DTE Energy Company DTE has long-term capital expenditure plans to upgrade and extend its infrastructure to provide customers with more efficient services. The company is also making ongoing investments to expand its renewable generation portfolio.

However, this Zacks Rank #3 (Hold) company faces risks related to its poor financial position and challenges in the energy trading business.

Positive Drivers for DTE

DTE Energy maintains and improves the dependability of its electric and natural gas utility infrastructure through a robust capital investment program. The company intends to invest a total of $30 billion over the next five years, representing a 20% increase over its previous investment plan. With these expenditures, DTE Energy should be able to meet its long-term operating earnings growth rate of 6-8%.

DTE Energy is expanding its non-utility operations and increasing its earnings diversification. DTE Vantage intends to invest $1.5 to $2 billion in renewable energy and tailored energy solutions between 2025 and 2029. This strategic investment helps the company achieve its long-term sustainability goals.

DTE Energy is also increasing its clean energy generation portfolio. Its DTE Electric subsidiary has put 2,300 megawatts (MW) of renewable energy into operation as of March 31, 2025. Over the next 10 years, the company plans to invest $10 billion in the clean energy transition. By 2026, DTE Energy aims to add more than 1,000 MW of new clean energy projects.

Factors That May Hinder DTE Stock

DTE Energy’s cash and cash equivalents as of March 31, 2025 totaled $0.09 billion. As of the same date, its long-term debt was $21.77 billion, significantly higher than the cash balance. Its current debt of $1.46 billion also came in quite higher than its cash position. This implies that the company holds a weak financial position.

DTE Energy anticipates that the market circumstances for its Energy Trading business will continue to be challenging. According to the company, fluctuations in commodity prices and the unpredictability of the effects of regulatory changes and modifications to Regional Transmission Organization operating guidelines might affect this segment's profitability.

DTE Stock Price Movement

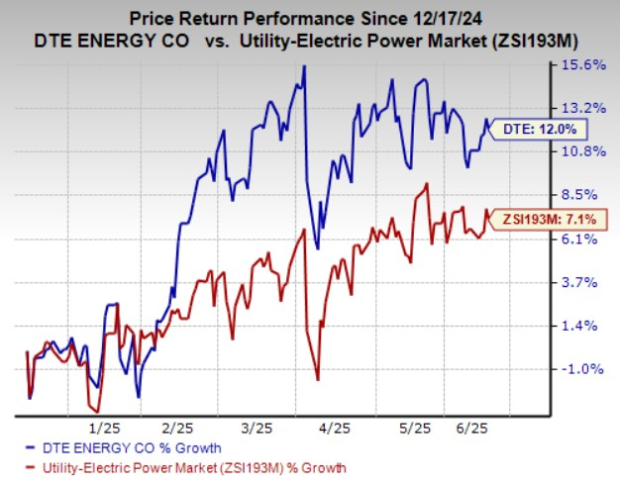

In the past six months, DTE shares have rallied 12% compared with the industry’s growth of 7.1%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the same industry are Fortis FTS, CenterPoint Energy CNP and NiSource Inc. NI, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

FTS’ long-term (three to five years) earnings growth rate is 5%. The Zacks Consensus Estimate for its 2025 earnings per share (EPS) stands at $2.47, which calls for a year-over-year jump of 3.4%.

CNP’s long-term earnings growth rate is 7.8%. The Zacks Consensus Estimate for its 2025 EPS stands at $1.75, which indicates a year-over-year rally of 8%.

NI’s long-term earnings growth rate is 7.9%. The Zacks Consensus Estimate for its 2025 EPS stands at $1.88, which implies a year-over-year jump of 7.4%.

Zacks' Research Chief Names "Stock Most Likely to Double"

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is a little-known satellite-based communications firm. Space is projected to become a trillion dollar industry, and this company's customer base is growing fast. Analysts have forecasted a major revenue breakout in 2025. Of course, all our elite picks aren't winners but this one could far surpass earlier Zacks' Stocks Set to Double like Hims & Hers Health, which shot up +209%.

Free: See Our Top Stock And 4 Runners UpWant the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NiSource, Inc (NI): Free Stock Analysis Report

DTE Energy Company (DTE): Free Stock Analysis Report

CenterPoint Energy, Inc. (CNP): Free Stock Analysis Report

Fortis (FTS): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

/Cisco%20Systems%2C%20Inc_%20HQ-by%20Sundry%20Photography%20via%20iStock.jpg)

/Pfizer%20Inc_%20logo%20sign-by%20JHVEPhoto%20via%20iStock.jpg)