/Globe%20Life%20Inc%20field-by%20Dorti%20via%20Shutterstock.jpg)

Globe Life Inc. (GL), with a market cap of $10.1 billion, is an insurance holding company based in McKinney, Texas. It offers a range of life insurance, supplemental health insurance products, and annuities, primarily targeting lower-middle- and middle-income families.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks and Globe Life fits this description perfectly. Its diversified product mix, encompassing life insurance, supplemental health, and annuities, provides consistent revenue streams. The company benefits from a multi-channel distribution model, including direct-to-consumer, agencies, and worksite marketing, which enhances reach and flexibility. Additionally, its disciplined underwriting, strong return on equity, and solid investment portfolio contribute to its long-term financial resilience and profitability.

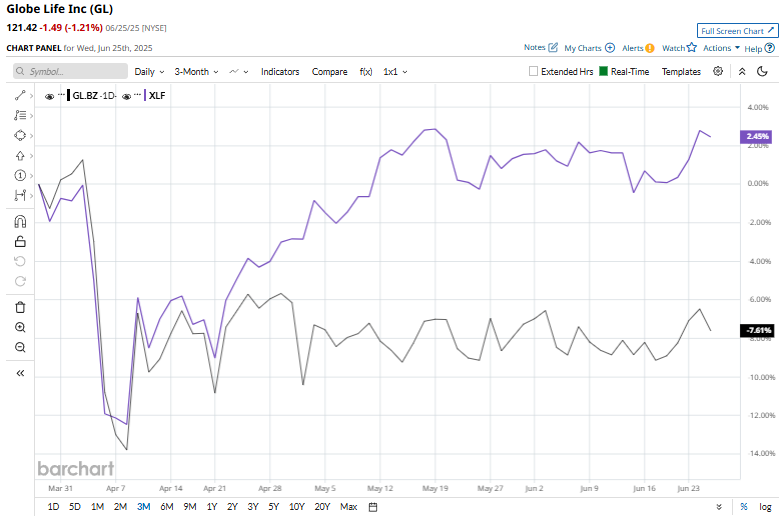

The stock is currently trading 9.2% below its 52-week high of $133.76 recorded on Apr. 2. Globe Life shares have plunged 6.5% over the past three months, underperforming the Financial Select Sector SPDR Fund’s (XLF) 1.9% rise over the same time frame.

Globe Life has delivered strong long-term performance, with its shares up 8.9% year-to-date, outpacing the XLF, which rose 6.4%. Over the past 52 weeks, GL has surged 45.4%, significantly outperforming XLF’s 24.5% gain.

Technically, the stock has maintained momentum, trading above its 200-day moving average since mid-September and recently staying above its 50-day moving average as well.

On April 30, Globe Life reported its Q1 results, and its shares dipped over 4% in the next trading session as results fell slightly short of market expectations. Revenue rose 5% year-over-year to $1.48 billion, while net operating EPS increased 10% to $3.07, supporting a solid 19% return on equity. The company continued to reward shareholders, repurchasing 1.5 million shares for $177 million, and reaffirmed its full-year net operating EPS guidance of $13.45–$14.05. Despite the strong fundamentals, the modest earnings miss weighed on investor sentiment.

In addition, when compared, rival Lincoln National Corporation (LNC) fell behind GL. LNC has advanced 3.9% in 2025 and 3.1% over the past 52 weeks.

Among the 11 analysts covering the stock, the consensus rating is “Moderate Buy,” and its mean price target of $145 implies a potential 19.4% upswing from the current market price.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Intel%20Corp_%20logo%20on%20mobile%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

/Nvidia%20logo%20by%20Konstantin%20Savusia%20via%20Shutterstock.jpg)