6/17/25

.

.

If you don't like the customer service or lack of personal attention you are receiving at your new and very large brokerage house, you have options, and you don't have to stay there. Account transfers are easy and so is opening a new account.

.

.

If you would like to receive more information on the commodity markets, please use this link to join my email list Sign Up Now

.

.

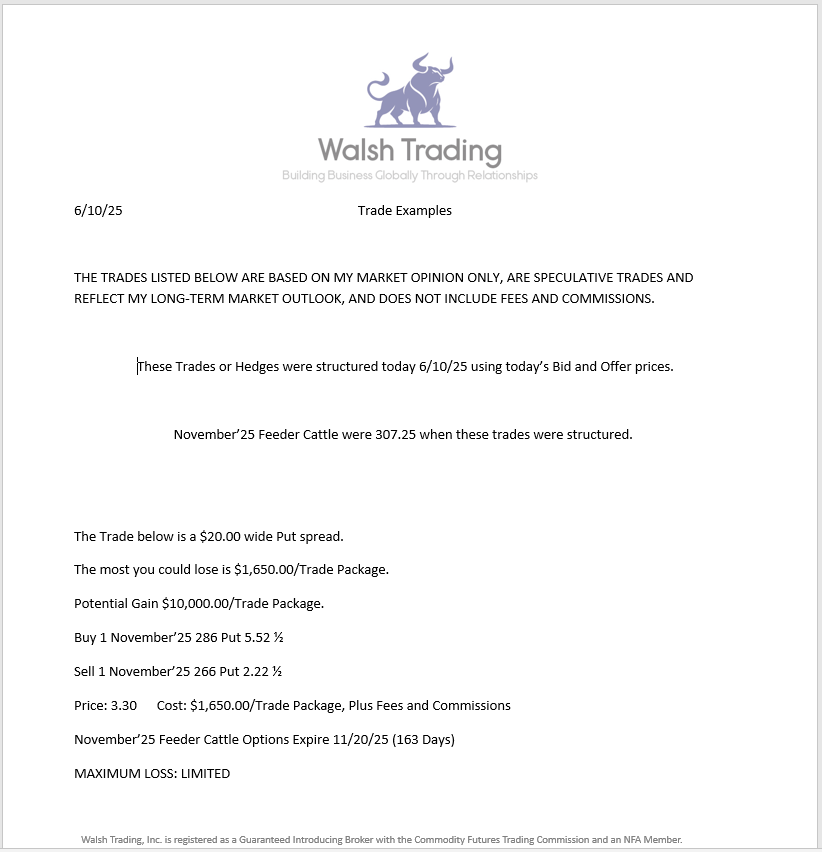

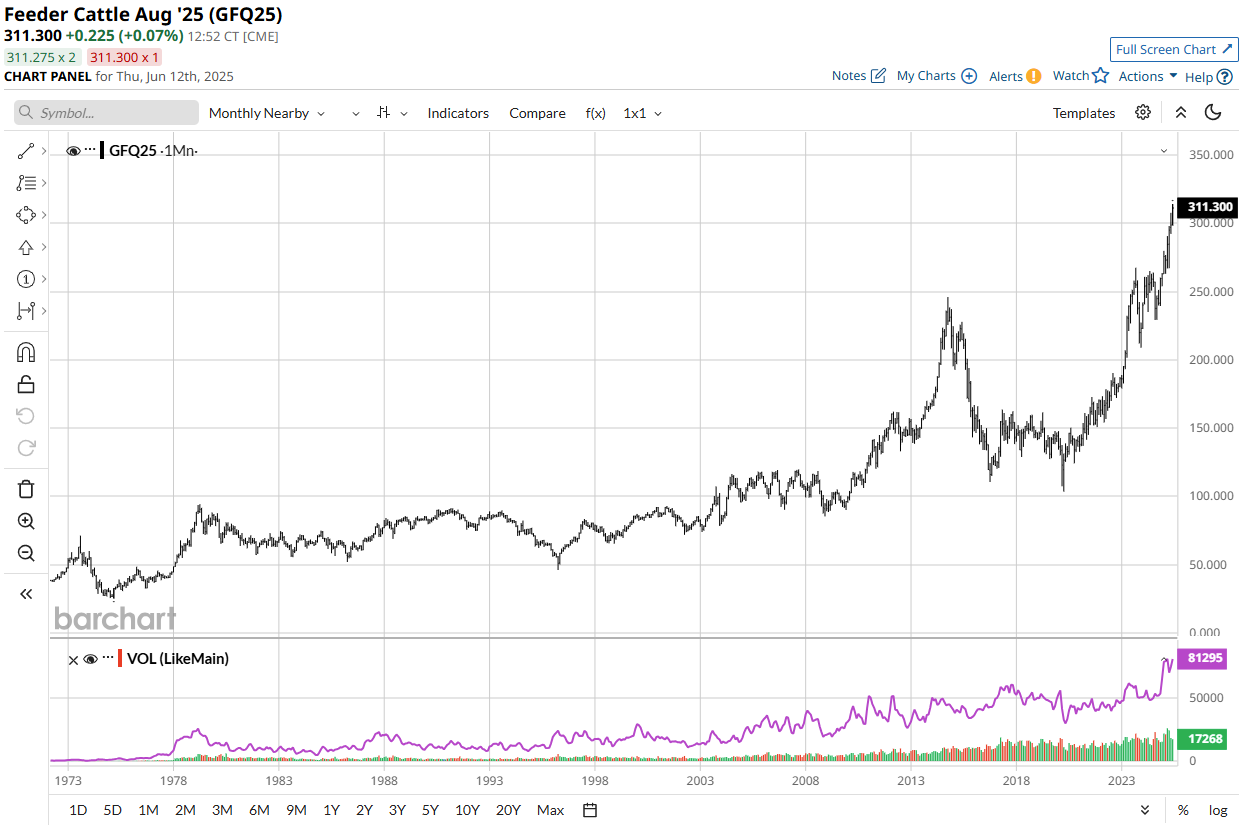

The Livestock Markets were all lower today, with the Cattle Markets leading the way down. The Fats dropped almost 5 bucks today. August'25 Live Cattle were 4.90 lower today and settled at 210.65. Today's high was 215.55 and the 1-month and contract high are 220.05. Today's low was 210.07 ½ and the 1-month low is 206.37 ½. Since 5/16 August'25 Live Cattle are 3.65 higher or almost 2%. The August'25 Feeders got wacked today. August'25 Feeder Cattle were 6.87 ½ lower today and settled at 303.35. Today's high was 309.35 and the 1-month and contract high are 314.20. Today's low was 302.75 and the 1-month low is 293.05. Since 5/16 August'25 Feeder Cattle are 6.90 higher or more than 2%. The Hogs followed the Cattle lower today. August'25 Hogs were 15 cents lower today and settled at 111.65. Today's high was 113.37 ½ and that is the new 1-month and contract high. Today's low was 111.55 and the 1-month low is 100.45. Since 5/16 August'25 Lean Hogs are 8.07 ½ higher or almost 8%. I still think we can see at least a 10% break in the market, and it could have begun today. If it does break 10% it would put the price of the August'25 Fats at 198.05. The 100-Day moving average sits just above at 200.50, but I still like the market about 10-dollar lower from there at 190, just below the 200-Day moving average of 191.05. The Feeders were lower across the board, with the August'25 contract month down almost 7-dollars. I thought the Feeders looked weak, and if the real selling starts it will get ugly. If the August'25 Feeders break 10% off the contract high, it would put the price at 282.78. The 100-Day moving average in the August'25 Feeders is 288.01, and I still like the market much lower than that, below the 50% retracement from the 52-week high/low of 275.16, and below the 200-Day moving average of 271.80. There are still 72 Days left before the August'25 Feeder Options Expire on 8/28/25. The November'25 Feeder Cattle Options Expire in 156 Days, on 11/20/25. The Hogs could not stay positive after making another new contract high today. The August'25 Hogs settled 25 cents off the lows and settled almost a dollar lower. I think there is a good chance for the Hogs to follow the Cattle Markets lower, if the Cattle break like I think they can. All of the major moving averages for the August'25 Hogs are more than 10-dollars lower around the 100.00 level. Iran has been bombed as I had anticipated last week, and it sent the Crude Oil Higher, Stock Markets lower, Grains Markets higher, and the Livestock lower. The real liquidation in the Cattle Markets has not begun yet, but it will be easy to recognize if it does occur. I have now spoken with several Ranchers who told me they are currently or will begin to retain heifers now. Sure, the Livestock Markets can maybe bounce back, but how many lives do you think the Cattle Markets have left? It looks like the US is about to get directly involved with Iran and if that does happen, it will add to the pressure the Funds are currently feeling. I would recommend selling into any rally in the Cattle Markets. The Options Markets are still extremely overpriced, and ripe with opportunity. The end of this month also marks the end of the second quarter of the year and could prompt the Funds to bank some profits with the current situation the world happens to be in now. The November'25 Feeder Cattle Trades from last week are still shown below, along with yesterday's Corn, Soybean, and Wheat Trades. I am ready when you are.

.

.

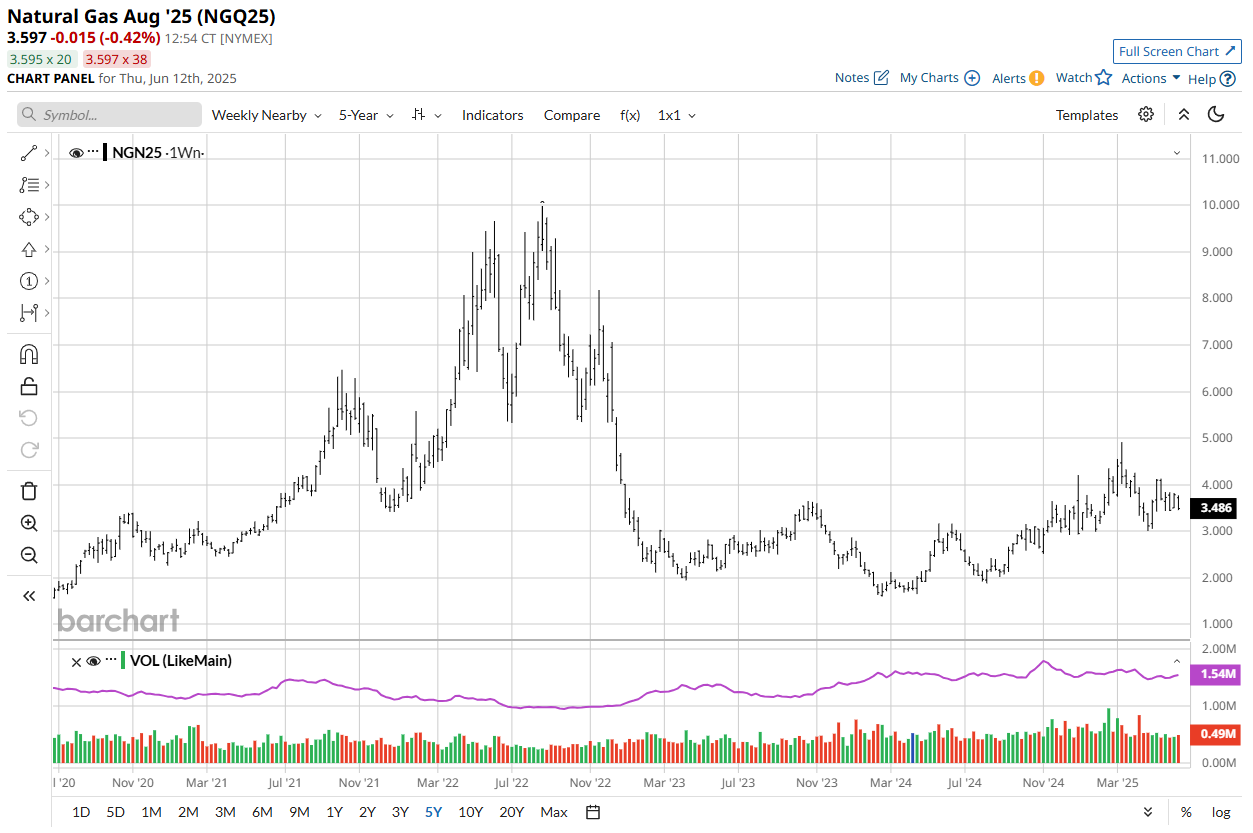

I see two big trades for this year. I still like the Soybean Oil and the Natural Gas. These markets will correct. Take advantage of any pullbacks in these markets. NOW IS THE TIME TO OPEN AN ACCOUNT. If you hit the link and provide your information, you will have a wealth of Market information at your fingertips. Sign Up Now

.

The need for a successful business to have a trading account is immeasurable. Look at the market movement in all markets over the last four trading days. Opening an account sometime in the future will not help you if you need access now. To be successful, and able to manage risk, you need to be proactive now and secure your access to markets in real time. You can be both Prepared and Patient at the same time.

.

.

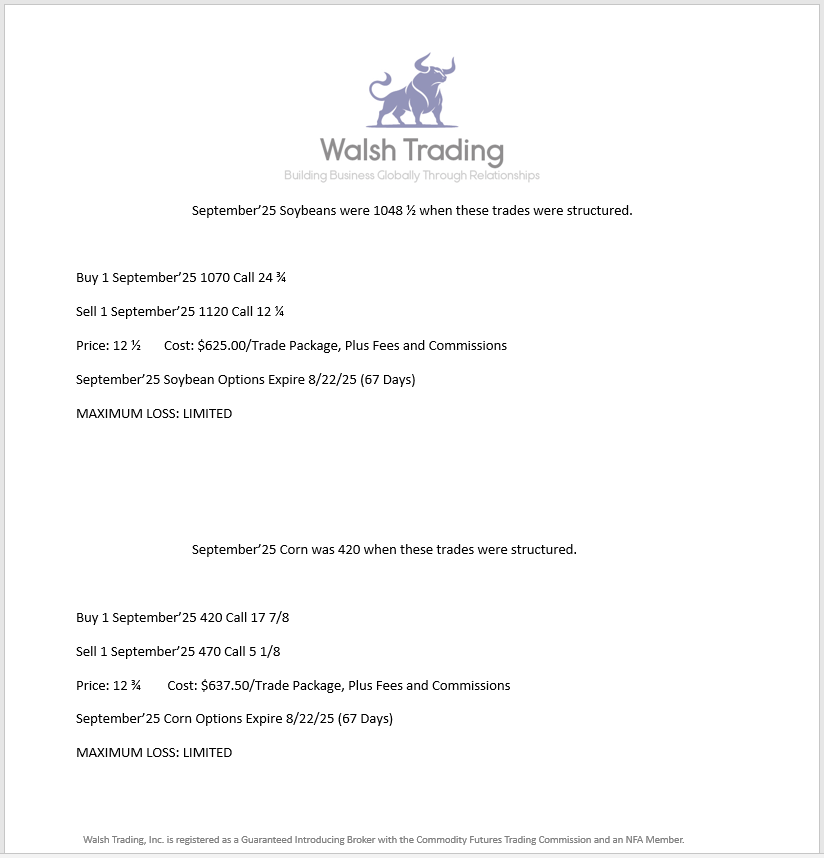

The Grain Markets were mixed again in the July'25 contract, but all higher in the August'25 and September'25 contract months today. The Beans had a solid gain today. August'25 Soybeans were 4 ½ cents higher today and settled at 1076 ¼. Today's high was 1077 ¼ and the 1-month high is 1079. Today's low was 1066 ½ and the 1-month low is 1026 ¼. Since 5/16 August'25 Soybeans are 30 cents higher or almost 3%. The Corn Market picked up a few cents today. September'25 Corn was 4 cents higher today and settled at 423 ¾. Today's high was 425 ¾ and the 1-month high is 444 ¼. Today's low was 420 and the 1-month and 52-week low is 418 ¾. Since 5/16 September'25 Corn is 2 ¼ cents higher or more than ½%. The Wheat Market has finally begun to trade higher and had a nice gain today. September'25 Wheat was 13 ¼ cents higher today and settled at 565 ½. Today's high was 568 ¼ and the 1-month high is 572 ½. Today's low was 552 ¾ and the 1-month low is 537 ¾. Since 5/16 September'25 Wheat is 26 ½ cents higher or almost 5%. The Funds are still close to record short in the Wheat market. The Wheat crop ratings have fallen, as the world seems to be getting more and more dangerous. Russia has been launching heavy attacks on Ukraine, the US looks to be more and more involved in Iran, and the Chinese could be taking another look at Taiwan as well. This is very Bullish for a Wheat Market that has the second smallest recorded planting since 1919. Now more than ever I feel we can see the Wheat shoot over 600 soon. The crop ratings for the beans were a little lower as well, and we are still waiting for trade deals to finalized. There is currently zero trade deal premium applied in the Grain Markets to date. There is still the big acreage Report at the end of the month on the 30th. We could see a drop in Corn acres with the amount of rain that fell in the South and Southeast Corn Belt. It could be the perfect storm the Grains have been waiting for. It looks like it is starting to get hot soon as well. All of the Grain Markets have their own reason to have substantial rallies over the next month or two. Just take a look at the Soybean Oil Market, and look how explosive the move higher was, and I feel that market has much more upside as well. The Funds are also still record short the Soybean Meal. We could see crazy price movement in all the Grains very soon. I still have two OTC Market Trades in December'25 Corn, and if you are a Producer and are interested in seeing them, just ask and I will email them to you. There are Grain and Livestock Trades below. Have a great night.

.

.

If you don't like the customer service or personal attention you are receiving at your new and very large brokerage house, you have options, and you don't have to stay there. I can have your new account open in 1-2 days. Call me anytime 312-957-8079 BALLEN@WALSHTRADING.COM Sign Up Now

.

.

Wheat Trade Below was sent out this morning.

.

.

.

.

.

.

NEW CORN, SOYBEAN, AND WHEAT CALL SPREADS FROM YESTERDAY BELOW.

.

.

.

.

.

.

.

November'25 Feeder Cattle Trades/Hedges From 6/10/25 Below

.

.

.

.

.

.

.

.

.

50-Year Cattle Chart Below. Whenever it Breaks it Will Be a Spectacular Collapse.

.

.

.

.

August'25 Natural Gas 5-Year Chart Below.

.

.

.

.

September'25 Soybean Oil 5-Year Chart Below.

.

.

.

.

USE THE QR CODE BELOW TO SIGNUP FOR TRADE ALERTS

.

.

.

.

If you would like to receive more information on the commodity markets, please use the link to join my email list Sign Up Now

.

.

Thank you to all of my Canadian Customers. If you live in Alberta or Ontario, you are able to open an account in the USA. Hopefully we can work with the Province of Saskatchewan, and all Canandian Provinces soon. Your ability to open an account in the US is blocked by your Provincial Governments, not by the United States.

.

.

Thank you to all of my old and new Customers. I appreciate your business. To those of you that are close to opening an account, please call me if you have any questions, and I look forward to working with you soon. To anyone thinking about opening a Hedge or Trading account, give me a call and we can talk about it.

.

.

Most Recent Walsh Gamma Trader Link Walsh Gamma Trader

.

.

.

.

.

.

.

.

Give me a call if you have any questions.

.

.

Bill Allen

Vice President

Pure Hedge Division

Direct: 312-957-8079

WALSH TRADING INC.

311 South Wacker Drive

Suite 540 Chicago, Illinois 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)