiple is below 7x, which also looks quite attractive. Peloton delivered on its commitment to turn free cash flow positive and is now targeting a positive operating income for the full fiscal year 2026.

True, the company is losing subscribers and witnessing degrowth and is present in a not-so-hot industry. However, at these valuations, I find a good enough margin of safety in this penny stock.

On the date of publication, Mohit Oberoi had a position in: PTON, AMZN. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock.jpg)