/PayPal%20Holdings%20Inc%20logo%20on%20phone-%20by%20bizoo_n%20via%20iStock.jpg)

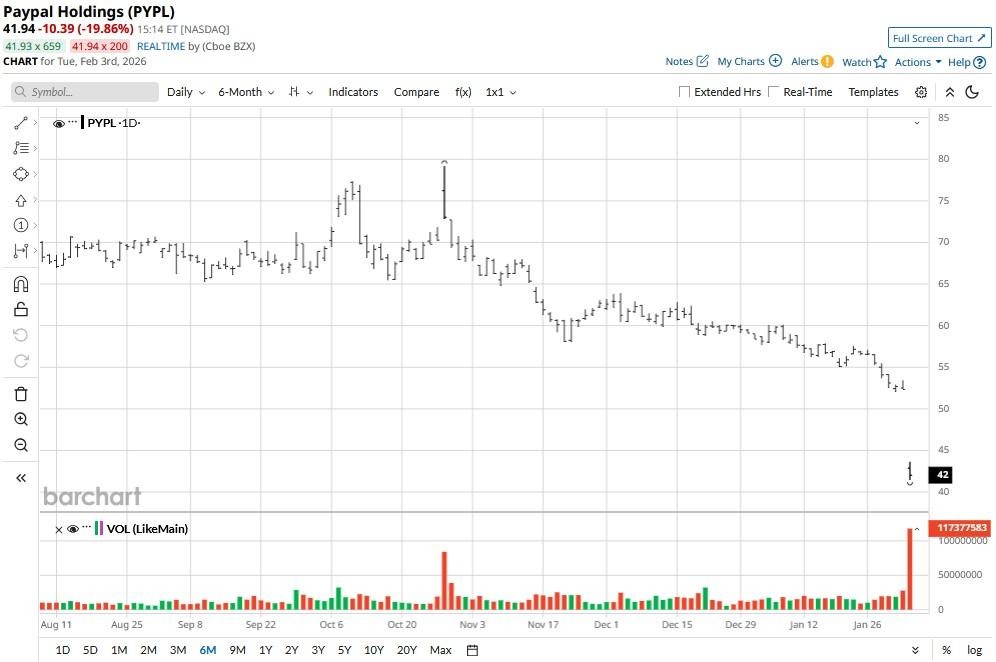

PayPal (PYPL) shares tanked nearly 20% on Feb. 3 after reporting disappointing Q4 earnings and offering guidance that suggests weakness will persist through the remainder of 2026.

Following the post-earnings plunge, PYPL’s standard relative strength index (14-day) sits at about 13, indicating extremely oversold conditions that may invite some buying interest in the near-term.

At the time of writing, PayPal stock is trading more than 30% below its year-to-date high.

Why PayPal Stock Looks More Like a Value Trap

While PYPL stock is historically cheap at about 9x forward earnings, caution is warranted, as the fintech firm faces several structural challenges in 2026.

For starters, the company sees its bottom line remaining roughly flat this year versus the consensus at about 8% growth, reinforcing that it’s losing share to the likes of Wise, Revolut, Stripe, Adyen, and Payoneer.

In fact, PayPal’s branded payment solutions saw total volume growth decelerate to just 1% in the fourth quarter.

From a technical perspective as well, the financial technology giant now sits decisively below its major moving averages (MAs), indicating bears are firmly in control across multiple timeframes.

Why New CEO Isn’t Bullish for PYPL Shares

On Tuesday, PayPal said Enrique Lores, the chief executive of HP (HPQ), will take the helm on Mar. 1, signaling a hard reset that may be more concerning than comforting.

By ousting Alex Chriss after only two years in the top role, the board has effectively admitted that the previous turnaround strategy failed to gain any real traction.

For shareholders, this means yet another transition year with all hopes of any meaningful recovery deferred until 2027.

In short, while PayPal shares may be a bargain for the patient, the opportunity cost sure is high. Agile competitors like Adyen and Stripe continue to innovate while PYPL remains stuck in a cycle of management reshuffles.

How Wall Street Recommends Playing PayPal Holdings

Heading into the earnings print, Wall Street firms rated PayPal a “Hold” with a mean target of $72.

However, following disappointing results and concerning guidance on Feb. 3, it’s reasonable to expect at least some analysts to downwardly revise their estimates for PYPL shares in the coming weeks.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/Ai%20chip%20by%20Quality%20Stock%20Arts%20via%20Shutterstock.jpg)

/Palantir%20by%20rblfmr%20via%20Shutterstock.jpg)