/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

Internet commerce and cloud computing giant Amazon (AMZN) will release its first quarter 2025 financial results on Thursday, May 1. AMZN stock has dropped over 23% from its 52-week high. Meanwhile, the company faces short-term challenges that could impact its share price.

Uncertainty surrounding new tariffs could squeeze Amazon’s profit margins, impact its e-commerce business, and limit AMZN stock’s upside potential. These external pressures come at a time when macroeconomic trends are also shifting, making it harder to predict how consumers and businesses will spend in the months ahead.

Investors should wait for further clarity on trade policy and management’s commentary on how the broader economic outlook will impact AMZN’s business. As for Q1, Wall Street expects Amazon to post strong bottom-line growth, reflecting the company’s continued strength in its core operations, including growth in the domestic and international markets and momentum in Amazon Web Services (AWS).

Amazon to Deliver Solid Growth in Q1

Analysts see continued momentum in Amazon’s financials. Wall Street expects AMZN to report earnings of $1.35 per share, reflecting a 19.5% increase year-over-year. This projection follows a pattern of consistent outperformance. For instance, AMZN has beaten earnings expectations in the last four consecutive quarters, most recently surpassing Q4 2024 estimates by 22.4%.

The company is guiding for net sales between $151 billion and $155.5 billion, reflecting year-over-year growth of 5.4% to 8.5%. While challenges remain, Amazon could continue to gain market share by leveraging its Prime member base and technological advancements.

Despite macroeconomic uncertainty, Amazon’s trifecta of affordability, selection, and fast delivery keeps customers loyal. The company continues solidifying its position in the e-commerce space, driven by an expanding product range, competitive pricing, and increasing convenience.

A significant development is the launch of “Haul” in the U.S., a new online hub for ultra-low-priced products. This initiative has already shown early traction, offering consumers a streamlined shopping experience for bargains. With affordability in focus, Amazon is poised to retain and grow its customer base, even amid economic uncertainty.

Besides focusing on value pricing, Amazon made significant gains in logistics, expanding its same-day delivery network by over 60% to more than 140 metro areas. Globally, over 9 billion orders were delivered same or next-day, reinforcing Prime’s value proposition and boosting user retention.

The company’s focus on efficiency will support its margins amid macroeconomic uncertainty. The company has streamlined its fulfillment network and optimized last-mile logistics, reducing its global cost to serve per unit for the second year in a row. Investments in automation, robotics, and inventory management are expected to yield further cost savings and margin expansion.

Advertising is another powerful revenue stream for the company. Amazon’s ad revenue soared to $17.3 billion in Q4 2024, translating to an annual run rate of $69 billion. Sponsored products lead the way, but Amazon is also unlocking new ad opportunities via its Prime video platform, further diversifying its revenue base.

Meanwhile, AWS, the company’s cloud computing arm, posted 19% year-over-year growth in Q4, reaching a $115 billion annualized run rate. As more enterprises modernize their IT infrastructure, AWS remains a key player. With innovations like custom AI chips (Amazon Trainium), advanced model services (SageMaker, Bedrock), and generative AI tools, AWS is poised to capture increasing demand in the AI era.

In summary, Amazon’s multi-pronged growth strategy, anchored by retail, cloud, and advertising, positions it well to deliver steady growth.

So, Is Amazon Stock a Buy?

In the near term, caution may be warranted. Potential tariffs and economic uncertainty could weigh on performance, and investors should wait for May 1 earnings to gain more visibility. But for long-term investors, Amazon’s diversified business model, fast delivery, wide offerings, cost-saving initiatives, and investment in AI, automation, and technology make it an attractive bet.

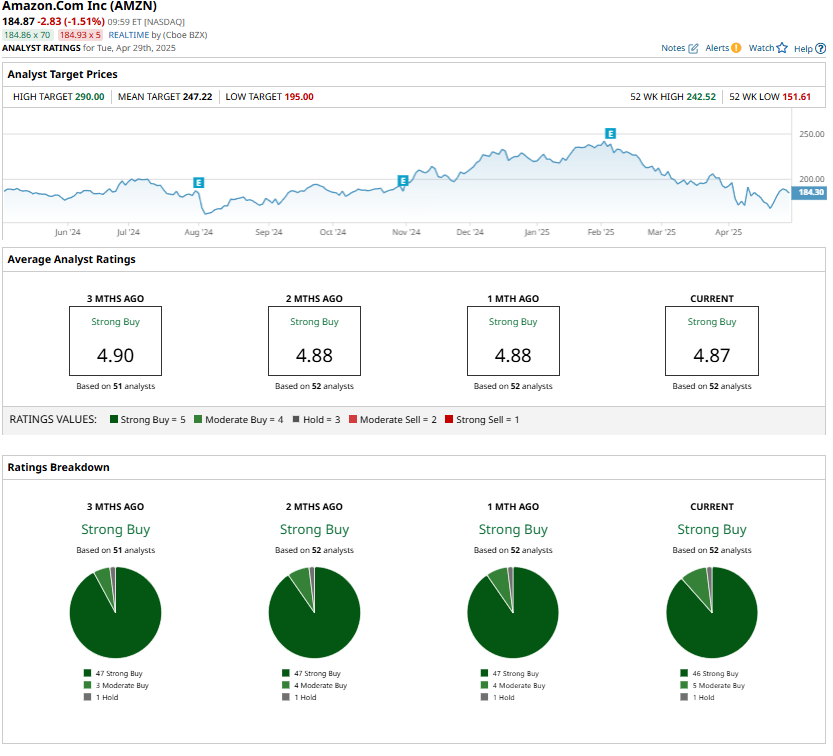

Wall Street agrees. The consensus rating on AMZN is a “Strong Buy,” with analysts setting an average price target of $247.22. That implies roughly 33% upside from current levels.

On the date of publication, Sneha Nahata did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Cybersecurity%20by%20AIBooth%20via%20Shutterstock.jpg)