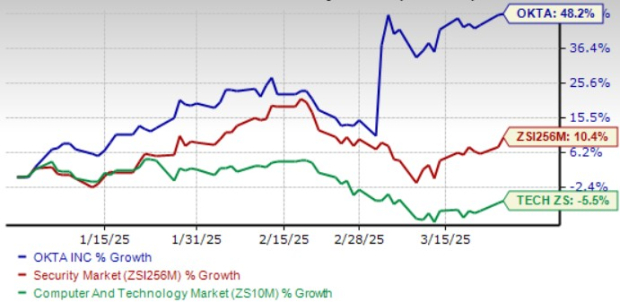

Okta OKTA shares have appreciated 48.2% year to date (YTD), courtesy of its portfolio strength. More than 20% of fourth-quarter fiscal 2025 bookings were from new products, including Okta Identity Governance, Privileged Access, Device Access, Fine Grain Authorization, Identity Security Posture Management and Identity Threat Protection with Okta AI.

OKTA’s innovative portfolio is helping the company win clients, driving top-line growth. It exited fourth-quarter fiscal 2025 with 19,650 customers and $4.215 billion in remaining performance obligations, reflecting strong growth prospects for subscription revenues. Customers with more than $100 thousand in Annual Contract Value (ACV) increased 7% year over year to 4,800.

The Total Contract Value (TCV) of the top 25 deals in the fourth-quarter of fiscal 2025 was more than $320 million. Okta added 25 customers with $1 million-plus ACV in the reported quarter.

Okta Stock's Performance

Image Source: Zacks Investment Research

OKTA Benefits From Strong Demand for Identity Solutions

Okta’s offerings include Okta AI — a suite of AI-powered capabilities embedded across several products — which empowers organizations to harness AI to build better experiences and protect against cyberattacks. Okta Platform and Auth0 Platform are compatible with public clouds, on-premises infrastructures and hybrid clouds.

Customers use Okta Workforce Identity to manage and secure their employees, contractors and partners. Through the Customer Identity solution, Okta customers enable, manage and secure the identities of their customers. Identity Governance, Privileged Access, Device Access, Identity Security Posture Management, and Identity Threat Protection with Okta AI are other key solutions in the Okta platform. The Auth0 platform comprises of the Auth0 Platform, Fine Grain Authorization, Highly Regulated Identity and Self Service.

Okta Identity Governance has been gaining traction with more than 1300 customers and $100 million in ACV.

Okta’s strong portfolio is helping it win market share in the cybersecurity domain against Microsoft MSFT, International Business Machines IBM and CyberArk CYBR. It is also winning accolades.

Gartner has placed OKTA higher than Microsoft and CyberArk in all use cases on the Gartner Critical Capabilities for Access Management. OKTA is the only vendor recognized as a Gartner Peer Insights Customers’ Choice for Access Management six times in a row.

Rich Partner Base Aids Okta’s Prospects

Okta is benefiting from a rich partner base that includes the likes of Amazon Web Services (AWS), CrowdStrike, Google, LexisNexis Risk Solutions, Microsoft, Netskope, Palo Alto Networks, Plaid, Proofpoint, Salesforce, ServiceNow, VMware, Workday, Yubico and Zscaler. The company has over 7,000 integrations with cloud, mobile and web applications and IT infrastructure providers as of Jan. 31, 2025.

In the fourth quarter of fiscal 2025, OKTA surpassed over $1 billion in aggregate TCV through its partnership with AWS. In fiscal 2025, revenues from the AWS marketplace jumped more than 80%.

Okta’s Q1 & FY26 View Strong

For first-quarter fiscal 2026, Okta expects revenues between $678 million and $680 million, indicating 10% year-over-year growth. Non-GAAP operating margin is expected to be 25%. It anticipates non-GAAP earnings between 76 cents and 77 cents per share.

For fiscal 2026, OKTA expects revenues between $2.85 billion and $2.86 billion, indicating 9-10% growth from the figure reported in fiscal 2025. Non-GAAP operating margin is expected to be 25%. Okta expects fiscal 2026 non-GAAP earnings between $3.15 and $3.20 per share.

The free cash flow margin is expected to be 26% for fiscal 2026.

OKTA’s Earnings Estimate Revision Shows Upward Trend

For fiscal 2026, the Zacks Consensus Estimate for Okta’s earnings has increased by 8.6% to $3.16 per share over the past 30 days. The earnings figure suggests 12.46% growth over the figure reported in fiscal 2025.

For first-quarter fiscal 2026, the Zacks Consensus Estimate for OKTA’s earnings has increased 10.1% to 76 cents per share over the past 30 days. The earnings figure suggests 16.92% year-over-year growth.

Okta’s earnings beat the Zacks Consensus Estimate in all the trailing four quarters, the average surprise being 15.7%.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Here is Why Okta Stock is Buy

Okta is an attractive bet in the near term, given its strong growth prospect and large addressable market, which justify a premium valuation, as suggested by the Value Score of F.

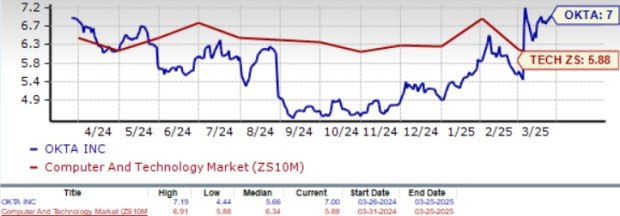

In terms of forward Price/Sales, OKTA is trading 7X compared with the broader sector’s 5.88X, suggesting a premium valuation.

Price/Sales F12M

Image Source: Zacks Investment Research

The stock is currently trading above the 50-day and 200-day moving averages, indicating a bullish trend.

OKTA Stock Trades Above 50-Day & 200-Day SMAs

Image Source: Zacks Investment Research

Okta currently has a Zacks Rank #2 (Buy) and a Growth Score of A, a favorable combination that offers a strong investment opportunity, per the Zacks Proprietary methodology. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Names #1 Semiconductor Stock

It's only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microsoft Corporation (MSFT): Free Stock Analysis Report

International Business Machines Corporation (IBM): Free Stock Analysis Report

CyberArk Software Ltd. (CYBR): Free Stock Analysis Report

Okta, Inc. (OKTA): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).