Shares of Gilead Sciences, Inc. GILD were down 2.47% after the Wall Street Journal reported that The Health and Human Services Department is evaluating plans to slash the federal government funding for HIV prevention in the country.

GILD boasts a market-leading portfolio of HIV treatments both for treating the disease and prevention. The company has two drugs for HIV prevention in its portfolio, Descovy and Truvada. Shares of another HIV drugmaker, GSK plc GSK, were also down 2.08% on the news.

However, the direct impact of this reduction under the Trump administration on these drugmakers is likely to be minimal. The reduction in funding would primarily target a Centers for Disease Control and Prevention division that helps fund local health departments and nonprofits.

The report of a cut in the federal government funding for HIV prevention adds to investor anxiety about broader potential reductions to Medicaid, which could impact access to HIV drugs.

Gilead Sciences is looking to get another drug approved for HIV prevention – lenacapavir. The optimism regarding lenacapavir’s approval has boosted investor sentiment of late.

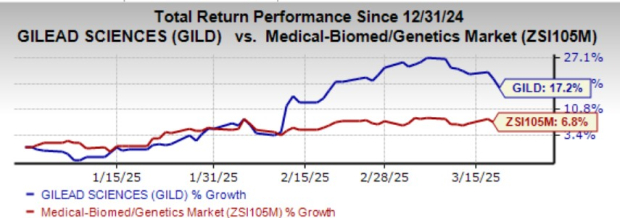

GILD’s shares have surged 17.2% year to date compared with the industry’s growth of 6.8%.

Image Source: Zacks Investment Research

GILD – A Major Player in the HIV Prevention Space

At present, there are two FDA-approved daily oral medications for pre-exposure prophylaxis (PrEP) — Truvada and Descovy.

Descovy (FTC 200 mg/TAF 25 mg) for PrEP has witnessed good uptake. It maintains more than 40% market share in the PrEP market in the United States. Descovy for PrEP is indicated in at-risk adults and adolescents (≥35 kg) to reduce the risk of sexually acquired HIV-1 infection, excluding individuals at risk from receptive vaginal sex.

Truvada is a two-drug combination of emtricitabine and tenofovir disoproxil fumarate, approved for the treatment of HIV-1 infection and PrEP.

The company is also looking to get FDA approval for lenacapavir for HIV prevention. Lenacapavir demonstrated 100% efficacy for the investigational use of HIV prevention in cisgender women. Data reinforce that twice-yearly lenacapavir could be a highly effective and potentially game-changing HIV prevention option.

Gilead Sciences’ application for the approval of lenacapavir is currently under review in both the United States and the European Union.

The FDA has granted Priority Review to GILD’s NDA submissions for lenacapavir and set a target action date of June 19, 2025.

The strong results from the PURPOSE study increase the probability of lenacapavir’s approval, which should further solidify GILD’s HIV franchise. Lenacapavir has a competitive advantage as it needs to be taken only twice yearly, unlike daily oral pills, and addresses a broad population.

Approval of better HIV treatments should strengthen the HIV franchise in the wake of increasing competition from GSK.

A long-acting injectable form of PrEP was also approved by the FDA. In 2021, the regulatory body approved ViiV Healthcare’s Apretude (cabotegravir extended-release injectable suspension) for use in at-risk adults and adolescents weighing at least 35 kilograms for PrEP to reduce the risk of sexually acquired HIV.

ViiV Healthcare is a global specialist HIV company, majorly owned by GSK with Pfizer PFE and Shionogi as shareholders.

The company was formed by GSK and Pfizer in 2009.

Apretude is given first as two initiation injections, administered a month apart and then every two months. Patients in need can either start their treatment with Apretude or take oral cabotegravir (Vocabria) for four weeks to understand how well they can tolerate the drug.

GSK posted 13% growth in HIV sales in 2024, driven by strong patient demand for long-acting injectable medicines (Cabenuva and Apretude) and Dovato.

GILD’s Zacks Rank

Gilead Sciences currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Names #1 Semiconductor Stock

It's only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

GSK PLC Sponsored ADR (GSK): Free Stock Analysis Report

Pfizer Inc. (PFE): Free Stock Analysis Report

Gilead Sciences, Inc. (GILD): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

/Pfizer%20Inc_%20logo%20sign-by%20JHVEPhoto%20via%20iStock.jpg)