Hercules Capital, Inc. HTGC announced that Morningstar DBRS (“DBRS”) has upgraded its investment grade credit and corporate ratings to BBB (high) from BBB. Further, the trend revision has been revised from Positive to Stable.

Rationale Behind HTGC’s Rating Upgrade

The upgraded ratings with a stable outlook indicate Hercules Capital’s sustained solid operating performance in 2024 and a roughly 14% rise in assets under management on a year-over-year basis.

Given the strong operating performance, the company strengthened its position as the leading non-bank dedicated lender to the venture capital (VC) ecosystem with a well-established franchise.

Additionally, HTGC’s asset-level credit performance, diversified funding profile and conservative balance sheet leverage support the credit rating upgrade.

The stable trend anticipates that Hercules Capital will continue to drive growth from its franchise-leading scale despite the uncertainty of the impact of evolving U.S. government policies on the VC market.

Seth Meyer, chief financial officer of Hercules Capital, stated, “This upgraded rating reflects the long-term strong operating performance of our scaled and well-diversified industry-leading franchise. Our differentiated venture and growth stage lending model and commitment to disciplined underwriting will continue to serve in the best interest of our shareholders.”

Hercules Capital’s Price Performance & Zacks Rank

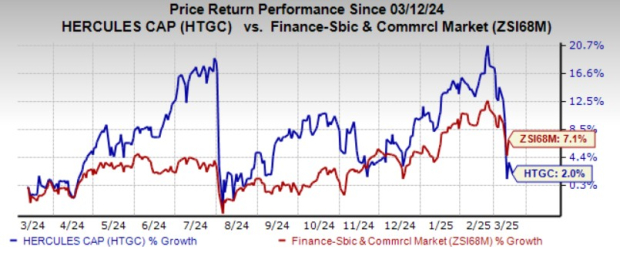

Shares of Hercules Capital have risen 2% compared with the industry’s 7.1% growth in the past year.

Image Source: Zacks Investment Research

HTGC currently carries a Zacks Rank #3 (Hold).

HTGC Peers Worth Considering

Some better-ranked peers of Hercules Capital worth a look are Amalgamated Financial Corp. AMAL and PhenixFIN Corporation PFX, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks Rank #1 stocks here.

The Zacks Consensus Estimate for AMAL’s current-year earnings has remained unchanged in the past 30 days. The company’s shares have lost 5.5% over the past six months.

The Zacks Consensus Estimate for PFX’s current fiscal year earnings has been revised 47.8% north in the past month. Its shares have gained 12.7% over the past six months.

Zacks' Research Chief Names "Stock Most Likely to Double"

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is among the most innovative financial firms. With a fast-growing customer base (already 50+ million) and a diverse set of cutting edge solutions, this stock is poised for big gains. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpWant the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hercules Capital, Inc. (HTGC): Free Stock Analysis Report

Amalgamated Financial Corp. (AMAL): Free Stock Analysis Report

PhenixFIN Corporation (PFX): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

/Intel%20Corp_%20logo%20on%20mobile%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/Nvidia%20logo%20by%20Konstantin%20Savusia%20via%20Shutterstock.jpg)