Geopolitics, Trade Tensions, And Fed Expectations Reignite Volatility

Silver is both a precious metal and an industrial input, which makes it uniquely sensitive to monetary policy, geopolitical stress, and global manufacturing trends. It trades as a hedge against currency debasement and financial instability, but it also responds to shifts in industrial demand, particularly from electronics and solar manufacturing.

Recent price action has been driven by several concrete developments. In January 2026, escalating security incidents in the Middle East, including renewed maritime disruptions in the Red Sea and heightened rhetoric between Iran and Western powers, triggered a surge in safe haven flows across precious metals. At the same time, renewed tariff discussions between the United States and China raised concerns about global trade stability and supply chain resilience, further boosting demand for hard assets.

On the monetary front, softer than expected United States inflation data in February increased expectations that the Federal Reserve could begin cutting rates sooner than previously projected. Falling real yields and a weaker United States dollar added fuel to the rally. These developments collectively contributed to the parabolic move that carried silver to new all-time highs before the blow off top in late January.

What The Market Has Done

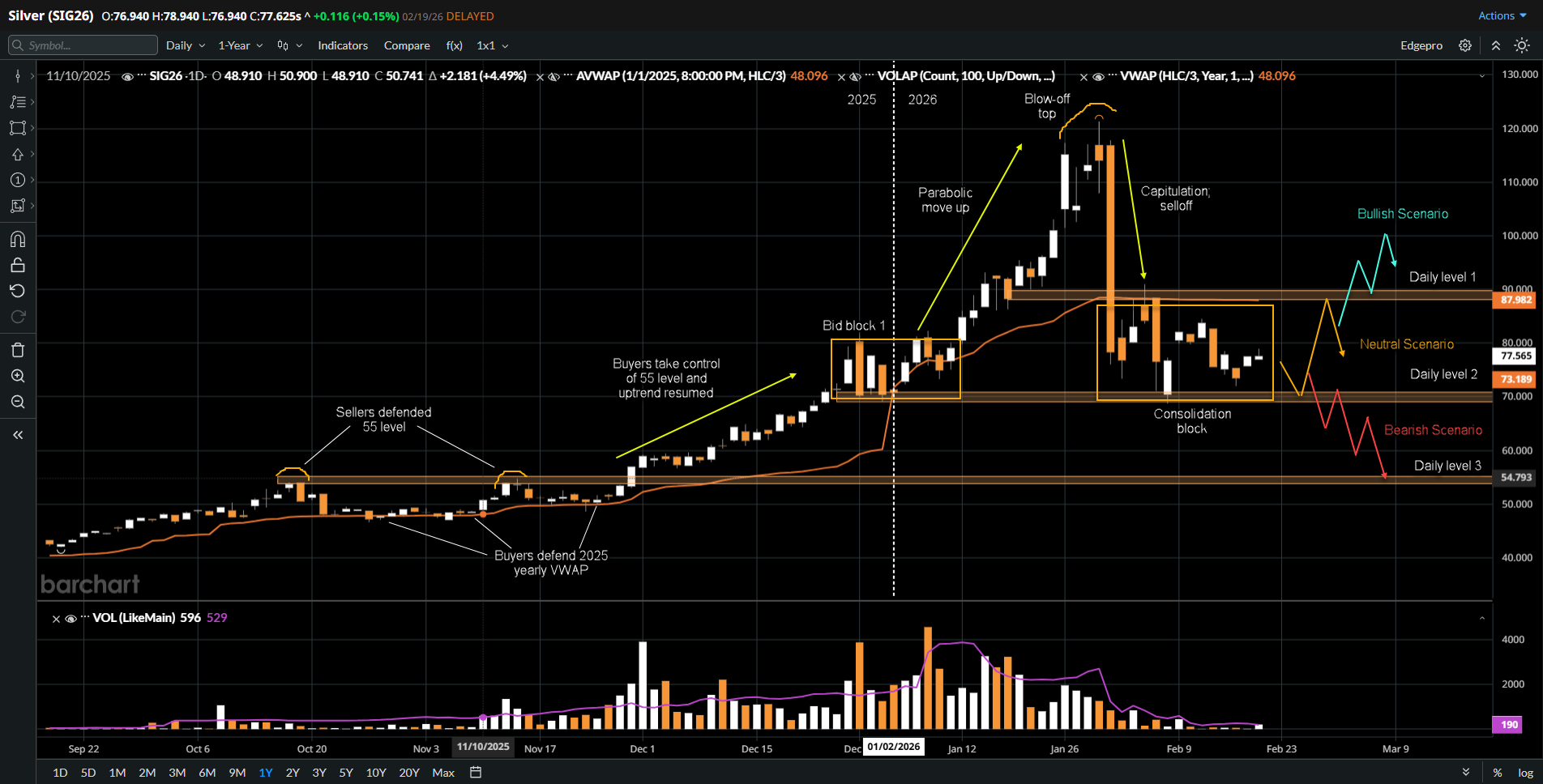

• The market has been in an uptrend since mid 2025, establishing higher highs and higher lows within a strong structural advance.

• In October, sellers responded at 55 while buyers stepped up and defended at the 2025 yearly VWAP, compressing prices higher and creating the conditions for an eventual breakout.

• The market broke above 55 in December 2025, with buyers taking control again and resuming the uptrend with strong upside momentum.

• From mid-December 2025 to mid-January 2026, the market consolidated and formed bid block 1, building a base before the next leg higher.

• On January 12, the market broke out above bid block 1 and resumed the uptrend. The subsequent move into all-time highs became parabolic as geopolitical escalation in the Middle East and renewed trade tensions triggered aggressive safe haven inflows.

• The market blew off the top at the end of January after the Federal Reserve signaled that rate cuts were not imminent despite softer inflation prints. At the same time, easing rhetoric around Middle East tensions reduced immediate fear premiums. This combination triggered a capitulation move down as late buyers liquidated.

• Price rotated back down to bid block 1, where buyers came back in to defend at the 70 level, identified as daily level 2.

• In the past two weeks, the market has auctioned two-way and balanced between the 90 and 70 levels to re-establish value after the prior excess.

What to Expect?

Key levels to watch are 90, identified as daily level 1, and 70, identified as daily level 2.

Neutral Scenario

• Without any further geopolitical or macro catalyst, expect the market to consolidate between the 70 and 90 levels to re-establish value and build a new base for the next directional move.

• Continued two-way auction within this range would reflect balance and uncertainty rather than trend continuation.

Bullish Scenario

• If buyers start to step up bids above the mid of the 70 to 90 range, it would serve as an early clue that a bullish scenario is in play.

• If the market breaks and accepts above 90 (daily level 1), expect a move toward 110 as momentum traders re-engage and longer-term participants add exposure.

• A renewed geopolitical flare up or a clear shift toward Federal Reserve rate cuts could provide the macro catalyst needed to fuel this extension.

Bearish Scenario

• If sellers start to step down offers below the mid of the consolidation block, it would increase the probability that a bearish scenario is developing.

• If the market breaks and accepts below 70 (daily level 2), expect a move down to 55, identified as daily level 3, where prior sellers previously responded.

• A sustained rebound in the United States dollar, stronger than expected inflation data, or de-escalation in geopolitical tensions could act as the catalyst for downside rotation.

Conclusion

Silver futures remain structurally bullish on a longer-term basis, but the market is currently in balance after an exhaustion move driven by specific geopolitical escalation and shifting Federal Reserve expectations. Technically, the 70 to 90 range defines value, and a break with acceptance outside of this area will likely determine the next directional leg. Traders should continue to monitor real yields, dollar strength, and geopolitical headlines for confirmation.

For traders looking to express views in metals markets such as silver, trading futures offers transparency, centralized pricing, and regulated execution that many exchange traded products cannot match. EdgeClear delivers direct access to global futures markets through trader focused platforms built for serious market participation. Learn more at edgeclear.com.

Disclaimer:

This article is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. The analysis presented reflects the author’s market observations and opinions at the time of writing and is not a recommendation to buy or sell any futures contract, security, or financial instrument. Futures trading involves significant risk and is not suitable for all market participants. Losses may exceed initial margin deposits, and market conditions can change rapidly.

Any scenarios, levels, or market expectations discussed are hypothetical in nature and are intended solely to illustrate potential market behavior. They do not represent actual trading results and should not be interpreted as guarantees of future performance. Past performance, market behavior, or historical price action are not indicative of future outcomes.

Readers are solely responsible for their own trading decisions and risk management. Always conduct independent research, consider your financial situation and risk tolerance, and consult with a qualified financial professional, if necessary, before engaging in futures or derivatives trading.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock.jpg)