This market environment may be one of the most uncertain I’ve experienced in my career. With global trade policies shifting by the day, little clarity from the US administration, and rising tensions between the president and the Federal Reserve, it’s no surprise that stocks have been reeling.

Yet amid the chaos, one sector has stood out for its resilience—insurance. While nearly all sectors have cratered, a range of international and domestic insurers have surged, with several notching fresh record highs in recent weeks. What’s fueling this quiet rally? Strong earnings momentum, high interest rates, and defensive positioning in an uncertain macro backdrop.

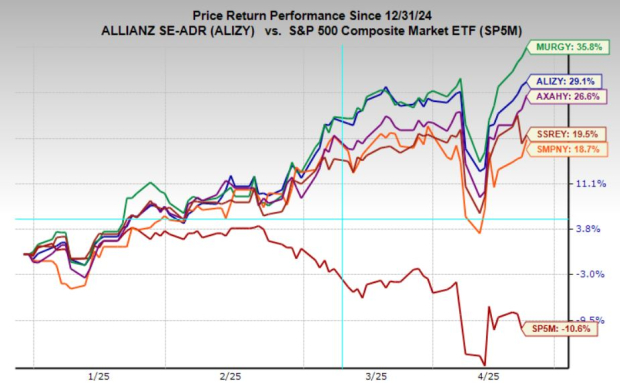

Among others, Allianz (ALIZY), Sompo Holdings (SMPNY), Munich Re (MURGY) and Swiss Re (SSREY) stand out as some of the most compelling, with powerful price momentum and top Zacks Ranks.

Image Source: Zacks Investment Research

Higher Yields = Higher Profits for Insurance Stocks

The insurance business model relies heavily on the investment income earned from customer premiums—also known as “float.” In a high-rate environment like today’s, that float becomes substantially more valuable. With yields that remain elevated and not expected to fall sharply anytime soon, insurers are enjoying strong tailwinds from their bond portfolios. These expectations of higher yields were further reinforced when Fed Chair Jerome Powell gave a hawkish speech, noting that the central bank is reactionary and is in no position currently to cut rates rapidly.

The insurance industry also enjoys business models that tends to be stable, highly regulated, and not particularly sensitive to economic cycles. In other words, they’re built for exactly the kind of murky environment we’re in now as illustrated by the massive capital rotation into these stocks.

Companies like Allianz, Sompo Holdings,Munich Re and Swiss Re offer exposure to diversified global operations, spanning life, property & casualty, reinsurance, health, and specialty insurance. These firms provide steady cash flow and benefit from being systemically important players in their home markets. Most notably, their stock prices are surging as the rest of the market can barely avoid selling day after day.

Insurance Stocks Boast Top Zacks Ranks

What makes this group especially interesting now is the earnings momentum confirmed by the Zacks Rank. A surprising number of insurance stocks currently hold a Zacks Rank #1 (Strong Buy), reflecting upward revisions to earnings estimates and growing analyst confidence.

Allianz, Swiss Re, Munich Re, and Sompo Holdings all have a powerful combination steady earnings growth forecasts, strong price momentum, and modest valuations, with none trading above 13x forward earnings. Each name also pays a reliable dividend, making them attractive total return plays in a sector that’s quietly leading the market higher.

Image Source: Zacks Investment Research

Should Investors Buy Shares in MURGY, ALIZY, SSREY and SMPNY?

In a market gripped by policy uncertainty and macro turbulence, insurance stocks have emerged as unlikely leaders. Buoyed by higher interest rates, stable earnings, and defensive business models, they’re delivering both performance and consistency.

While insurance may not be the flashiest corner of the market, it’s proving once again that in times of uncertainty, boring can be beautiful.

Only $1 to See All Zacks' Buys and Sells

We're not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not - they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 256 positions with double- and triple-digit gains in 2024 alone.

See Stocks Now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Swiss Re Ltd. (SSREY): Free Stock Analysis Report

M?nchener R?ckversicherungs-Gesellschaft (MURGY): Free Stock Analysis Report

Sompo Holdings, Inc. Unsponsored ADR (SMPNY): Free Stock Analysis Report

Allianz SE (ALIZY): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).