Here are three stocks with buy rank and strong income characteristics for investors to consider today, May 15th:

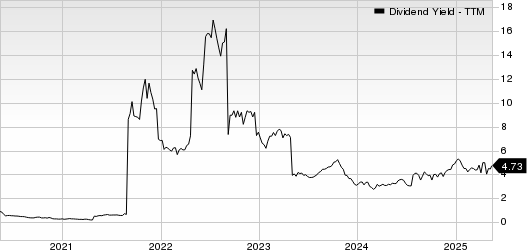

Usinas Siderurgicas de Minas Gerais USNZY: This company which is Latin America's biggest flat steel complex and it ranks among the world's largest twenty steel producers, has witnessed the Zacks Consensus Estimate for its current year earnings increasing 50% over the last 60 days.

This Zacks Rank #1 (Strong Buy) company has a dividend yield of 4.7%, compared with the industry average of 1.7%.

Bank of Hawaii BOH: This bank holding company which provides a broad array of products and services in Hawaii, Guam and other Pacific Islands, has witnessed the Zacks Consensus Estimate for its current year earnings increasing nearly 10% over the last 60 days.

This Zacks Rank #1 company has a dividend yield of 4%, compared with the industry average of 3.1%.

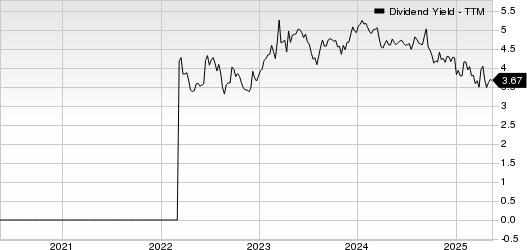

Epsilon Energy EPSN: This on-shore focused oil and natural gas company which engaged in the acquisition, development, gathering and production of oil and gas reserves, has witnessed the Zacks Consensus Estimate for its current year earnings increasing nearly 9.1% over the last 60 days.

This Zacks Rank #1 company has a dividend yield of 3.7%, compared with the industry average of 2.4%.

See the full list of top ranked stocks here.

Find more top income stocks with some of our great premium screens

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Usinas Siderurgicas de Minas Gerais SA (USNZY): Free Stock Analysis Report

Bank of Hawaii Corporation (BOH): Free Stock Analysis Report

Epsilon Energy Ltd. (EPSN): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

/Intel%20Corp_%20logo%20on%20mobile%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/Nvidia%20logo%20by%20Konstantin%20Savusia%20via%20Shutterstock.jpg)