Here are three stocks with buy rank and strong value characteristics for investors to consider today, April 2nd:

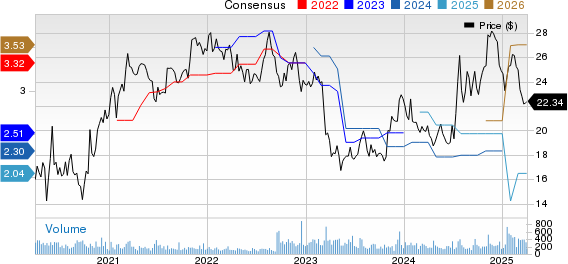

CNB Financial Corporation CCNE: This bank holding company for CNB Bank carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 18.6% over the last 60 days.

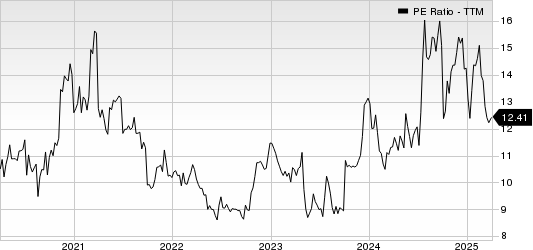

CNB Financial Corporation has a price-to-earnings ratio (P/E) of 10.91, compared with 20.29 for the S&P 500. The company possesses a Value Score of A.

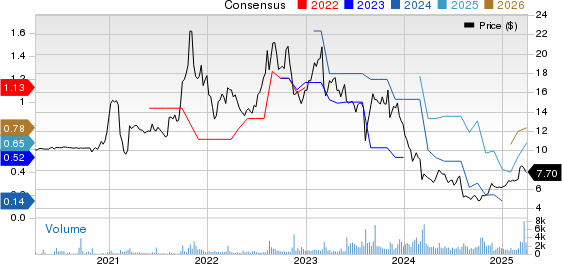

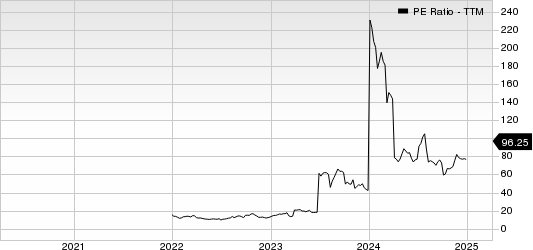

AerSale Corporation ASLE: This company that provides aftermarket commercial aircraft, engines, and parts carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 62.5% over the last 60 days.

AerSale has a price-to-earnings ratio (P/E) of 11.52, compared with 34.50 for the industry. The company possesses a Value Score of B.

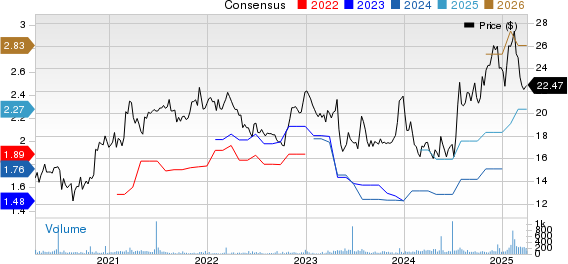

First Community Corporation FCCO: This bank holding company for First Community Bank carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 6.1% over the last 60 days.

First Community has a price-to-earnings ratio (P/E) of 9.92, compared with 11.10 for the industry. The company possesses a Value Score of B.

See the full list of top ranked stocks here.

Learn more about the Value score and how it is calculated here.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CNB Financial Corporation (CCNE): Free Stock Analysis Report

First Community Corporation (FCCO): Free Stock Analysis Report

AerSale Corporation (ASLE): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

/AI%20(artificial%20intelligence)/AI%20engineer%20working%20on%20laptop%20by%20ART%20STOCK%20CREATIVE%20via%20Shutterstock.jpg)

/Nike%2C%20Inc_%20swish%20by-%20Tartezy%20via%20Shutterstock.jpg)