/A%20Klarna%20advertisement%20in%20a%20store%20window%20by%20Tada%20Images%20via%20Shutterstock.jpg)

Klarna (KLAR) shares closed roughly 26% down on Thursday even though the buy now, pay later (BNPL) firm posted its first billion-dollar quarter. Investors bailed on KLAR mostly because its profitability metrics deteriorated in the fourth quarter and the management offered disappointing guidance for Q1.

Following the post-earnings decline, Klarna’s relative strength index (14-day) sits at about 18.39, indicating extremely oversold conditions that often trigger a relief rally.

However, there was hardly enough in KLAR’s earnings release to warrant buying at current levels. Year-to-date, Klarna stock is down more than 50% at the time of writing.

Here’s Why You Should Buy the Dip in Klarna Stock

Despite strong revenue, Klarna lost $26 million in its fiscal Q4 as credit loss provisions climbed more than 6% sequentially to about $250 million, reflecting an inherent credit risk in the BNPL sector.

And while gross merchandise volume came in up 32% on a year-over-year basis, the firm’s management confirmed it will decelerate later this year due to tough comparisons.

This transition from explosive growth to more normalized expansion signals a maturing company that’s likely to see slower growth as it continues to scale through the remainder of 2026.

Caution is warranted in buying the dip in KLAR stock because the fintech’s revenue per active consumer remained flat at $30 in the fourth quarter, indicating spending per user has plateaued.

KLAR Shares Remain Expensive to Own in 2026

Klarna shares remain unattractive as the company’s Q4 adjusted operating profit printed nearly $20 million below Street estimates, with management seeing no signs of improvement in the near term.

In the current quarter, it expects that metric to come in at $35 million tops, well below the $67 million that analysts had forecasted.

Moreover, while KLAR’s partnerships with major payment processors like Worldpay, JPMorgan , and Stripe signal longer-term growth potential, its executives cautioned merchant activation could take time, delaying top-line benefits from these strategic alliances.

All in all, the fintech firm’s Q4 release suggests it’s an expensive stock to own at about 38x forward earnings.

How Wall Street May Respond to Klarna’s Q4 Earnings

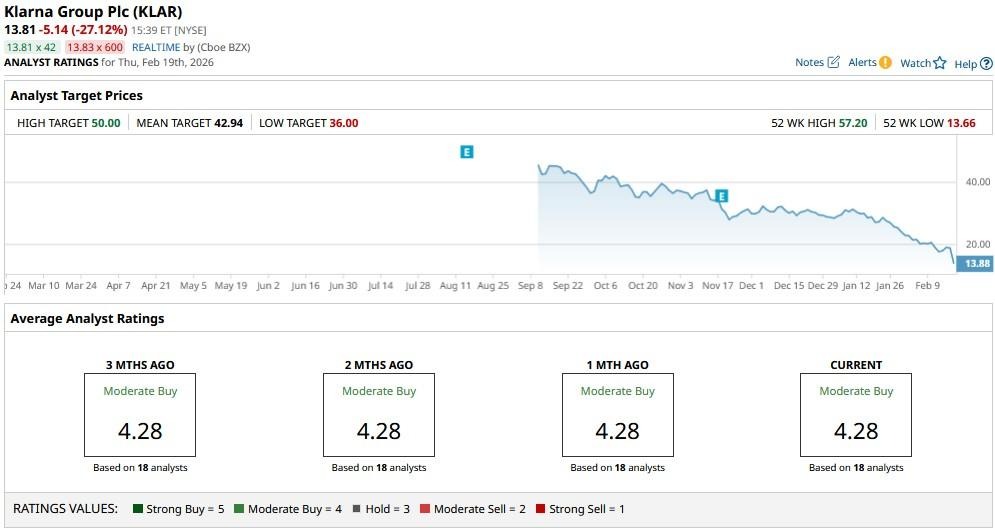

Heading into Thursday, Wall Street had a consensus “Moderate Buy” rating on Klarna with a mean target of nearly $43.

However, it’s reasonable to assume that some analysts will downwardly revise estimates for KLAR shares following the company’s disappointing Q4 release.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

/Apple%20products%20arranged%20on%20desk%20by%20tashka2000%20via%20iStock.jpg)