Here are three stocks with buy rank and strong momentum characteristics for investors to consider today, April 4:

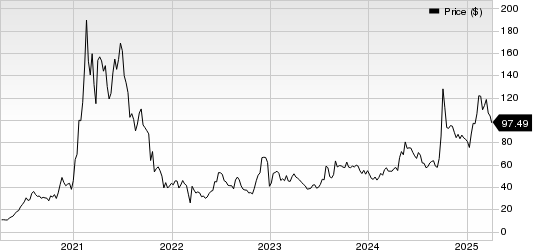

Futu Holdings Limited FUTU: This digital securities brokerage company has a Zacks Rank #1 and witnessed the Zacks Consensus Estimate for its current year earnings increasing 11.6% over the last 60 days.

Futu Holdings Limited's shares gained 20.7% over the last three months compared with the S&P 500’s decline of 5.2%. The company possesses a Momentum Score of A.

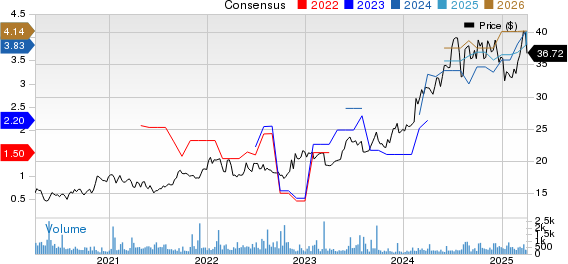

Tokio Marine Holdings, Inc. TKOMY: This insurance and financial services company has a Zacks Rank #1 and witnessed the Zacks Consensus Estimate for its current year earnings increasing 17.7% over the last 60 days.

Tokio Marine Holdings' shares gained 1.9% over the last three months compared with the S&P 500’s decline of 5.2%. The company possesses a Momentum Score of A.

Société Générale Société anonyme SCGLY: This banking and financial services provider has a Zacks Rank #1 and witnessed the Zacks Consensus Estimate for its current year earnings increasing 7% over the last 60 days.

Société Générale Société anonyme's shares gained 48.9% over the last one month compared with the S&P 500’s decline of 5.2%. The company possesses a Momentum Score of B.

See the full list of top ranked stocks here

Learn more about the Momentum score and how it is calculated here.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers "Most Likely for Early Price Pops."

Since 1988, the full list has beaten the market more than 2X over with an average gain of +23.9% per year. So be sure to give these hand picked 7 your immediate attention.

See them now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Tokio Marine Holdings Inc. (TKOMY): Free Stock Analysis Report

Societe Generale Group (SCGLY): Free Stock Analysis Report

Futu Holdings Limited Sponsored ADR (FUTU): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)

/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock.jpg)

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)