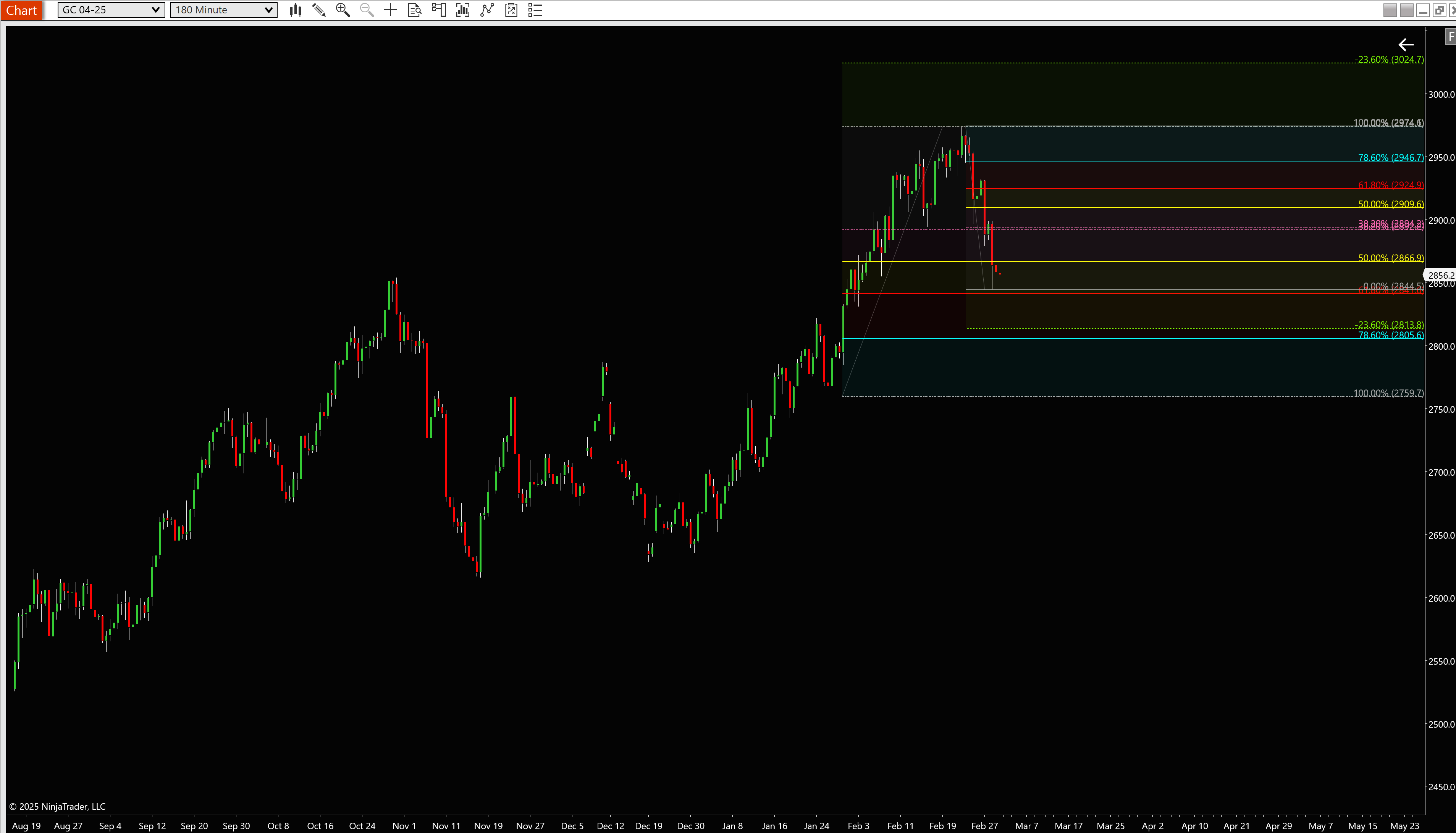

While the week's events had nothing to do with Gold as PCE initially just kept us with the trend lower with indices, participants in the precious metals market preferred to keep with their "profit taking" sentiment while using the upper 2900's as resistance and driving prices sharply lower on Thursday and Friday in what could be viewed as the first weekly decline in over two months. We started the week at 2939 pulling about 15 points lower during the session and topping out at 2955 this past Monday. We never really added to the “accumulation” column ad from there we just looked to go sideways to lower into the end of the week losing the 2900 price handle and on Friday dropping even below 2850 only to find some month-end buying that pushed us right above that 2800~2900 midpoint. Despite what some of the technical analysis states, we believe there is now support in a wide price band between 2781.7~2849.5. We tested the upper level of that price band on Friday on the short covering month-end move that occurred during the last half hour of the market. So in summary here is our take on Gold:

Preferred trading direction: Buy [Stay long]

Support zone: 2781.7~2849.5 with downside anchor at 2731 below which we will likely break the 2-month trend.

Target price: 3024

Chart (GSM25)

/AI%20(artificial%20intelligence)/Businessman%20touching%20the%20brain%20working%20of%20Artificial%20Intelligence%20(AI)%20Automation%20by%20Suttiphong%20Chandaeng%20via%20Shutterstock.jpg)

/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)

/EV%20in%20showroom%20by%20Robert%20Way%20via%20Shutterstock.jpg)