Intuitive Surgical ISRG delivered strong top-line growth in the first quarter of 2025, with revenue rising 19% year over year to $2.25 billion, supported by a 17% increase in da Vinci procedures and a 58% increase in Ion procedures. However, despite these positive fundamentals, the company revised its full-year gross margin guidance downward to 65%–66.5% compared with approximately 69.1% in 2024. The adjustment reflects an estimated 170 basis point impact from higher U.S.–China tariffs, which are expected to increase costs on imported components. For a company historically known for margin consistency, the update introduces a level of near-term uncertainty.

The longer-term concern is not just the immediate margin drag, but the signaling effect it has on Intuitive Surgical’s cost structure resilience. The da Vinci system, especially the newly launched da Vinci 5, relies on a global supply chain of high-spec components and precision manufacturing. This makes the company more exposed to tariff volatility than peers with more geographically diversified operations. Management has not announced any supply chain reshoring plans, suggesting the gross margin impact could persist if trade tensions remain elevated.

However, Intuitive Surgical remains fundamentally well-positioned. Its recurring revenue base is stable and growing, procedure volumes continue to expand at a healthy pace, and the company maintains a strong balance sheet with approximately $9 billion in cash. This financial strength supports continued investment in innovation and infrastructure, giving Intuitive Surgical the tools to navigate near-term pressures and preserve its long-term competitive position.

Peers Update Amid Tariff Pressures

Per the fourth quarter fiscal 2025 earnings presentation, Medtronic MDT expects a $700–950 million gross impact from U.S.–China tariffs in fiscal 2026 but aims to offset $500–600 million, resulting in a net COGS hit of $200–$350 million. The impact will ramp through the year, with approximately 60% expected in the fiscal fourth quarter. While margin guidance remains unchanged, Medtronic’s broad global manufacturing base positions it to manage trade volatility more effectively than peers with more concentrated supply chains.

Per the first-quarter earnings call, Zimmer Biomet ZBH anticipates a $60–$80 million tariff-related drag on its 2025 operating profit, with most of the impact expected in the second half of the year. Despite this headwind, the company is actively implementing mitigation strategies including country-of-origin optimization, dual sourcing, transfer pricing adjustments, and selective cuts in discretionary spending, measures expected to confine near-term cost pressure to a manageable range.

ISRG’s Price Performance, Valuation and Estimates

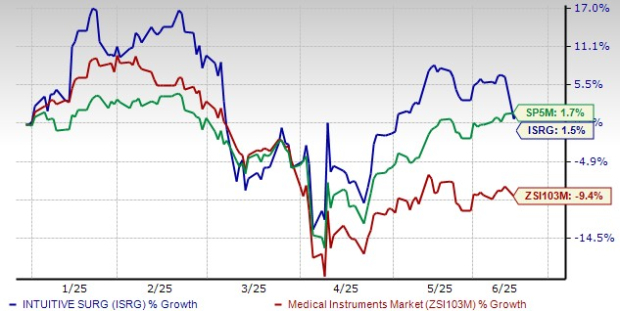

Shares of ISRG have gained 1.5% in the year-to-date period against the industry’s decline of 9.4%.

Image Source: Zacks Investment Research

From a valuation standpoint, Intuitive Surgical trades at a forward price-to-sales ratio of 18.43, above the industry average. But it is still lower than its five-year median of 19.23. ISRG carries a Value Score of D.

Image Source: Zacks Investment Research

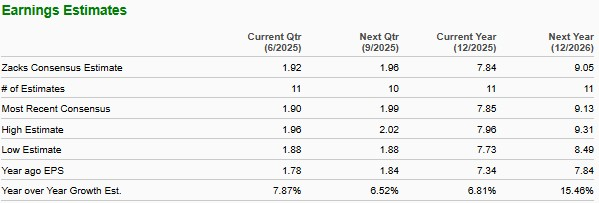

The Zacks Consensus Estimate for Intuitive Surgical’s 2025 earnings implies a 6.8% rise from the year-ago period’s level.

Image Source: Zacks Investment Research

The stock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks' Research Chief Names "Stock Most Likely to Double"

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is a little-known satellite-based communications firm. Space is projected to become a trillion dollar industry, and this company's customer base is growing fast. Analysts have forecasted a major revenue breakout in 2025. Of course, all our elite picks aren't winners but this one could far surpass earlier Zacks' Stocks Set to Double like Hims & Hers Health, which shot up +209%.

Free: See Our Top Stock And 4 Runners UpWant the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Medtronic PLC (MDT): Free Stock Analysis Report

Intuitive Surgical, Inc. (ISRG): Free Stock Analysis Report

Zimmer Biomet Holdings, Inc. (ZBH): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)

/Nvidia%20logo%20on%20phone%20screen%20with%20stock%20chart%20by%20xalien%20via%20Shutterstock.jpg)