Wednesday's options volume was relatively light, with 52.25 million contracts traded, over seven million below its 30-day average, with calls accounting for about 55% of the contracts traded.

Of the stocks that had options volume yesterday, 1,181 recorded volumes higher than their 30-day averages. One of those with higher-than-normal volume was Cogent Communications (CCOI).

Its volume was 68,987, over 18 times its 30-day average. Not only was the internet communication company’s volume considerably higher than average, but it was also the highest single-day total in the past two years, nearly three times higher than the second-highest volume of 24,524 on Nov. 14, 2025.

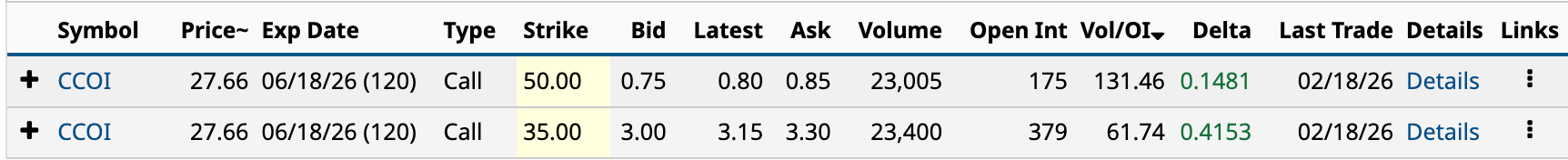

That’s where its unusual options activity comes in. CCOI had two call options with Vol/OI (volume-to-open-interest) ratios in the top 10.

The June 18 $50 call had the second-highest Vol/OI ratio yesterday, trailing only Figs’ March 20 $12.50 call with a Vol/OI ratio of 221.01. Cogent’s June 18 $35 call was the seventh-highest at 61.74.

I’ve got 21,000 reasons why these two unusually active call options scream Bull Call Spread.

Why 21,000 Reasons?

If you think I’m going to rhyme off 21,000 actual reasons for the bull call spread, you’ve come to the wrong place. Not even options are that complicated. No, the 21,000 comes from two multi-leg trades yesterday that accounted for most of Cogent’s volume on the day.

As I said earlier, Cogent’s volume yesterday was 68,987. These five trades accounted for 90% of it.

As you can see, four of the five trades were for June 18 calls. You’ve got 5,000 each for the $35 and $50 strikes, and 16,000 each for the $35 and $50 strikes. That’s 21,000.

Is the $35/$50 Combination the Best Bull Call Spread Bet?

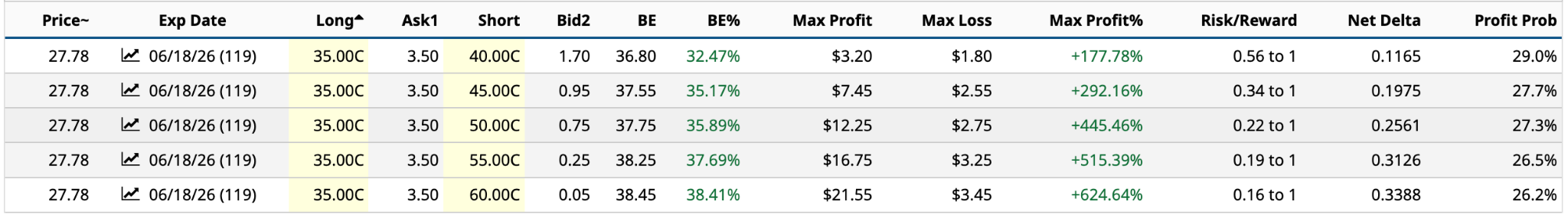

Here are the various combinations based on going long the $35 call and short the $50 call, and four other strike prices, as I am writing this early in Thursday trading.

In case you’re new to options, the bull call spread involves buying a call option at one price and selling a call option at a higher strike price for premium income to lower the overall cost of the trade, where both have the same expiration date.

You’re bullish on its future stock price. It's attractive to risk-averse investors because both the profit and loss are defined before the trade is made and capped, limiting the risk/reward proposition.

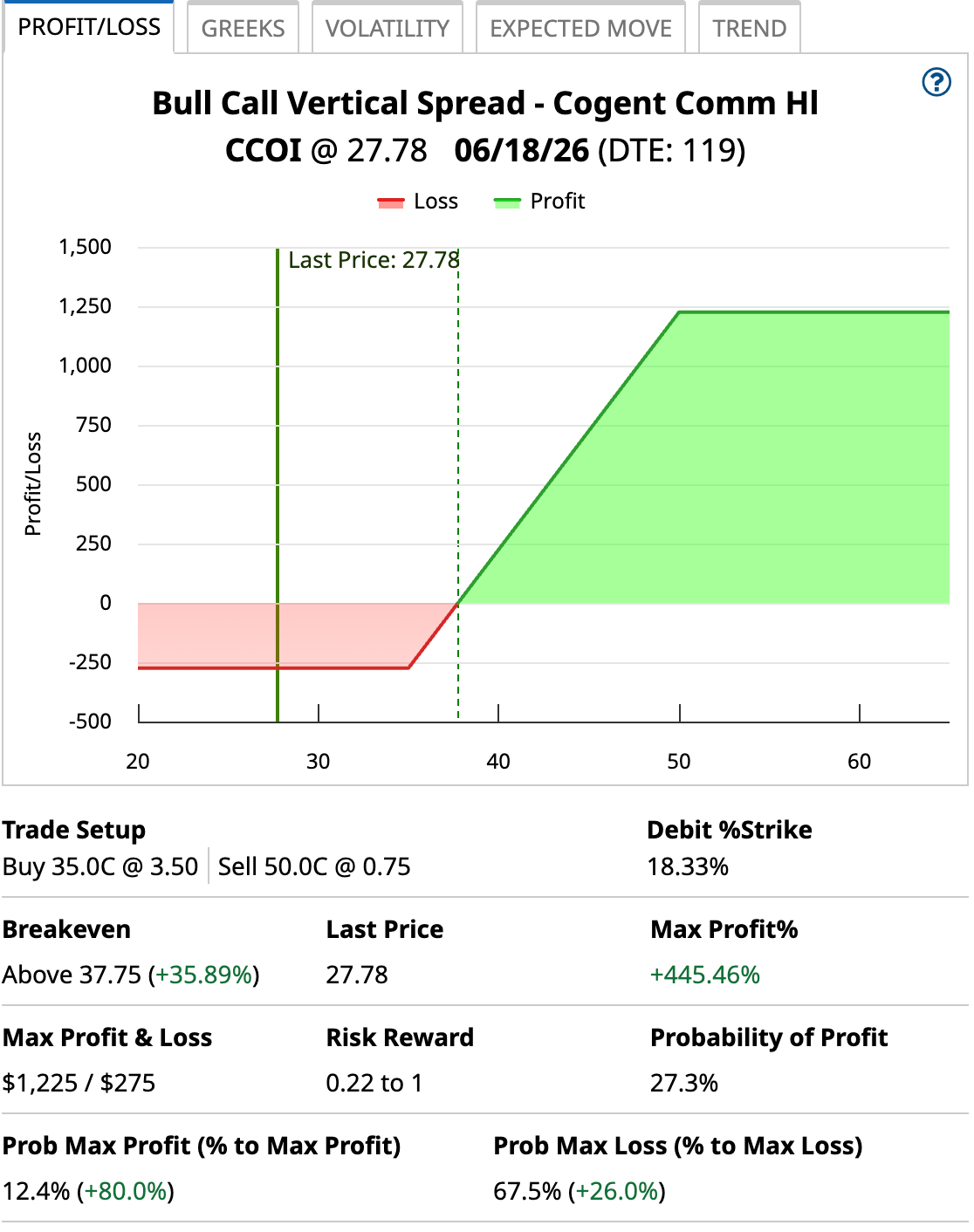

So, using the $35/$50 combination to start, the trade costs $2.75, or $275 [$3.50 ask price - $0.75 bid price], or 9..9% of the share price. Under 10% is always a good bet. This is called your net debit and is your maximum loss. It happens if the share price is below $35 at expiration on June 18.

The maximum profit on this combination is $12.25 ($1,225), which is the difference in strike values minus the net debit [$50 strike - $35 strike - $2.75]. You achieve maximum profit if the share price at expiration is above $50.

As you can see, the risk/reward ratio is 0.22 to 1, which is the maximum loss divided by the maximum profit. That’s the good news. Risk is low. The bad news is that the likelihood of the share price being above the breakeven price of $37.75 [the lower $35 strike price + $2.75 net debit] at expiration is 27.3%, or slightly more than one in four.

Based on the expected move for CCOI of $9.78 by June 18 (35.48%), the upper price is $37.33, and the lower price is $17.78. Between February 2021 and February 2026, Cogent’s share price traded above $50 until May 2025, hitting a five-year low of $15.96 last November. From the bottom, its shares are up 74%.

From where I sit, it has a much higher chance of hitting the upper price than the lower one, making the bet a risk worth taking.

Why Bet on Cogent?

That’s not a bad question. As far as I can tell, there is no hope of Cogent making money in the near future — the analyst estimate for 2025 is a loss of $4.27 a share, and for 2026, a loss of $3.73 -- we’ll no more tomorrow morning. It will issue a press release detailing fourth-quarter results at 7 a.m. ET.

Yet, four of 13 analysts rate it a Buy (3.54 out of 5), with only one rating it a Sell; the rest are on the fence. Analysts are paid well. There has to be a reason for four of them recommending investors buy the stock, which has a $30.55 target price, and a high target of $55.

So, the November low I mentioned previously was due to Q3 2025 results, which saw revenues fall nearly 6% year-over-year, and, more importantly, the company announced a 98% cut in its quarterly dividend to $0.02 a share. At the time, the dividend yield was over 10% -- always a warning sign -- and is now 0.3%.

If you’re an income investor, that’s of no interest. The question is, how long will it take to get back to a $1.0150-per-share dividend? Clearly, the analysts who say it’s a buy believe it will happen sooner rather than later.

What proof is there?

As far as I can tell, the company’s turnaround hinges on three things: new revenue streams that require less capital, savings from ongoing cost-cutting, and higher EBITDA (earnings before interest, taxes, depreciation, and amortization) and EBITDA margins resulting from these two initiatives.

In Q3 2025, its revenue from wavelength services was $10.2 million -- I’m not a techie by any means, but it seems positive -- up $1.1 million from the previous quarter and nearly double what it was a year ago.

“At the end of the quarter, we had sold and provisioned waves in 454 locations as opposed to the 418 data centers that we had installed waves in at the end of Q2. We currently have a backlog and funnel of wave opportunities of 5,221 opportunitiesm” stated CEO and founder, David Schaeffer, in the Q3 2025 conference call.

“We intend to continue to capture market share and believe our goal of 25% of the highly concentrated long-haul wavelength market in North America in 3 years is achievable.”

At the same time, its revenue from leasing IPv4 addresses was $17.5 million in the third quarter, $2.2 million higher than Q2 2025 and 56% higher than Q3 2024.

So, it’s essentially added over $11 million in revenue over the past 12 months from two newer initiatives. At the same time, it continues to monetize its 24 data centers. During the third quarter, it sold two of them for $144 million. The remainder will also be sold or leased to another party. Either way, that’s a significant short-term to mid-term revenue generator.

As for cost-cutting, it said a year ago that it was 90% of the way toward its goal of generating $220 million in annual savings from integrating the Sprint wireline assets it acquired in late 2022. These assets included 20,000 miles of fiber.

These two initiatives have led to higher EBITDA and EBITDA margins. In Q3 2025, its adjusted EBITDA was $73.8 million with a 30.5% EBITDA margin, 70 basis points higher than in Q2 2025. Things are moving in the right direction.

But Is It Enough?

The last year Cogent had an operating profit was 2022. Its EBITDA margin that year was 35.7%, so it’s not too far off that.

It’s not a stock that I would choose to own, but there’s enough meat on the bone to justify a speculative bet on Cogent. While going with a lower call strike for the short portion of the bull call spread, say $40, is tempting, you’re trading significant profit for a slightly higher profitability of success.

If it were me, I’d go with the $35/$50 combination. You’ve got 21,000 reasons.

On the date of publication, Will Ashworth did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

/Apple%20products%20arranged%20on%20desk%20by%20tashka2000%20via%20iStock.jpg)